|

| By Marija Matic |

October is historically one of Bitcoin’s (BTC, “A-”) stronger months.

But after a six-year streak of positive performance and an optimistic start, Uptober 2025 broke tradition.

And this has set the tone for a jittery November.

As of yesterday, Nov. 3, the entire crypto market was down around 4%.

Today, BTC is down another 5% intraday.

Over 298,000 traders were liquidated in between Sunday and Monday, wiping out $1.13 billion in leveraged positions.

So, what exactly is going on?

1. Lingering Liquidity Scars

The crypto market still hasn’t fully recovered from the Oct. 10 liquidation cascade.

Total futures open interest across major exchanges has dropped from $90 billion pre‑Oct. 10 to around $70 billion today (CoinGlass data), a ~22% reduction.

The combination of thinner order books and lower open interest means that even moderate selling or macro shocks can produce outsized price swings.

2. The Fed Strikes Again

Markets entered last week expecting a dovish tone after October’s quarter-basis-point rate cut.

Instead, Federal Reserve Chair Jerome Powell threw cold water on expectations, saying another cut in December isn’t “a foregone conclusion.”

That single line was enough to reprice the entire easing cycle. Before Powell spoke, traders saw a 96% chance of a December rate cut. Afterward, that probability plunged to 66%.

Bond markets quickly followed suit: the U.S. 10-year Treasury yield climbed to 4.1%, a three-week high, signaling skepticism that policy will loosen soon.

The result? Risk assets sold off, with crypto retreating 6.5% last week alone.

3. Liquidity Drains in the Dollar System

Yesterday also saw the Secured Overnight Financing Rate (SOFR) — a key U.S. funding benchmark — spike 18 basis points to 4.22%.

This was its biggest one-day jump in a year.

In short: the government issued a flood of short-term debt, draining cash from repo markets and tightening dollar liquidity.

When dollar liquidity tightens, institutional investors de-risk. And since crypto is the ultimate risk asset, it tends to feel the impact first.

4. Profit-Taking and Institutional Outflows

Even without new macro shocks, the market was due for a cooldown.

After months of steady gains, institutional investors began to lock in their profits. This triggered a wave of outflows from digital asset funds.

Last week, investment products saw $360 million in withdrawals, with Bitcoin ETFs bearing the brunt and shedding roughly $946 million.

Not every asset followed suit, though.

Solana (SOL, “B”) stood out as a rare bright spot.

It attracted $421 million in inflows, largely thanks to the launch of new U.S.-listed ETFs with staking capability.

Adding to the selling pressure, BlackRock transferred 1,198 BTC — or roughly $125 million — and 15,121 Ethereum (ETH, “A-”) worth $56 million) to Coinbase today.

While the act itself means nothing, it’s a move that often precedes institutional liquidation.

