|

| By Marija Matic |

The tide has shifted.

Digital asset funds saw $921 million in inflows last week, according to CoinShares.

This is the largest injection in months. And it hit just as cooling U.S. inflation data reignited risk appetite.

CPI came in just below expectations, at 3.0% year over year, fueling hopes that the Federal Reserve might finally turn toward rate cuts.

Put plainly, liquidity optimism is creeping back. And with it comes crypto’s momentum.

Crypto mergers and acquisitions (M&A), for example, topped $10 billion for the first time in the third quarter, a more than thirty-fold increase from a year earlier.

And Citi is tapping Coinbase to explore stablecoin payments for clients, while treasuries continue hoarding Bitcoin (BTC, “A-”) and Ethereum (ETH, “A-”).

Even legacy overhangs are easing and clearing the way for a bullish Q4.

Mt. Gox pushed its long-awaited creditor repayments back another year, delaying potential sell pressure until October 2026. For the market, that’s one more bearish overhang postponed … and one more reason prices are finding room to breathe.

But one headline this week stood out for entirely different reasons.

CZ Is Back on the Move

Binance founder Changpeng Zhao — who had previously pled guilty to enabling money laundering as the head of Binance — was pardoned by President Trump last week.

Now, Zhao, who goes by CZ, is back in the driver’s seat. And he’s paving the way for BNB’s (BNB, “C+”) future growth.

The Binance founder has re-emerged on the geopolitical stage. This time in Kyrgyzstan, where he’s advising the rollout of KGST, a “national stablecoin” issued on BNB Chain.

But that’s only one digital currency in development. Kyrgyzstan has three in the works …

- KGST: A som-pegged stablecoin on BNB Chain

- Digital Som: a central bank digital coin built on a permissioned blockchain

- USDKG: A gold-backed, USD-pegged stablecoin with $500 million in reserves

In addition, Kyrgyzstan is also developing a state crypto reserve that will reportedly hold BNB tokens.

Whether KGST is meant as a commercial stablecoin like USDC or as a sovereign instrument remains unclear.

If it’s the former, using a public chain like BNB makes sense. If it’s the latter, it raises real questions about control, security and monetary independence.

Officials say KGST will “eventually be integrated” into the digital som, though it begs the question of why both are needed if integration is planned.

For now, the setup looks ambitious … if a bit tangled.

What is clear is that Binance’s post-pardon expansion is back in full motion.

And BNB is reaping the rewards.

Having any altcoin included in a national reserve is a great milestone, even if the actual allocation ends up small.

But the optics matter. And they add momentum to a token that’s already having a standout year.

Over the past twelve months, BNB has climbed 95%.

That outpaces Bitcoin’s 70% gain and leaves traditional markets — the Nasdaq (+27%) and S&P 500 (+18%) — far behind.

And it was enough for BNB to overtake XRP (XRP, “C+”) to become the fourth-largest cryptocurrency by market cap.

