4 Resurrected Crypto Dinosaurs Ready to Dominate Institutional Interest

|

| By Marija Matic |

The American cryptocurrency market continued its strong performance over the holiday weekend. We’re now closing in on a month of bullish action.

A few older crypto projects in particular, affectionately referred to as dinosaurs, have made remarkable resurgences since the U.S. presidential elections.

Many were dismissed in the past few years for various reasons.

Some were incompatible with more popular networks …

Others failed to gain significant user traction …

And some failed to reach their all-time highs during the last bull market.

But in the crypto world, things can change overnight! Especially if the use case is institution-oriented instead of retail.

That’s why, despite being overlooked in the past, these coins are now experiencing impressive comebacks.

One of the biggest winners in this "American crypto season" is Ripple (XRP, “B”).

Just a few years back, this coin was weighed down by legal issues. Now, though, it is riding on a wave of optimism. Its price surged 343% in just 30 days!

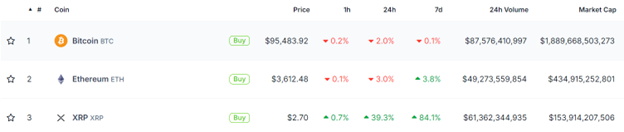

That was enough for it to overtake Solana (SOL, “B+”), a favorite this bull market, and leading stablecoin Tether (USDT) to become the third-largest cryptocurrency by market cap, behind only market leaders Bitcoin (BTC, “A”) and Ethereum (ETH, “A-”).

As of now, XRP boasts a market cap of over $153 billion, while Tether stands at $134 billion and Solana at $107 billion.

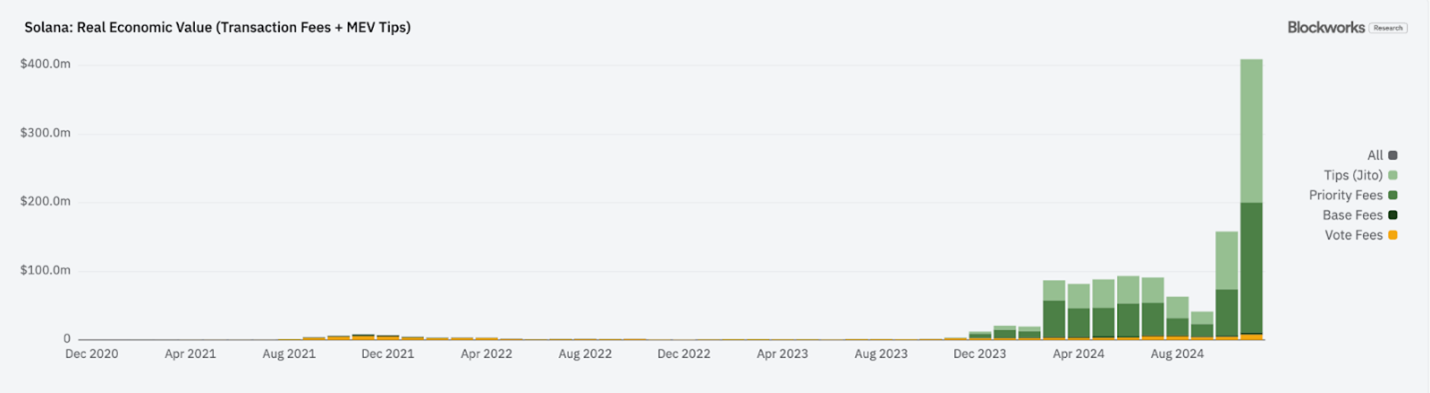

That’s impressive, but not just for XRP. Its growth just goes to show how undervalued the price of SOL currently is, especially when considering its real economic value!

In November, Solana generated a record $409 million in transaction fees and MEV tips, according to Blockworks data, highlighting its incredibly robust economic fundamentals:

That means SOL has more room to grow.

To learn more about even better growth opportunities in this market, I suggest you watch my colleague Juan Villaverde’s urgent briefing. In it, he reveals the three smaller coins that he believes have the sort of growth potential that can yield impressive returns.

XRP’s meteoric rise can be largely attributed to growing optimism around its regulatory future, which had long been stifled by lawsuits over alleged securities violations.

As the legal cloud begins to clear, several bullish developments are fueling renewed confidence in Ripple, such as …

-

Anticipated Regulatory Approval for a Stablecoin: On Nov. 29, reports emerged that Ripple’s RLUSD stablecoin — an overcollateralized dollar-pegged token — is expected to receive approval from New York financial regulators.

This approval would mark a significant milestone for Ripple in its efforts to expand its regulatory foothold.

