All Eyes Are Watching the Wrong Crypto Revolution

|

| By Marija Matic |

As September winds down, Bitcoin (BTC, “A-”) holds onto modest monthly gains.

Nothing dramatic, especially after the recent correction. But steady growth is still growth.

And more could be on the horizon if October shapes up differently.

That’s because there are 16 spot crypto ETF applications pending approval right now. And not just for one or two coins.

Spot ETFs for Solana (SOL, “B”), XRP (XRP, “B-”), Litecoin (LTC, “B-”), Cardano (ADA, “B+”) and even Dogecoin (DOGE, “C+”) are all awaiting the green light from the SEC.

Decisions could drop at any moment. And any approval could potentially be the spark for the next altcoin rally.

But here's what the mainstream headlines are missing: While everyone fixates on ETFs, the real revolution is unfolding in decentralized perpetual exchanges.

Yeah, I know. I briefly touched on how impressive perp exchanges have been last week.

But I just can’t stop writing about them!

That’s because they are far more interesting and useful than ETFs.

That’s not to say ETFs don’t have their place.

They’re great tools for bringing institutional capital into the ecosystem. And they offer an easy way to onboard newcomers while providing regulatory comfort.

But DeFi utility is what gets investors to stay in the crypto market.

To that end, perps are doing the heavy lifting right now. In fact, I’d say we’re in the middle of perp season, both in terms of price action and actual usage.

Want proof? Look no further than this:

The NFT Flex That Signals a Movement

At the center of the perp boom is Hyperliquid (HYPE, “D”), which launched late last year.

And it quickly became the darling of this sector.

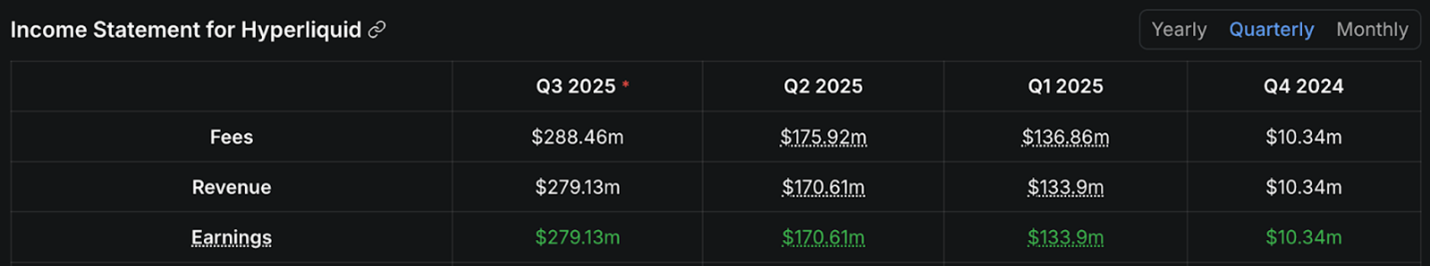

Hyperliquid has generated $612 million in fees over the past year, with $84.88 million earned in the last 30 days alone!

In addition, its Layer-1 blockchain already hosts approximately 50 functioning dApps beyond the exchange itself.

No wonder that the price of HYPE token reached its all-time high just a few days ago!

