|

| By Juan Villaverde |

The trading action in Bitcoin (BTC) has been choppy — first up, then down and now sideways.

That’s a sign of a market holding its breath for the Fed’s decision.

But that’s not the only date I’m watching in September.

In fact, it may end up not even being the most important one!

That’s because my Crypto Timing Model is now highlighting three key dates next week:

- Saturday, Sept. 13 (a potential low)

- Wednesday, Sept. 17 (FOMC announcement)

- Saturday, Sept. 20 (a potential high)

This suggests we could see a rally into the Fed’s decision day next week.

And afterward, a sharp decline into a low set for some time in October.

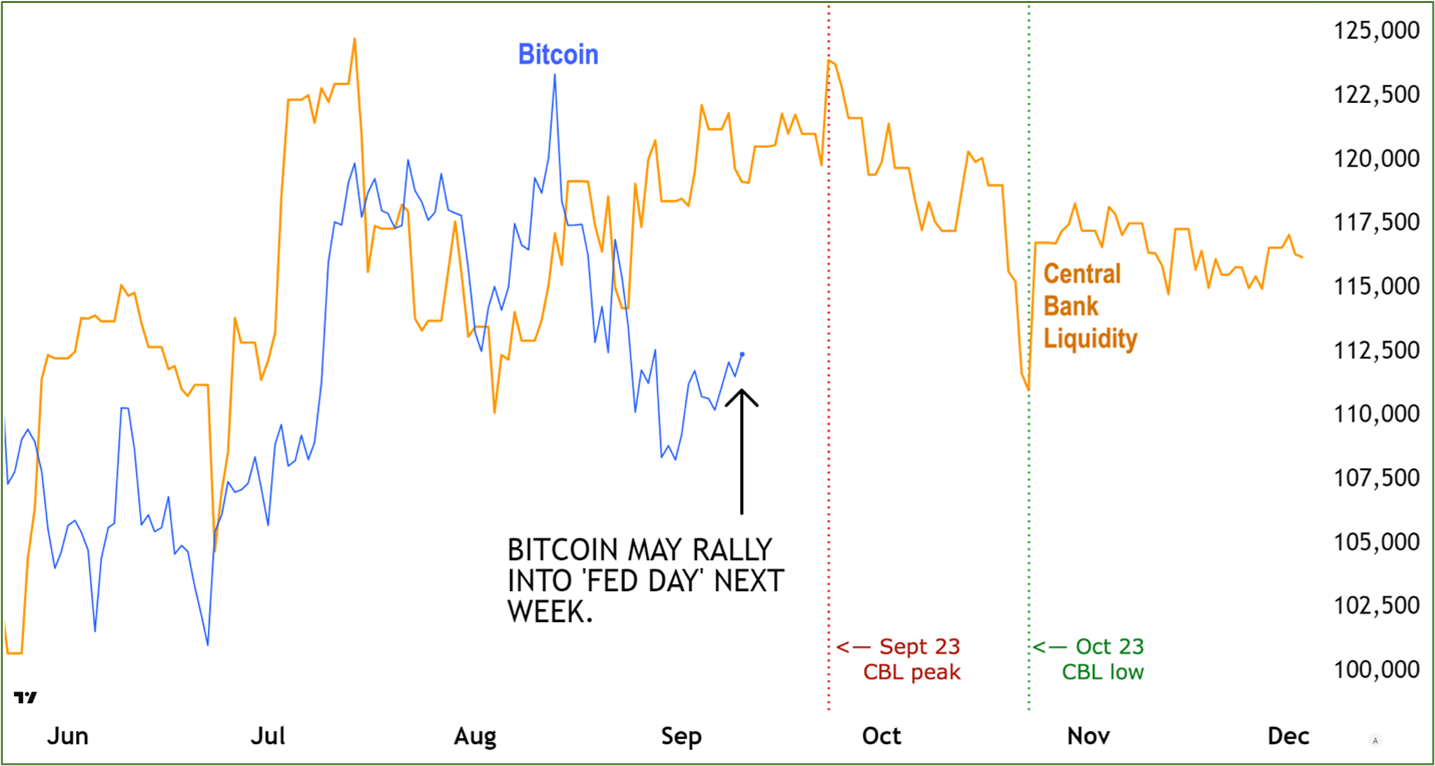

That’s because global Central Bank Liquidity (CBL) peaks Sept. 23 and declines sharply until Oct. 23.

Global liquidity is a leading indicator for Bitcoin price action.

And with the Fed and other central banks getting ready to flood the system with money, Bitcoin tends to get a boost.

But other assets can get an even bigger boost.

Here’s why that is a very real possibility this time around.

Bitcoin Diverges from Liquidity

Note that CBL has trended up since Aug. 3 (continuing until Sept. 23).

Observe also the two vertical lines (above): the red dotted line (Sept. 23) and the green dotted line (Oct. 23).

In between, liquidity nosedives.

Sept. 23 is also eerily near the Sept. 20 high my Timing Model foresees for Bitcoin.

That would make this whole pre-interest-rate-cut scenario just another classic case of: “Buy the rumor, sell the news.”

Keep in mind that when my model flags a key date, that is not necessarily a guarantee that the action will be bullish or bearish.

So, be mindful of that when trading on your own.

One thing that is almost certain: We could see some fireworks following Fed day.

Whatever happens will likely usher in several chaotic weeks of robust volatility.

But don’t be surprised if that results in little net movement for a lot of crypto asset prices.

In other words, don’t just rush out and buy or sell Bitcoin when there’s a whole universe of cryptos that could beat Bitcoin in the coming year.

Best,

Juan