|

| By Juan Villaverde |

Forecasts were made. And now, events have been confirmed.

For weeks, I’ve rung the bell about a Q2 relief rally.

And with this week’s market moves, it’s finally underway.

Crypto markets rallied smartly as Bitcoin (BTC, “A-”) burst above $90,000 in a matter of hours. Altcoins didn’t lag far behind either, as nearly everything crypto moved briskly higher.

My Crypto Timing Model, you recall, had long been calling for this rally.

Specifically, it showed the March-April window was slated to produce a 320-day-cycle low. Which we hadn’t been able to confirm … until this week.

That all changed when Bitcoin broke above the key $90,000 level on Tuesday. This confirmed the 320-day-cycle low was in.

And it signaled the rebound we’d been anticipating for more than a month … is finally here.

Is it a surprise to see such a strong rally so soon after “Liberation Day” tariffs hit global markets like a ton of bricks?

Not really.

As I’ve been saying for some time, global liquidity has already been climbing since the start of the year — with no sign of slowing.

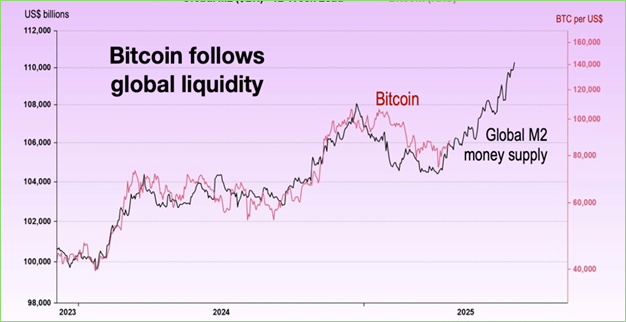

Liquidity works with roughly a three-month lag in crypto. So, if liquidity bottomed in January, crypto should bottom in April. That’s essentially what we observed:

This chart illustrates the strong correlation between Bitcoin’s price (red line) and the global money supply (Global M2, black line).

And the ongoing rise in Global M2 is now evoking a powerful Bitcoin rally. So powerful, it could push prices into new high territory.

Assuming the correlation that has held since late 2023 persists, Bitcoin now looks like it could hit $140,000 to $160,000 before this move exhausts itself.

That also lines up nicely with my Crypto Timing Model, which called the 320-day-cycle low near $80,000 on April 7. A double from there gives a 320-day-cycle-high target near $160,000 range — which is now squarely “in the cards.”

However, it’s not a sure thing.

Manage Your Expectations

The global-liquidity data leads crypto in direction — not magnitude. So, a 5% rise in liquidity does not guarantee a proportional move in Bitcoin in this relief rally.

In 2017, for example, we saw a 5% liquidity bump led to a whopping 500% jump in Bitcoin. By contrast, last August, another 5% rise ushered in only a 100% gain.

The current increase — about 5.7 % from January through today — is giving us this April–to-June rally. But the ultimate magnitude still remains to be seen.

Trade war headlines, inflation fears and headlines like President Trump threatening to fire Federal Reserve Chair Jerome Powell … all add fresh uncertainty. This makes the coming rally a likely prelude for a broader market top.

Not just in crypto but across global risk assets.

2 Ways to Play It

In this rally, Bitcoin could punch above $150,000 … or it could stall near its previous cycle peak just north of $100,000.

Either way, I expect to see a significant pause in BTC’s momentum between now and new all-time highs.

After all, while this rally is most welcome, the next four-year-cycle high isn’t expected until the second half of 2025 according to my Crypto Timing Model.

That means even if a new high is in our future, it most likely won’t come this quarter.

So, how should you play this rally?

Well, ultimately, that’s up to you.

If you are looking to mitigate risk exposure, you may want to use this rally as a chance to sell more volatile assets into strength. Then, you can hop back into the market once the looming storm clouds have cleared.

If you’re looking to ride the rally, there should be plenty of opportunities to grab nice gains on this wave, which I expect will last until late May.

If you take this route, just be aware you may need to pivot quickly and respond to market moves at a moment’s notice.

But however you choose to play this, I hope you keep up with our Weiss Crypto Daily updates along the way to stay informed about every twist and turn this market may bring.

Best,

Juan Villaverde