When it comes to gas prices, you can’t blame consumers for not knowing whether they’re coming or going, due to all the geopolitical problems bubbling to the surface.

But there IS good news, at least here in the short term, for the 31 million Americans hitting the road this holiday week.

And for the rest of summer, too. Here’s why …

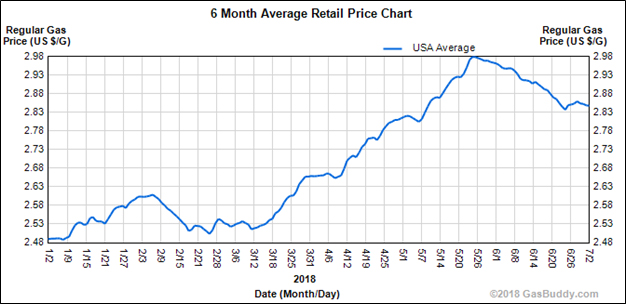

That news: Gasoline prices have PROBABLY peaked for the summer and are headed lower. Here’s the chart from GasBuddy.com …

Gas prices are averaging $2.85 per gallon nationally. That’s DOWN from the high of $2.97 hit over Memorial Day weekend.

The sour grapes view of this is that it’s the highest on record since 2014. Also, that’s up from $2.23 a gallon a year ago.

But focus on the positive. The Energy Information Administration (and others) say that should be the peak for the summer. And remember, every one-cent reduction in gas prices puts more than $1 billion a year into consumers’ hands.

Now, here’s where you might be driven around the bend by the gasoline market. Before we all put the pedal to the metal, you should know there are a few potential “black swans” that could drive prices higher.

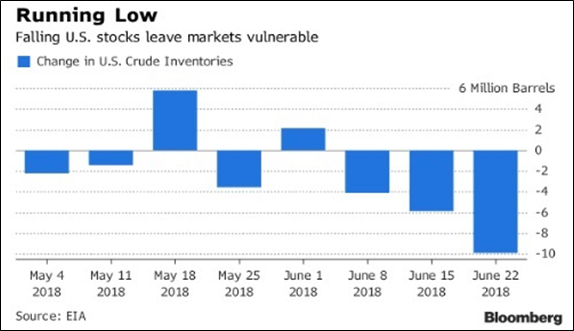

#1. U.S. Crude Oil Supplies are Low

Here’s a chart from Bloomberg, and it ain’t pretty.

U.S. crude oil stocks have dropped consistently since the top in March of last year. Tighter stockpiles put upward pressure on oil and gasoline prices. If we get a sharp drop in U.S. oil stocks, that will probably send gasoline prices higher in a hurry.

As it is, that drop in stockpiles shows steady, perhaps growing demand, as well as rising U.S. exports. And speaking of that …

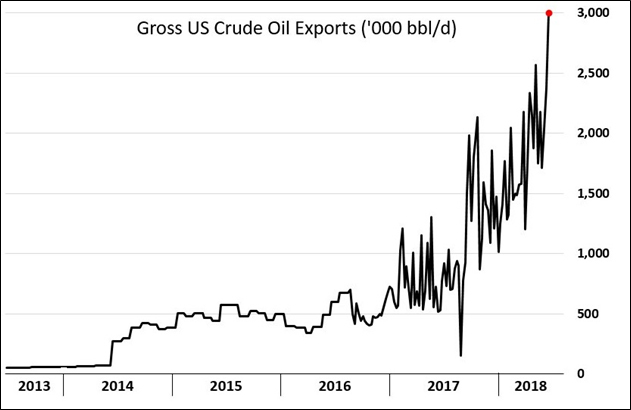

#2. U.S. Exports Are Surging

U.S. oil exports have also reached new highs — 3 million barrels a day in a recent week. That’s according to EIA data.

When combined with fuel products, like diesel and gasoline, U.S. oil and related product exports totaled 8.5 million barrels a day last week.

So, one thing that COULD push your price at the pump higher is if U.S. oil companies export even more of their gasoline.

More bad news (for consumers) is that U.S. imports of foreign oil are going down. This zigs and zags. Canada sends the U.S. almost all of its oil exports. We buy from others as well.

By the way, U.S. exports are more than most OPEC countries can produce each day. And only Saudi Arabia and Iraq export more than we do.

So, cool beans there. We are an energy superpower.

#3. Sanctions Could Bite

The Trump administration has slapped new economic sanctions on Iran. And that country’s main exports are oil and gas. We’ve also asked our allies to stop buying oil from Iran. That means they are competing with us for other barrels of oil on the market.

These sanctions take time to ramp up. But the International Energy Agency estimates that 900,000 barrels a day of Iranian crude could be off the market next year. That’s about half of what Iran usually exports.

Other problems in Libya, Venezuela and even Canada, which is seeing a (hopefully temporary) disruption in its oil sands fields, could also squeeze international oil supply.

The bottom line: That road marker says “bumpy road ahead” for gasoline prices. We can have either lower gasoline prices or sanctions on Iran. It’s tough to have both. Throw in all the other uncertainties, and relief may not be long-lived.

So, enjoy it while it lasts. Get out and have fun this Fourth of July. From all of us at Weiss Publishing, we offer our thanks to America’s veterans. And have a wonderful holiday, all of you.

All the best,

Sean

P.S. I’ll be speaking at the San Francisco Money Show in August. It will be a great show, with all sorts of experts sharing their insights. You can find more about that incredible conference HERE. I hope to see you there!