A Stealth Bull Market That Could Make Bitcoin Unstoppable

|

| By Bob Czeschin |

Five short years ago, somebody let the genie out of Aladdin’s lamp.

What was revealed was this hidden secret of vast wealth:

To 10x your money, buy Bitcoin. If you want 100x … buy it using other people’s money.

The CEO of a little-known company took this advice to heart.

On Aug. 10, 2020, he started plowing corporate cash into Bitcoin (BTC, “A-”). He stashed it away on the company’s balance sheet.

Later, he issued convertible bonds and new shares. He used the money raised from those for the same purpose.

Now, fast forward to May 2025. How has this worked out? Especially compared to other high-performing investments?

Well, since then …

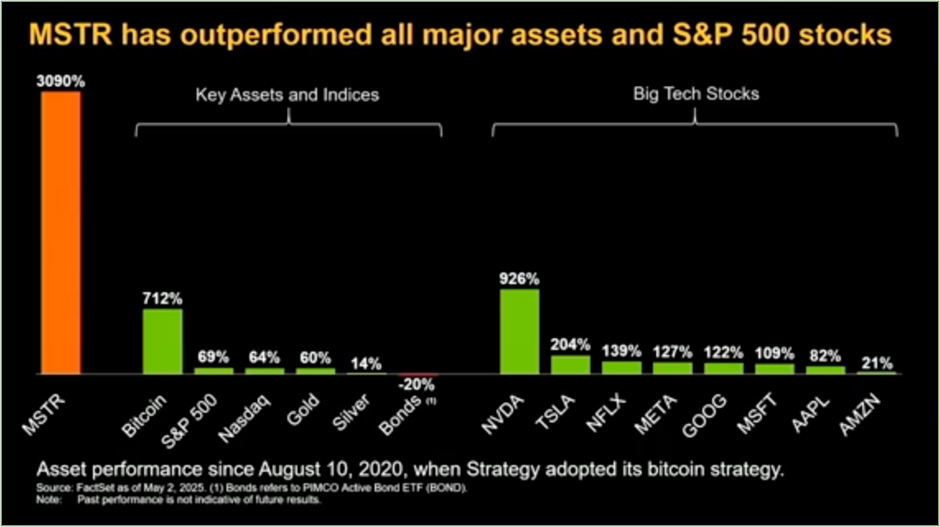

- The S&P 500 has climbed a healthy 69%.

- Tesla shares rose a respectable 204%.

- Bitcoin advanced an amazing 712%.

- AI-chip darling Nvidia shot up a meteoric 926%.

- But this Bitcoin-buying company’s shares blasted up an astonishing 3,090%.

Because of this foresight, this once obscure Bitcoin-buying company — recently re-christened Strategy (MSTR) — has become one of the most famous names on Wall Street … in crypto … and around the world.

Not surprisingly, this real-world track record swiftly spawned legions of copycats.

All wish to duplicate — or even exceed — MSTR’s success.

Strive Asset Management, co-founded by former U.S. presidential candidate Vivek Ramaswamy, is one example.

Earlier this month, the company said it would buy Bitcoin as a reserve asset and merge with Nasdaq-listed Asset Entities (ASST).

The stock shot up 450% in a day.

Last year, Metaplanet (MTPLF), a failing Japanese hotel company, announced the purchase of Bitcoin as a balance sheet asset.

Its market cap exploded an astounding 100x — which made it the best-performing stock in the world for 2024.

No doubt hoping for a repeat performance, Metaplanet recently announced a new $21.25 million bond issue — to raise money to buy more Bitcoin.

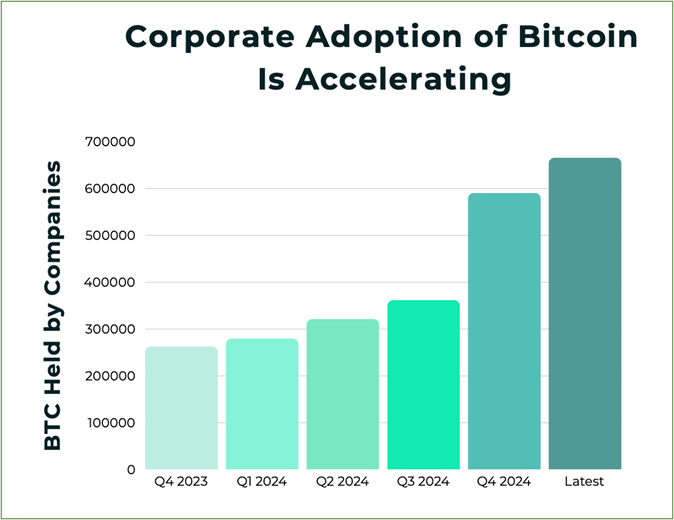

Global corporate holdings of Bitcoin more than doubled in 2024. And are still rising strongly.

5 Reasons Why Bitcoin’s Like Catnip to Companies

What company would not like to see its stock blast up like MSTR?

