3 Tools to Navigate Crypto’s Black Swan Events

|

| By Juan Villaverde |

My Crypto Timing Model is a powerful tool. It uses real-time data, key support and resistance levels and historical crypto cycle patterns to make sense of the crypto market’s slings and arrows.

In short, it clears up the method in the market’s madness. That’s why, last week, I said I saw the early July correction coming from a month away.

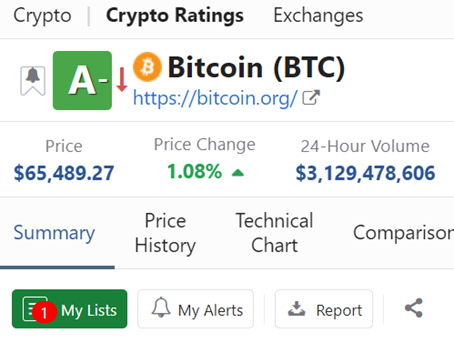

That’s because the Crypto Timing Model told me it was time for a Bitcoin (BTC, “A-”) correction.

But while the model can tell me if the market is ready for a move up or down, what it can’t do is predict the black swan catalysts that really send the market swinging.

So, this past weekend’s fireworks were just as surprising to me.

I refer, of course, to the failed assassination attempt on former President and current Presidential candidate Donald Trump at his campaign rally in Butler, Pennsylvania.

In my opinion, we should be past this kind of violence in the 21st century. It’s an act that should be condemned no matter the circumstances.

But it happened. And as an analyst, I have to look at the data in front of me. So, I can’t ignore the interesting and surprising way the crypto market reacted to the news, which was to rally powerfully.

Just last Friday, Bitcoin was meandering around the $58,000 level. As I write, it’s hovering just under $65,000. It’s as if the epic Fourth of July sell-off … that practically shook the earth beneath investors’ feet … never even happened!

A similar event took place after the failed assassination attempt on Ronald Reagan back in 1981. History shows that when a popular candidate survives an attempt on his life, his popularity often gets a boost.

But that reaction was rocket fuel for the crypto markets as Trump is considered a more crypto-friendly candidate than his opponent, President Biden.

You see, currently …

- Most innovation in the crypto industry happens outside the United States.

- DeFi platforms often exclude American investors.

- Many crypto exchanges are so cautious about serving U.S. customers that I once had my trading account blocked just for logging in from a U.S. IP address.

Sadly, years of regulatory uncertainty — and at times, downright hostility — have driven the crypto industry offshore.

Now, I’ve pointed out that there are signs of a shift when it comes to crypto regulation in the U.S., and we’re moving in a positive direction. But we still have a long way to go to catch up with the crypto leaders abroad.

And to many in the crypto community, the Biden Administration is moving too slowly.

Trump, on the other hand, has embraced crypto as part of his platform. And his vice-presidential nominee, J.D. Vance, is one of the most crypto-friendly candidates in American politics.

To be fair, Trump was not always a friend to the crypto industry. Far from it — he bashed it publicly several times on social media when he was president. He has since had a change of heart.

Some say he’s just trying to get "the crypto vote." I like to believe his intentions are more sincere. But regardless, he has embraced a pro-crypto agenda as part of his campaign.

Don’t get me wrong, crypto is probably just a secondary issue for Trump, but it’s the direction of travel that matters.

Anything can happen between now and Nov. 5. But a different administration is likely to be MUCH more favorable toward crypto than the current one. And that’s what markets are rallying on.

And it’s why I’ll be watching the rest of the election season closely. Any headlines that say Trump, as a pro-crypto candidate, is in the lead — or is falling behind — could impact the market.

This is a timely reminder of the importance of staying informed … and ready to act.

That’s why I’m glad you’re a Weiss Crypto Daily member.

Together with my colleagues, I’ll keep you in the know about everything crypto. That way, you can better navigate these turbulent times with strategic insight and a steady hand.

And don’t forget about the helpful tools around the website that you can use for free.

Our crypto ratings, for example, can help you sort out promising opportunities from coins that don’t deserve a second look.

And you can add your favorites to your watch list to get notified of any price changes or ratings updates. Just search your favorite crypto and click on it. Then, on that coin’s page, you’ll find the My Lists and My Alert buttons at the top, right under the rating and real-time price.

To your wealth,

Juan Villaverde