5 Ways to Avoid Sir Isaac Newton’s Financial Faux Pas

|

| By Bob Czeschin |

Some of history’s greatest minds have been utterly flummoxed by problems ordinary investors routinely confront.

Isaac Newton was one of history’s most brilliant scientists. He invented calculus, discovered gravity and worked out the famous Three Laws of Motion that determine the orbits of planets.

He was also an investor.

And the hottest stock of his era was the London-listed South Sea Company. Set up in 1711, it had exclusive rights to trade with the Spain’s South American colonies.

This was a big deal. Thanks to Spain’s colonization and conquest of Mexico, Peru and Bolivia, enough gold and silver flowed back to Madrid that the Spanish money supply nearly quadrupled!

Seeing that success, it was easy to imagine exclusive trading rights with these colonies might unlock another avalanche of wealth for stockholders.

As the story spread and speculation grew, shares in the company soared. Much like we’d see centuries later during the Dot-Com bubble. Or more recently in the burgeoning AI revolution.

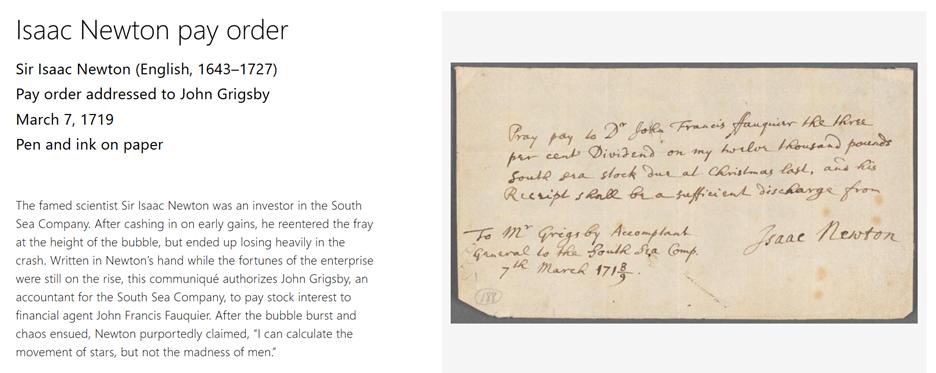

Newton made a modest initial investment in South Sea Company shares, reportedly doubling his money, and cashed out. But speculation continued to intensify.

And after weeks watching remaining investors continue to multiply their wealth, he resolved to jump back in. And to make up for lost time, this time, he invested every last farthing he could scrape together.

The stock — which traded at £128 in January 1720 — surged to £890 by May. By August, it was above £1,000.

But nobody rings a bell at market tops. Six weeks later, the stock was back down to £400. And by December, £124.

Isaac Newton, one of the smartest men that ever lived, lost £20,000. In today’s money, roughly $8 million.

I can calculate and predict the path of stars and planets, he reportedly said later. But not the madness of people.

A Financial Lesson from One of History’s Greatest Minds

If Newton’s experience sounds familiar, you’re in good company. Almost every investor can identify with some aspect of this story.

The jolt of panic. The knot in your stomach. Your pounding heart, as your body prepares to confront mortal peril — even if there’s none present.

Orchestrating this primal, fight-or-flight response is an almond-sized, deep-brain structure called the amygdala. It constantly scans for threats like a smoke detector.

In normal, settled times, the brain’s prefrontal cortex runs the show, handling executive function and rational decision-making.

But when the amygdala senses danger, it hijacks the system entirely.

For investors, this is a road to ruin.

The amygdala doesn’t distinguish between real physical danger and purely imagined scenarios. So, decisions made in a cauldron of fear are almost always sub-optimal, if not disastrous.

However, neuroscience and behavioral finance suggest a number of things you can do to keep your amygdala on a leash, …

Your prefrontal cortex in charge …

And your portfolio safe from FOMO and panic selling.

1. Never decide anything important when your amygdala is in charge.

The first step to solving a problem is recognizing when one arises. Take note of your emotional response. Then, delay doing or deciding anything important until your logical brain is the one in charge.