- The Potential for an XRP ETF: In November, major asset managers including 21Shares, WisdomTree and Bitwise filed for XRP ETFs. With new incoming leadership to the SEC, there’s growing speculation that they will be approved, which could open the door for broader institutional adoption of XRP.

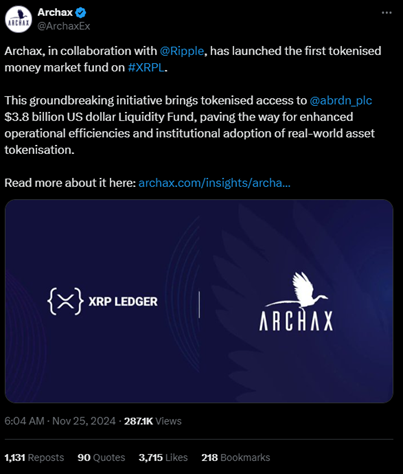

- The Tokenization of Money Market Funds: On Nov. 25, Ripple Labs announced the launch of the first tokenized money market fund on the XRP Ledger. The company plans to tokenize Abrdn’s $4.77 billion U.S. dollar liquidity fund, marking a significant expansion of Ripple’s use cases in traditional finance.

These developments paint a picture of increasing regulatory clarity and institutional interest. And that image has inspired a wave of optimism around XRP’s future.

However, despite this bullish sentiment, XRP whales — holders with at least 100,000 XRP — have been using the recent price surge to take profits at seven-year highs. According to Messari data, large holders have sold off more than 30% of their holdings since Nov. 24, taking advantage of the elevated price levels.

It’s likely that we’ll continue to see sell pressure from whales as this market continues.

But this isn’t the only American dinosaur cryptocurrency experiencing a remarkable rally. Over the past 30 days, several other established coins have seen significant gains, highlighting a broader resurgence … and more opportunity for investors.

Here’s a closer look at three other large dinosaur gainers:

Stellar (XLM, “B”): Up 441% in 30 Days

Stellar has seen impressive growth, driven by its strong focus on facilitating cross-border payments, fiat-to-digital on and off-ramps and asset tokenization. The network is primarily designed to make international money transfers faster, cheaper and more accessible, particularly for underserved regions and populations.

Stellar’s partnerships with major financial institutions, such as Stripe and MoneyGram, have reinforced its position as one of the leaders in global remittance solutions. This recent price surge reflects growing interest in its ability to help traditional banking with blockchain-based solutions.

Hedera (HBAR, Not Yet Rated): Up 412% in 30 Days

Hedera has emerged as one of the most notable institution-focused distributed ledger technologies. Its governing council consists of 32 major global institutions — including IBM (IBM), Google, Dell (DELL), Boeing (BA) and Deutsche Telekom — which act as consensus nodes, earning rewards from network transactions.

Unlike permissionless blockchains, Hedera's network is permissioned, meaning only approved entities can become nodes. While less desirable in the DeFi environment, this design makes Hedara better suited for real-world asset use cases.

Hedera is actively involved in tokenizing assets like commercial real estate, securities, carbon credits and even diamonds. Through these applications, Hedera is positioning itself as one of the leading players in the adoption of blockchain technology for institutional use.

Algorand (ALGO, “B+”): Up 299% in 30 Days

Known for its scalability and speed, Algorand has gained significant traction over the past month. The network boasts one of the fastest transaction speeds thanks to its unique consensus mechanism that can achieve high throughput and low latency. This has made it an attractive option for enterprise-level solutions and positioned the project as a strong contender to provide a scalable solution across multiple sectors. It is mostly used for tokenization of real estate, wholechain’s end-to-end traceability, authentication and verification of medical data and even for dynamic flight swaps and seat buyback offers.

In addition, around 30% of all electricity bills in Afghanistan are paid via Algorand, by using the HesabPay app. Algorand Foundation working with UNDP is one part of the Foundation's strategy to grow Algorand adoption in less developed areas.

Bullish momentum remains strong for these American coins. But more important is what this optimism means.

The resurrection of these seemingly extinct crypto projects signals a shift every investor should be aware of. While retail-driven projects continue to capture the spotlight, institution-focused networks are gaining traction and reshaping the narrative.

With increased regulatory clarity and growing support from major financial institutions, these networks are poised to play a pivotal role in the next phase of the crypto revolution. And projects like these offer a great opportunity to find projects with bigger growth potential … that also have a little more trading history behind them.

But notably, none of them have yet surpassed their established all-time highs, though XRP is the closest to reaching that milestone.

Savvy investors may still be able to find opportunity here.

Because as the market matures and adoption spreads beyond the retail sector, some of the above coins may very well define the future of the institutional crypto space.

Best,

Marija Matić