|

| By Marija Matic |

Last week, Bitcoin’s (BTC, “A”) impressive rally finally brought us to the moment we’ve all been waiting for.

Bitcoin officially broke above $100,000 with confidence!

The No. 1 crypto by market cap has since played jump rope with this significant level, crossing below, then back above, then below again, a few times over the weekend.

For now, it is taking a breather and trading around the $98,000 mark.

This period of consolidation is essential for allowing technical indicators to cool off and avoid overbought conditions.

Or, in plain English, this is a healthy pause before Bitcoin resumes its upward trajectory.

That is why this short-term pause should not be mistaken for the end of the bull market.

In fact, Bitcoin’s price action and the broader market dynamics suggest that we’re only at the beginning of a much larger move.

Bitcoin's market capitalization has recently surpassed a staggering $1.96 trillion. That overtakes the GDP of severallarge nations, such as …

- Spain, at $1.73 trillion,

- Mexico, at $1.85 trillion, and

- Australia, at $1.8 trillion.

Considering how remarkable Bitcoin’s rise has been, it could even surpass larger economies like those of Russia ($2.18 trillion), Brazil ($2.19 trillion) and Canada ($2.21 trillion)!

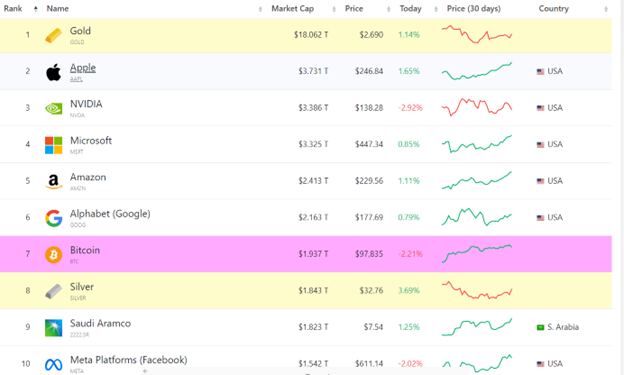

After all, Bitcoin has already eclipsed the market valuations of major entities such as Meta (FB), Saudi Aramco and silver.

Bitcoin is officially the seventh largest asset in the world!

The number one asset, gold, still sits atop the global hierarchy.

For now.

Consider Bitcoin’s position as a digital store of value — digital gold, if you will — and it’s clear that Bitcoin has its sights set on dethroning this century-old store of value.

To surpass gold’s market cap, Bitcoin would need to increase by about 823%. That is a lot, but it is also an achievable target in the coming years. Especially as institutional adoption accelerates, and global fiat systems continue to experience volatility.

Institutional Adoption Intensifying

Institutions have lately become key players in Bitcoin's ascent. And it is a trend that is intensifying.

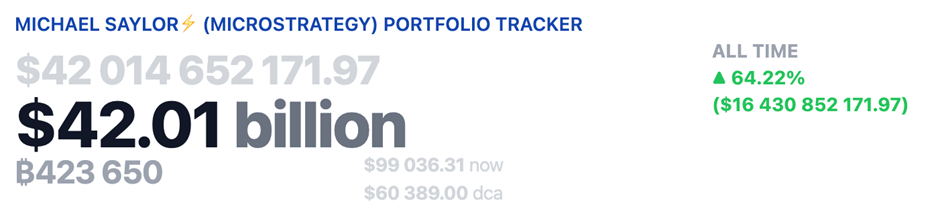

MicroStrategy (MSTR) — one of the largest corporate holders of Bitcoin — is a prime example. The company has been accumulating bitcoin through the cycles over the past five years. That includes buying at the peak of bull runs.

And its holdings are up an impressive 64.22%.

Between Dec. 2 and Dec. 8, MicroStrategy purchased an additional 21,550 BTC to bring its total holdings to 423,650 BTC, valued at over $42 billion.

This unrelenting accumulation is a strong signal of confidence in Bitcoin’s future.

Similarly, El Salvador, the first country to make Bitcoin legal tender, has seen a significant rise in the value of its BTC holdings, up by 121.36%.

As of now, El Salvador holds 6,181 BTC, worth more than $563 million, with an average purchase price of $44,757.50.

This bold move is starting to look increasingly prescient as Bitcoin continues its upward march.

All that just shows how much Bitcoin has grown up to now. But, as I said earlier, this is just the start.

