A Hidden Divergence Could Impact Your Q4 Crypto Plan

|

| By Juan Villaverde |

Bitcoin (BTC, “A-”) inched up to a new all-time closing high on Monday.

According to my research, breakouts like this lead to spirited subsequent rallies about 80% of the time.

So, the disciplined approach is to buy the market and increase exposure, after such an event.

In this case, however, Bitcoin seems in no rush to follow through.

It sold off sharply on Tuesday, surrendering the previous days’ gains.

So, the question now is this. Is Bitcoin still going to surge higher? Or is this week’s move going to be among the 20% of the time — when the power of a bullish breakout gets swamped by opposing influences?

The answer is not as straightforward as it might seem.

The Technical Reason Behind Bitcoin’s Reluctance

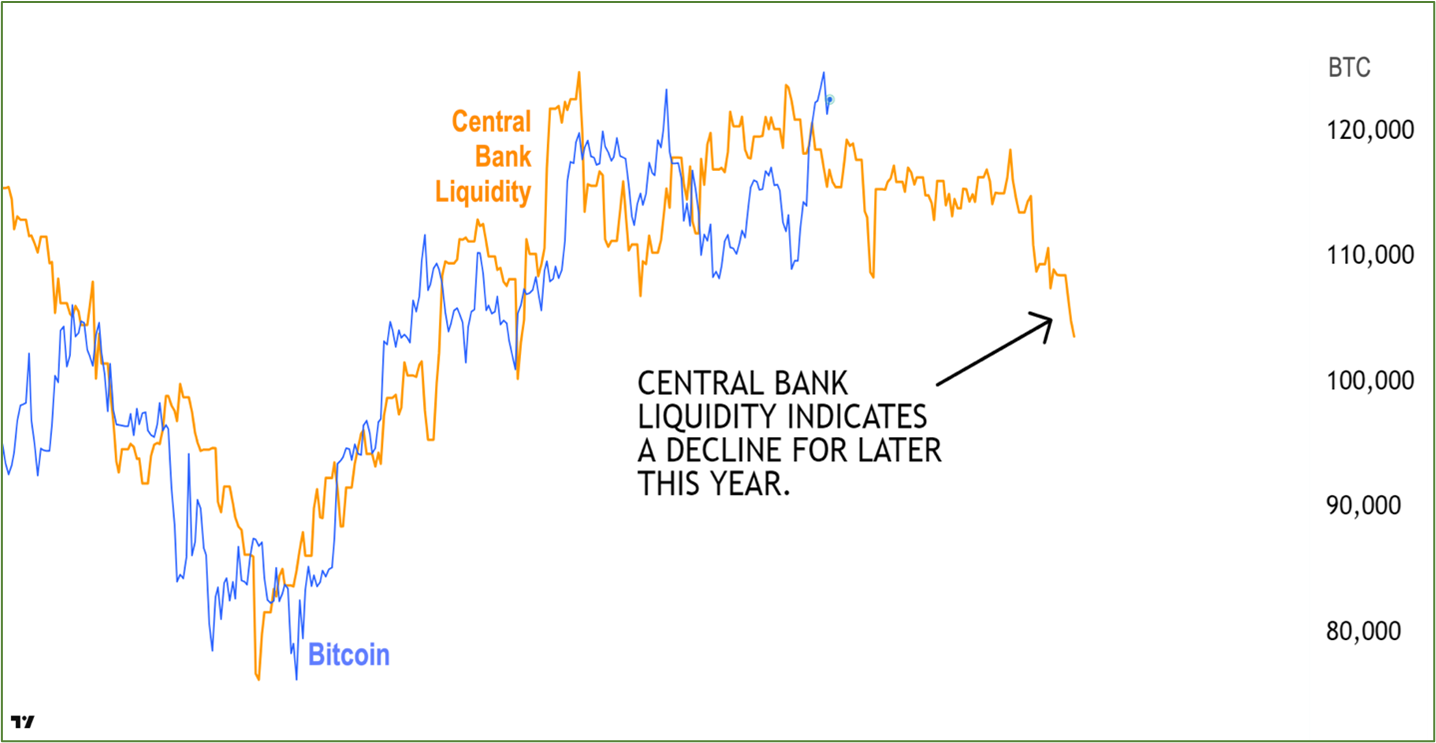

As you can see, Central Bank Liquidity — an indicator that leads Bitcoin by roughly 88 days — has basically been flatlining for months.

Until this week, that is.

As you can see, it fell quite sharply. This suggests a major high may soon form.

But as we’ve already noted, this stands in opposition to historical evidence that Bitcoin breakouts typically lead to fresh rallies.

This contradiction led me to dig deeper into CBL.

