2 Ways to Prepare for the Next Bull Market Rally

|

| By Juan Villaverde |

The crypto marketplace is on the verge of undergoing a rapid transformation even as we speak.

And it couldn’t have happened at a better time.

We have proven — many times and in many ways — that crypto bull cycles have always lasted three years.

Year one of the cycle is the transition from bear to bull, as the market begins its ascent …

Year two is the big bull market, and …

Year three is an even bigger bull market.

Last year — 2023 — was the transition year. Bitcoin (BTC, “A-”) more than doubled, and our favorite altcoins beat Bitcoin by a mile.

But if you missed it, don’t let that bother you.

Because history tells us that far more money can be made in the next two years than in the last.

Consider these facts:

In 2019, the transition year of the last bull market, investors could have made 183% in Bitcoin, 118% in Ethereum (ETH, “B+”) and 49% in Cardano (ADA, “B-”).

But investors who completely missed the first year and didn’t begin investing in the second year could have made:

- 640% in Bitcoin, or 3.5x more than year-one investors …

- 2,537% in Ethereum, or 21.5x more than year-one investors, and …

- 4,998% in Cadano, or a whopping 102x more than year-one investors.

We see the same pattern unfolding in the current cycle.

Investors who bought our favorite coins at the beginning of 2023 and sold them before year-end could have made very good money.

But all our research tells us that investors starting to invest right now could make much more.

That’s because the crypto market is transforming, moving from the fringes of finance to the center of many financial advisors’ attention.

You’ll recall that the Securities and Exchange Commission approved 11 spot Bitcoin ETFs run by Wall Street giants like BlackRock, Fidelity, Franklin Templeton, Grayscale, VanEck and others.

And I’ve made clear how these institutions will funnel huge amounts of new capital from the world of traditional investors to the world of crypto.

But what you may not realize is that influx has barely begun.

I just talked to Dr. Martin Weiss about this in a Zoom call, and his response was very revealing:

“For me as an investor,” he said, “the Bitcoin ETFs change everything. I have a Fidelity account. I've had it for years. So, now all I have to do is just log in as I always do, click on the ‘buy’ button as I always do, and presto, I own Bitcoin?!

“After all these years of struggling with exchanges and weird websites and wallets and God knows what else, it’s hard to believe that I can do it just by a single click on Fidelity. What an amazing change that is! What does this really mean?”

What this means is virtually unlimited demand for Bitcoin from institutional investors and from traditionally minded investors.

But when it comes to supply, Bitcoin is one of the most restrictive of any asset class that anybody can invest in.

I cannot overstate how limited the actual physical supply of Bitcoin is.

There is still time to get ready for the coming rally. But not much.

As such, I recommend you take two steps to prepare:

First, the next few days could be an ideal time to buy Bitcoin if you want to load up.

Reason: Bitcoin has suffered a moderate correction. But my cycle analysis tells me it could be over as soon as the end of the month.

Second, be sure to watch my Zoom call with Martin.

And pay special attention to what I say near the end of the 17-minute call.

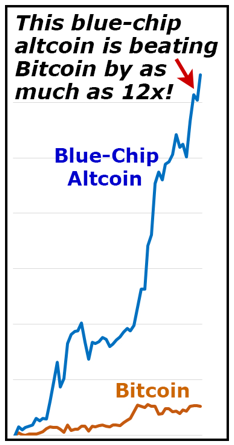

It’s about an altcoin that was recently up a whopping 325% in just 54 days!

Meanwhile, Bitcoin was up only 26% in the same period.

That’s right: This coin’s gains were 12x bigger.

All in less than two months!

And here’s the key: This is not some small-cap start-up project that no one’s heard of … or that any crypto whale could easily pump and dump.

Quite the opposite: It’s among the top cryptos in the world in terms of market cap. And it’s been actively traded for years.

For more info plus a quick 17-minute update on what I see happening in the market right now, be sure to watch my Zoom call with Martin while it’s still hot news.

Best,

Juan