|

| By Marija Matic |

The Trump empire has always been built on bold bets — real estate towers, luxury resorts, beauty pageants, even reality TV.

Now, cryptocurrency is quickly becoming its most lucrative chapter.

In just a few months, the family has amassed more than $1.3 billion in crypto wealth.

This makes digital assets a core pillar of the Trump business portfolio.

Much of that windfall comes from World Liberty Financial (WLFI, Unrated).

WLFI is a crypto project spearheaded by Donald Trump’s sons Donald Jr., Eric and Barron alongside real estate mogul Steve Witkoff and his two sons Zach and Alex.

The five children are listed as cofounders, while the president and elder Witkoff are listed as cofounders emeritus.

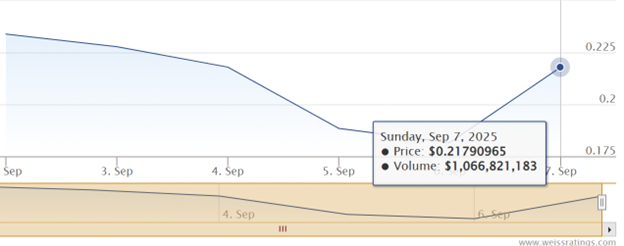

WLFI officially launched its token on Sept. 1 when public trading was allowed for the first time.

But the launch was anything but smooth.

WLFI Got a Rocky Start, but Some Investors Still Hold Rock-Solid Profits

The Trumps’ WLFI project hit headlines last month when Las Vegas-based fintech ALT5 Sigma struck a deal to buy $1.5 billion worth of WLFI tokens.

That single transaction alone added some $670 million to the Trump family’s net worth.

On paper, the Trumps still hold 22.5 billion WLFI tokens valued at $4 billion.

However, these tokens remain locked and unsellable for now. So, they aren’t counted in official wealth tallies.

Yet the token’s public launch has been rocky. WLFI debuted at 30 cents per token, only to plunge to 16 cents within days.

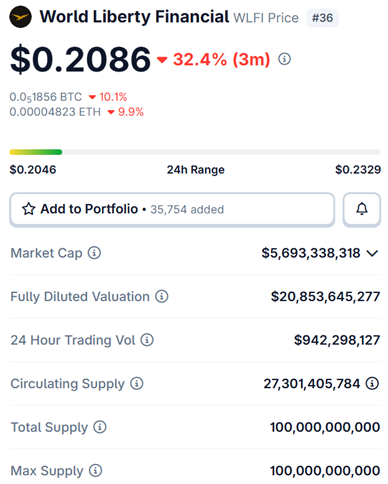

WLFI has since rebounded to around 21 cents, giving the project a market cap of about $5.8 billion.

The volatility has rattled retail investors, many of whom bought near the highs and are now sitting on steep losses.

Meanwhile, early backers like Justin Sun — who acquired tokens at just a little over a penny ($0.015) — remain massively in profit despite recent turbulence.

Justin Sun’s Frozen Wallet Sparks Backlash

WLFI’s biggest controversy erupted when the team blacklisted 272 wallets it accused of manipulative or high-risk activity.

Among them: the wallet of Justin Sun, founder of Tron (TRX, “C+”) and WLFI’s largest individual investor.

Sun had transferred $9 million in WLFI to exchanges after the token’s price dropped.

The WLFI team immediately froze his wallet — holding about $107 million in tokens.

The move shocked the crypto community.

Critics asked: If they can do it to Sun, who’s next?

Sun denied any wrongdoing.

He claimed the price correction was driven by broader dumping from market-makers, rather than his trades.

The data supports his claim.

He called the freeze “unreasonable” and even pledged to buy another $20 million in WLFI/ALTS tokens to show support.

Sun’s exposure is substantial …

As of the latest reports, his investment in World Liberty Financial is valued at around $700 million.

Compared to the $75 million he originally invested, that’s a remarkable unrealized gain.

Security or Centralization?

WLFI defended its actions.

It insisted the blacklist was a protective measure aimed at safeguarding users, not punishing investors.

According to the project, of the 272 wallets frozen:

- 79% (215 wallets) were linked to phishing attacks.

- 18.4% (50 wallets) were flagged by owners as compromised.

- 1.8% (5 wallets) were marked “high-risk exposure.”

Still, it’s unclear which bucket Sun’s wallet fell into.

Other affected holders included well-known developer Bruno Skvorc. His wallet was flagged as high-risk — likely due to his use of the privacy tool TornadoCash.

The controversy highlights a deeper tension …

Can a project call itself decentralized while exercising centralized control over user wallets?

Some critics argue WLFI undermined trust by freezing assets post-launch rather than filtering wallets before its presale, since some of the users weren’t aware their wallets could be tainted.

American Bitcoin Corp.:

The Other Half of the Fortune

WLFI isn’t the Trumps’ only crypto jackpot. Earlier this year, Eric and Don Jr. cofounded American Bitcoin Corp. a Bitcoin mining firm.

The company merged with Gryphon Digital Mining and now trades publicly under the ticker ABTC.

At one point, Eric’s stake alone was worth nearly $1 billion, with Don Jr. holding a smaller share.

The project has made Eric Trump a leading figure in the family’s crypto push.

He even took the stage at the Bitcoin Asia Conference, urging attendees to start buying Bitcoin now.

My colleague Juan Villaverde’s Crypto Timing Model points to Sept. 20 as the next date to watch in crypto. But with a U.S. interest-rate cut potentially coming three days before that, it might pay to be invested before that time.

Bitcoin could do well but select cryptos — like the altcoins Dr. Martin Weiss and my colleague Mark Gough discuss here — could do even better.

Potentially much better.

The Road Ahead for WLFI

WLFI’s leadership is scrambling to stabilize the project and restore investor trust.

Recently, the team announced the burning of 47 million tokens — a move designed to reduce supply and support the price.

So far, the measure hasn’t fully reassured markets.

The project’s trajectory now depends on whether it can rebuild credibility while navigating the tension between security measures and the decentralization principles that crypto investors prize.

Wallet blacklisting may have addressed certain risks.

But it has also raised concerns over governance, transparency and consistency …

Issues that could alienate some crypto natives.

For the Trump family, however, the immediate picture is clear:

Crypto is no longer a speculative side venture but an increasingly significant pillar of their business portfolio.

Whether WLFI can sustain its momentum — or become another cautionary tale in a volatile industry — remains to be seen.

Best,

Marija Matić

P.S. World Liberty Financial owns dozens of different cryptos worth $475M. But only a small amount is in Bitcoin.

The fund — nearly half a billion dollars — is invested almost entirely in altcoins.

My colleague Mark Gough has counted 43 altcoins that have soared way past Bitcoin recently — as much as 37x better.

To see how you can get your hands on Mark’s top three critical altcoin opportunities for September, watch this video now.