And if that weren’t good enough, there are practical business benefits to having Bitcoin on the balance sheet. Among them …

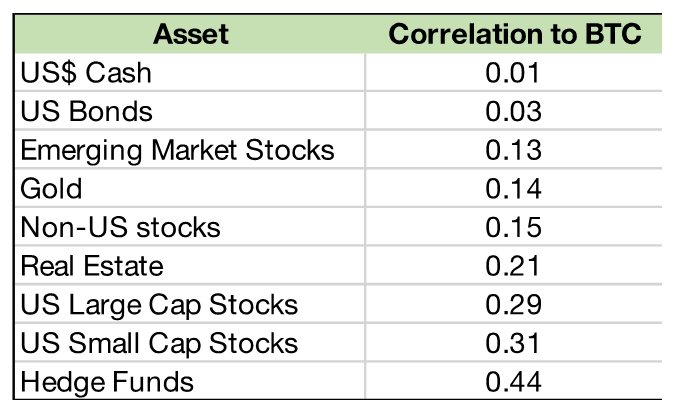

One, diversification. Bitcoin has a very low correlation with other widely held corporate treasury assets, particularly cash and bonds. This makes it extremely useful for diversification purposes.

Two, counterparty risk. Unlike bank deposits and fiat currencies, Bitcoin is one of the few assets that are not simultaneously someone else’s liability. This can be hugely important — as the failures of Credit Suisse, First Republic and Silicon Valley Bank have made clear.

Three, U.S. dollar distrust. Whenever the U.S. government freezes dollar balances around the around the world — or locks countries (e.g., Russia, Venezuela, Iran, North Korea) out of the dollar-based global financial system — it undermines confidence in the greenback.

Bitcoin offers a form of money immune to political interference.

Four, inflation hedge. Bitcoin’s hard ceiling on the number of tokens that can ever be created makes it inherently disinflationary. The OG crypto can truly serve as a bulwark against erosion of value over time.

Five, geopolitical uncertainty. War is the great destroyer of accumulated wealth. And we live in an era where wars and rumors of war abound. Thanks to its decentralized nature, Bitcoin is largely unaffected by war, rebellion or revolution. Which makes it a go-to asset for companies seeking long-term safety and stability.

Potential Corporate Bitcoin Buyers Totally Overwhelm Supply

As I write, BitcoinTresuries.net counts 102 public companies and 26 private companies holding Bitcoin — either directly or through a custodian.

And this is still just a drop in the Bitcoin bucket.

More firms will no doubt jump on the MSTR bandwagon every quarter and add momentum to this already accelerating trend.

Bitcoin’s total supply is a mere 21 million tokens (of which 94% have already been minted). But there are presently an estimated 400.4 million public and private corporations presently in existence worldwide.

Global Company Population

In other words, the theoretical number of potential corporate buyers of Bitcoin as a balance sheet asset … utterly dwarfs the total supply of Bitcoin — by a whopping 19-to-1!

This goes to the heart of why this stealth bull market is so seismically potent. Let’s take another look at MSTR’s 5-year track record (above) compared to other leading assets.

Bitcoin, you recall, was up 712%.

But simply by adding Bitcoin to its balance sheet, MSTR shot up 3,090%. How can this be?

It’s because investment demand for MSTR securities — shares and especially its convertible bonds — was actually a lot stronger than demand for Bitcoin itself.

Remember, this was five years ago. There were no ETFs. So, MSTR’s securities were one of the very few ways the vast universe of stock market investors could get in on crypto.

Even after the advent of ETFs, MSTR’s convertibles are still one of the only ways traditional investors can buy a stake in Bitcoin that pays a modest yield. No ETF can do that.

In other words, public and private companies are set to be …

The Next Wave in Bitcoin’s Securitization Megatrend

Upon reflection, this makes a lot of sense.

Because with a simple company structure, you can tap pockets of pent-up demand for what crypto has to offer — that no cumbersome, heavily regulated ETF could ever reach.

Dozens, maybe hundreds, more companies around the world are now taking the genie’s advice every year. They’re raising billions in fresh capital to buy more Bitcoin.

What’s going to happen to prices — as this Noah’s Flood of fresh money comes pouring into and over Bitcoin’s strictly limited token supply? Quarter after quarter? Year after year?

This stealth bull market could eventually lift the price of Bitcoin to heights no one dares even to imagine today. That’s what megatrends do.

Make sure you invest on the right side of this one.

Best,

Bob Czeschin

P.S. Thanks to its low correlation to TradFi markets, Bitcoin has become a portfolio stable for retail and institutional investors alike.

And not just as a hedge against TradFi market volatility. But also from a weakening dollar … counterparty risk … and even geopolitical uncertainty.

But it’s only one piece in the puzzle to protect your assets.

That’s where the Emergency Wealth Conclave comes in.

Just released earlier today, this free presentation reveals even more off-the-grid assets and how they can help you navigate this delicate market.