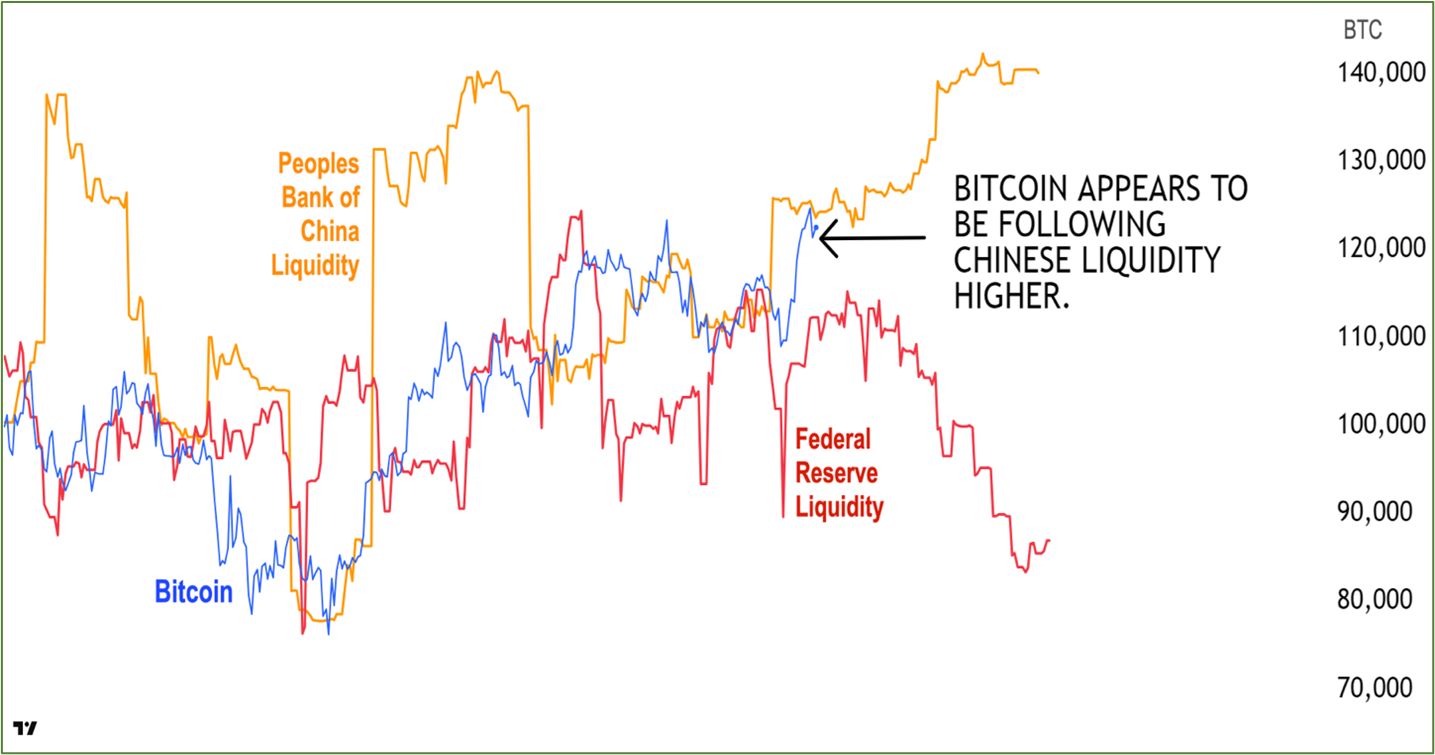

There are two major suppliers of global liquidity: the Federal Reserve and the People’s Bank of China (PBoC).

Why has liquidity flatlined recently?

Because the Federal Reserve has been draining liquidity from the market, while China has been injecting it.

The result? A stalemate. East expands as West contracts.

Adjusted for the 88-day lag it takes for liquidity to work its way into crypto, this stalemate began around mid-July. That’s also when Bitcoin first hit $123,000.

Since then, however, Bitcoin has been slightly more bullish than CBL alone would suggest. After its mid-July peak, BTC made a marginally higher high in mid-August — and again earlier this week.

China Pumping in More Money Outweighs Fed Efforts to Withdraw It

Here’s the good news. My research indicates Bitcoin is actually far more sensitive to Chinese liquidity than to the Fed’s.

The Fed has been a net drainer of liquidity since Q1 of last year. And although Bitcoin has had its ups and downs, it has still trended higher during that time — just like the PBOC balance sheet.

Now, as these two 800-pound gorillas move in opposition, it appears once again, Bitcoin is taking its cues from the East. That is, seemingly ready to break to new highs, in line with what the orange line (above) suggests.

I’m not saying the Fed doesn’t matter. Clearly, it does.

But right now, the evidence shows Bitcoin’s principal propellant comes from Beijing.

Not Washington, nor any other Western capital.

Final Thoughts

Diverging indicators …

Macroeconomic surprises …

Unexpected forces acting on the market are almost guaranteed to throw a wrench in any analytical outlook.

That’s why it’s important to stick to your strategy.

Twists in the market can shake even experienced investors. And fear, uncertainty, doubt or even FOMO can inspire risky behavior in the face of volatility.

To avoid falling for that trap, I keep my Crypto Timing Model at the core of my analysis.

It filters out the emotion. Using raw data and boosted by AI, it tells me the key levels that, if crossed, could really change Bitcoin’s trajectory.

And, to help maximize returns, it flashes automatic “buy” and “sell” signals when it spots the opportune moment to enter or exit specific trades.

In fact, testing proves my improved version 2.0 has the power to generate AVERAGE gains of 6,630% for each crypto asset.

I shared how my model works and how it expects crypto will progress in Q4 in my recent crypto briefing.

Here’s a spoiler: Despite diverging from CBL, I expect Bitcoin will continue higher over the course of the quarter.

With BTC just under its all-time high, now could be your last chance to load up before the rally resumes.

And if you want to know how my timing model can help you navigate what’s to come, I hope you’ll watch this briefing now.

Before the market moves again.

Best,

Juan Villaverde