To speed up that process, you could …

- Concentrate fully on your breathing. Breath in, silently counting to four. Hold while counting to 7. Exhale on 8. Repeat for 5 to 10 minutes until you feel your body and mind settle.

-

Engage in a whole-body activity. Take a walk, a swim, a bike ride, dance. Anything that engages your entire body and makes your heart work for a bit for about 10-15 minutes.

The idea here is to let your body work out all the panic your brain just sent through your system. This way, there’s none left when you review the market.

- Visit or call (do NOT text) someone you have a real relationship with in real life. Human connection is biologically stabilizing. It helps recalibrate the brain away from fear toward balance.

These small steps can help avoid panic that can be poisonous to your financial future.

2. Avoid market noise.

While the above are all great ways to handle financial anxiety and panic in the moment, you also want to avoid needing those exercises in the first place.

Sensational news and real-time price feeds scrolling across your screen are anxiety amplifiers. And unless you’re a high-frequency trader, nothing good can come from obsessively tracking your portfolio.

Instead, I suggest you rely on alerts and automated “sell” targets when you can. This way, you can implement your financial strategy … without getting overwhelmed by the talking heads.

3. Look out for loss aversion.

This is a common cognitive bias that causes investors to experience the pain of losses more intensely than the pleasure of equivalent gains.

Simply put, losing $1,000 feels psychologically worse — often twice as intense — as the good feeling you get from gaining $1,000.

Because they hate locking in a loss, investors often hold losers longer than logic or fundamentals justify.

Likewise, they tend to sell winners too early. Because they fear losing the paper profit more than they value further upside.

This is why having clear targets and stop losses — based on technical support and resistance levels — is key. It helps you filter out the FUD and FOMO to see the best moves for your portfolio.

4. Beware of confirmation bias.

Once people come to an opinion on a matter, their brains tend to actively seek out information that supports it. They ignore new information or twist it to fit their accepted narrative.

But the investment markets are already full of buzzing, chaotic and conflicting signals. This makes it even easier for confirmation bias to filter things in a way that creates a self-reinforcing feedback loop.

One that sees investors reducing diversification (by sticking to familiar sectors). Or postponing selling losing positions (“the fundamentals are still OK”).

It can also steer you away from genuinely undervalued assets when market sentiment is sour. And lead you to ignore signs of a bubble when sentiment is euphoric.

Which means the difference between average and good investors is usually not better information. But superior ability to challenge their own convictions when the evidence demands it.

So, how can you combat confirmation bias?

A few countermeasures include …

- Actively seeking evidence that could prove your opinion wrong.

- Following a few thoughtful analysts who often disagree with you.

- Journaling your investment activity to record the reasons behind each move.

Bonus Lesson for Any Market

The above strategies are solid places to start when it comes putting yourself in control of your portfolio.

But when tough times come knocking, it can be hard to fully keep the panic at bay.

That’s when I turn back and learn from my father’s example.

He was a self-taught income investor. And I never saw him lose a single night’s sleep — even in the worst of times for the stock market.

How?

By redirecting his focus from gains to income when tough markets hit hard.

When price action can make the pit in your stomach grow heavy, a change in how you measure success can be the key to your inner peace.

In my father’s case, he measured success only according to the stream of unearned income his stocks could generate. Not the moment-to-moment market fluctuations.

Of course, dividends can fluctuate, too. But at a vastly slower rate of change than prices.

And as long as the dividend checks keep rolling in, it’s a lot easier to keep a level head. When almost everyone around you is losing theirs.

In fact, this benefit encouraged Weiss Ratings founder Dr. Martin Weiss to take a closer look at dividend-paying stocks.

When combined with Weiss Ratings’ research, he was able to design a system that’s looking at a 16-to-1 outperformance!

Martin will reveal all the details in tomorrow’s Infinite Income Summit, which is set to start at 2 p.m. Eastern.

It’s free to attend.

Just be sure you save your seat ahead of time.

Best,

Bob Czeschin