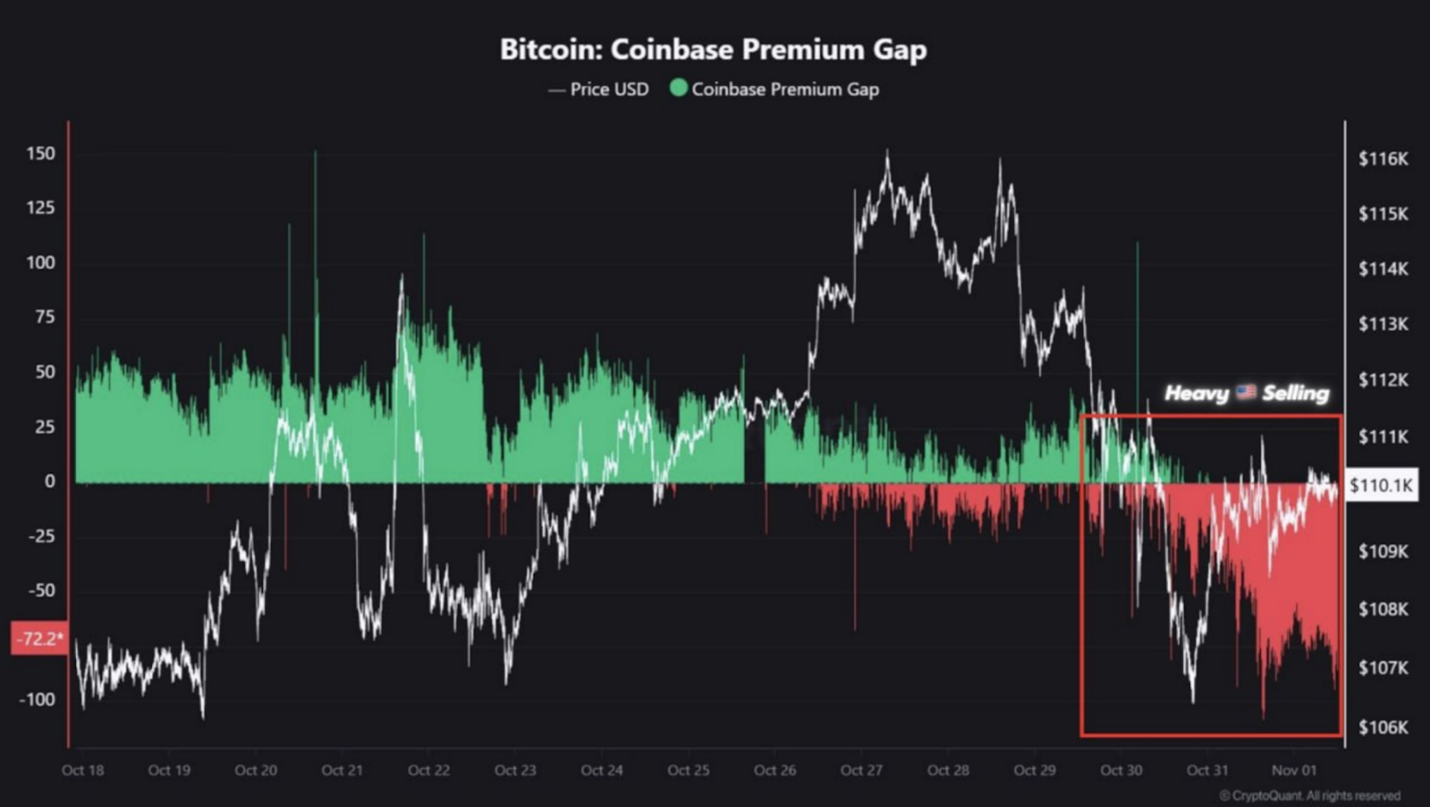

Further evidence of U.S.-led selling comes from the Coinbase Premium Gap. It’s a metric that tracks the price differences between Coinbase and offshore exchanges like Binance.

And it has turned sharply negative in recent days. That tells us that U.S.-based investors were offloading positions much more aggressively than their overseas counterparts.

Historically, a negative premium tends to appear during periods of institutional profit-taking and heightened risk aversion in U.S. markets.

Those who bought near the recent top, are starting to sweat. Unrealized losses are piling up.

But short-term holders haven’t thrown in the towel just yet. And that’s an important sign that sentiment is weak but not broken.

What It All Means

This combination of hawkish Fed rhetoric, tightening dollar liquidity, institutional outflows and whale profit-taking created a perfect storm.

The result was yesterday’s sell-off.

Still, the broader trend remains structurally bullish.

Trendlines are intact, and liquidity pockets above $117,000–$121,000 BTC range suggest plenty of upside potential once macro headwinds ease.

Which means in the short term, volatility is likely to remain elevated as traders brace for next week’s U.S. inflation data.

If macro data softens and the Fed’s tone shifts, crypto could rebound sharply.

For now, traders are watching whether Bitcoin can hold the $100,000 support zone.

Traders love round numbers, which makes this a major psychological level. A decisive bounce from there could set up the next leg higher.

For investors, now is the time to plan out your strategies so you don’t get shaken out in the near term.

My Crypto Yield Hunter strategy, for example, utilizes delta-neutral staking opportunities to balance our portfolio. This way, my members can protect themselves against market volatility … while still harvesting DeFi’s impressive yields.

My colleague Nilus Mattive has a different approach to pulling income from tough markets. One that allows you to earn on gold — the original safe-haven asset.

In fact, just this year, he has shown his readers how to collect payments of $828, $973, $884 and $1,040 from gold and silver.

You can learn more about it here.

Best,

Marija Matić