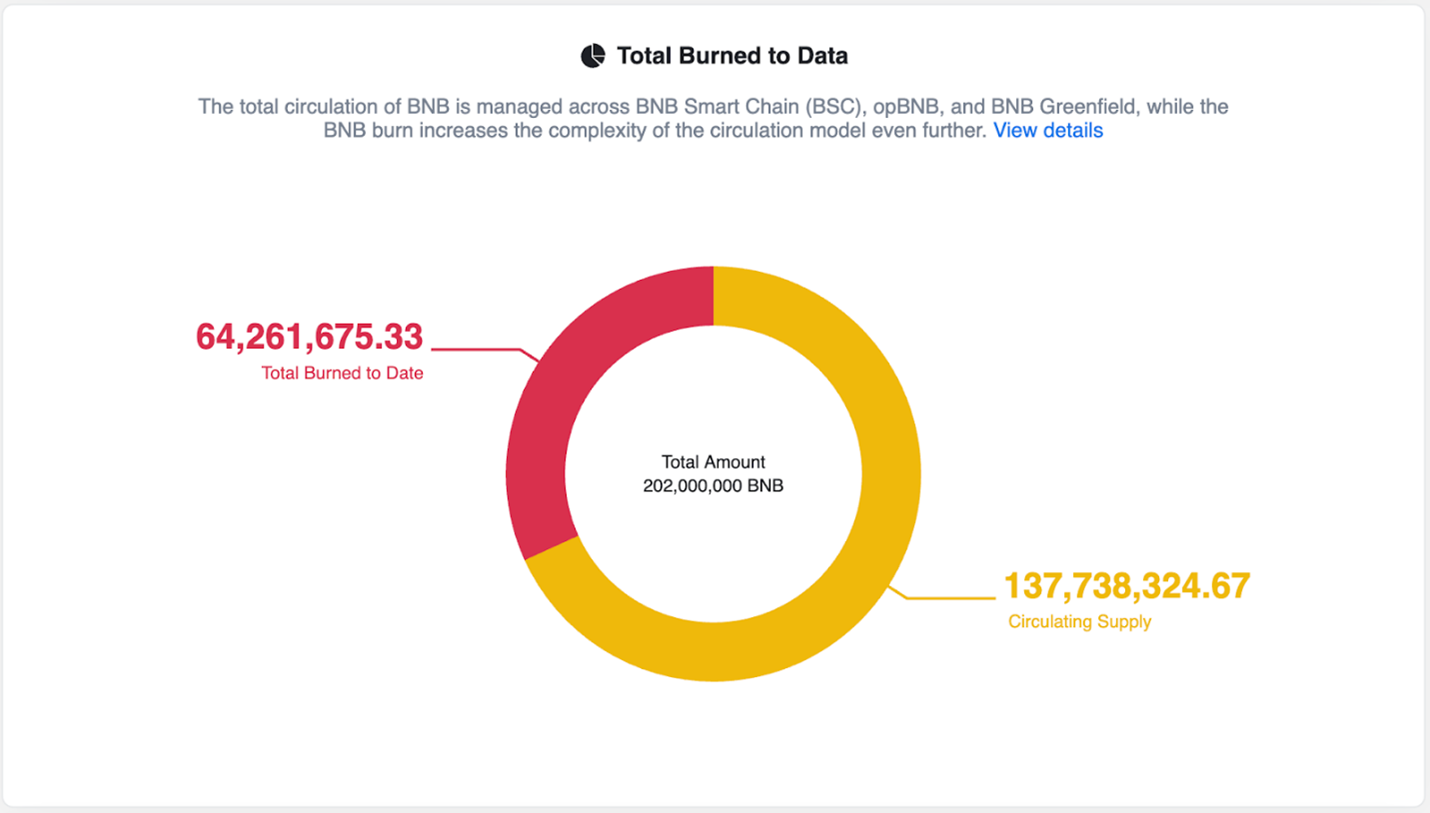

BNB’s resilience isn’t built on hype alone. Its supply steadily contracts through a built-in burn system:

- Quarterly auto-burns, which are tied to price and network activity

- And continuous real-time burns that remove a portion of transaction fees

In the latest quarterly event, 1.44 million BNB — roughly $1.65 billion — was permanently destroyed. Since launch, Binance has eliminated over 64 million BNB, worth more than $70 billion at current prices.

That’s the equivalent of $11,000 in BNB disappearing every minute, one of the most aggressive deflationary systems in crypto.

Growth on the network reflects this underlying strength.

Daily active addressesnow exceed 2.6 million, with weekly users tripling year-on-year to nearly20 million. And the total value bridged from other networks has doubled to $55 billion in October.