4 Key Drivers for Bitcoin’s Bullish Outlook

While short-term consolidation is expected, several powerful macro trends suggest that Bitcoin's bull market is far from over.

Here are the four key factors that are likely to drive Bitcoin’s price to new heights in the near future.

1. Bitcoin ETFs: A New Institutional Gateway

Spot Bitcoin ETFs are quickly becoming the largest holders of Bitcoin. This signals a massive shift in institutional involvement.

Just last week, U.S. spot Bitcoin ETFs saw a net inflow of $2.7 billion. BlackRock’s iShares Bitcoin Trust (IBIT) — which surpassed 500,000 BTC in holdings on Dec. 2 — now boasts over $50 billion in assets under management.

Collectively, Bitcoin ETFs hold more than 1.1 million BTC, surpassing the holdings of Bitcoin’s anonymous creator, Satoshi Nakamoto!

This surge in ETF adoption demonstrates that institutional interest in Bitcoin is growing at an unprecedented pace. Bitcoin ETFs are still in their infancy, and their ability to attract new capital will likely continue to propel Bitcoin to new heights.

2. Corporations Flock to Bitcoin

Corporate treasuries are starting to see Bitcoin as an asset class worth holding.

Amazon (AMZN) shareholders have just urged the company to consider adding Bitcoin to its treasury. They are following in the footsteps of Microsoft (MSFT), which will vote tomorrow on expanding into Bitcoin.

Some top public companies like Tesla (TSLA) are already holding Bitcoin. The electric vehicle company owns 9,720 BTC, worth almost $1 billion.

As companies like Amazon and even Apple (AAPL) — which reportedly plans to buy $250 million worth of Bitcoin by the end of 2024 — explore Bitcoin, it’s clear that Bitcoin’s institutional adoption is just starting.

3. State-Level Bitcoin Reserves: The Newest Trend

Bitcoin’s influence is spreading. And I’m not just talking about institutional adoption. Even governments want to get in.

President-Elect Donald Trump has repeatedly called for a national Bitcoin reserve. But that’s just the tip of the iceberg. His ambition to make the U.S. the "crypto capital of the world" is starting to echo at the state level.

A handful of U.S. states have begun to explore the idea of their own Bitcoin reserves as Trump’s crypto vision ignites decentralized treasury battles.

Florida, for example, is taking steps to establish its own Bitcoin reserve by the first quarter of 2025. Pennsylvania, meanwhile, has introduced a bill to invest up to 10% of its general fund into Bitcoin.

Other states, such as Michigan and Wisconsin, are investing in Bitcoin-related ETFs and trusts.

These state-level initiatives reflect a growing recognition of Bitcoin as a hedge against inflation and a long-term store of value. And as they gain traction, they could form the foundation for a national Bitcoin reserve in the future.

4. Favorable Political Environment and Global Adoption

With governments taking a new look at Bitcoin’s potential, the political sphere has become more welcoming.

In the U.S., the incoming administration has begun to lay the groundwork for a more crypto-friendly future. And it has figures like David Sacks — PayPal’s former executive and now a key crypto advocate — playing central roles.

Beyond the U.S., China’s stance on Bitcoin has softened. While the country remains cautious about crypto, the court has recently clarified that personal ownership of crypto is legal. And there are even discussions about gradually opening up to crypto support.

Additionally, Russia, with its frozen foreign reserves, has become a supporter of Bitcoin, adding to its global appeal as a decentralized store of value.

With these four forces — institutional adoption, state-level initiatives, corporate interest and an increasingly supportive political environment — acting at once, one thing is clear: the $100,000 mark is just the beginning.

As Bitcoin continues to consolidate and more players enter the market, the long-term bullish case remains intact. In fact, the future looks incredibly bright for Bitcoin as it becomes an ever-larger part of the global financial landscape!

Looking much farther out to the coming years, we could see Bitcoin’s value surpass gold and reach levels that were once thought to be impossible.

Whether you're a long-time holder or a new investor, the path forward for Bitcoin is one of remarkable growth and expansion.

And when Bitcoin goes up, altcoins soar. In fact, this is one of the most exciting times for smaller crypto projects. That’s because this is when select small caps can outperform Bitcoin and see outsized returns.

To learn more about that — and which projects have caught the eye of Weiss’ small-cap experts — I suggest you watch my colleague Juan Villaverde’s latest briefing now.

Buckle up: This is just the beginning.

Best,

Marija Matić