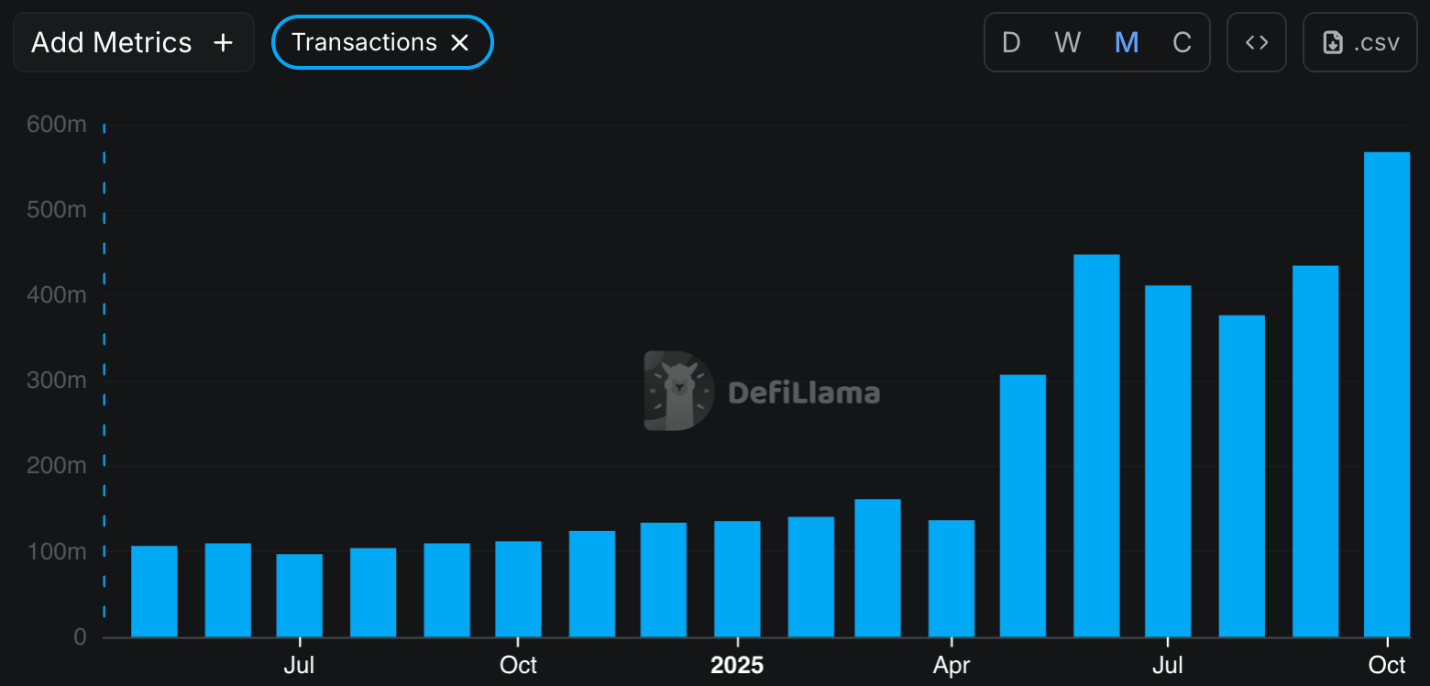

Furthermore, on-chain activity reached a record 567 million monthly transactions.

This is evidence of a thriving, expanding ecosystem. And one that’s outgrowing its original exchange roots.

Now, BNB is positioning itself as a desirable institutional-grade asset. One that appears not just on corporate balance sheets but, remarkably, in the plans of national treasuries.

So yes, the markets have turned, and the narrative is evolving.

Easing inflation, renewed inflows and CZ’s diplomatic comeback suggest crypto is moving beyond simple recovery into a quieter, more deliberate phase of accumulation.

Reflecting this broader trend, BNB is steadily cementing its relevance in both markets and institutions.

Savvy investors may want to look for opportunities to gain exposure to this growing network. My colleague Juan Villaverde’s Weiss Crypto Investor Members already have.

If you want to learn more about the other opportunities they’re targeting, click here.

Best,

Marija Matić