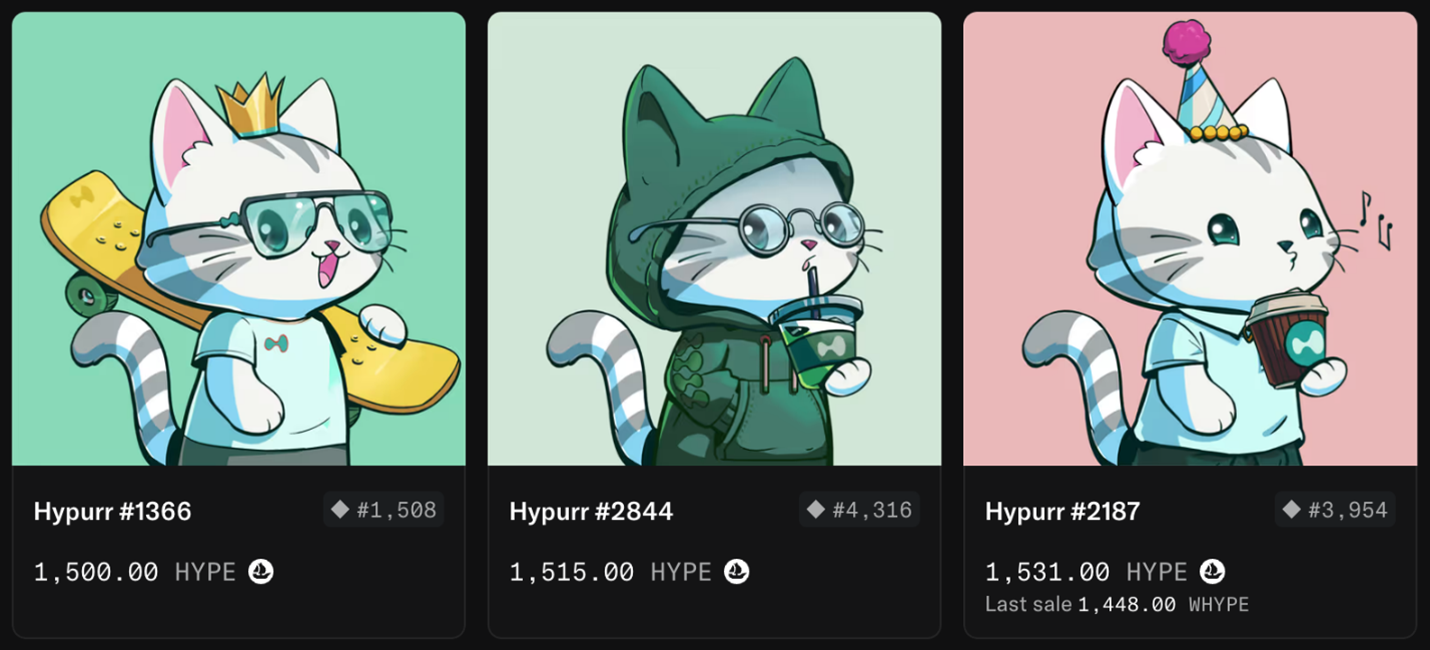

And yesterday, the platform distributed 4,600 Hypurr non-fungible tokens to early users.

Hyperliquid simply airdropped these cute cat NFTs for free to early users' wallets as a thank you.

But when they hit secondary markets, something remarkable happened: Others wanted in on that exclusive club.

And that FOMO sent prices soaring.

These digital cats — admittedly simple, arguably childish — now command a floor price of $68,000:

The collection has generated over $64 million in trading volume on OpenSea in one day!

Now, critics will — rightfully — point out that these aren't masterpieces. They're cartoonish cat avatars that look like they belong in a children's book.

So why would sophisticated traders pay luxury car prices for them?

Because of what they really represent.

These aren't really art acquisitions.

They're digital battle scars.

Proof-of-presence tokens for those who believed in Hyperliquid early. Before it captured a sizeable chunk of the market.

When someone uses a Hypurr profile picture, it’s not about showing their aesthetic taste.

It’s about bragging rights. Boasting that this user is a DeFi trader, an early adopter who contributed to building Hyperliquid.

It is a badge of honor that's now public and tradeable.

And it could come with potential future benefits (though Hyperliquid wisely promised nothing as of yet).

The fact that thousands of traders received what became $70,000 assets as a "thank you" demonstrates the kind of value that can flow back to communities in decentralized systems.

The Binance-Backed Disruptor

Just when you thought perpetual DEXs couldn't get more interesting, enter Aster (ASTER, Not Yet Rated).

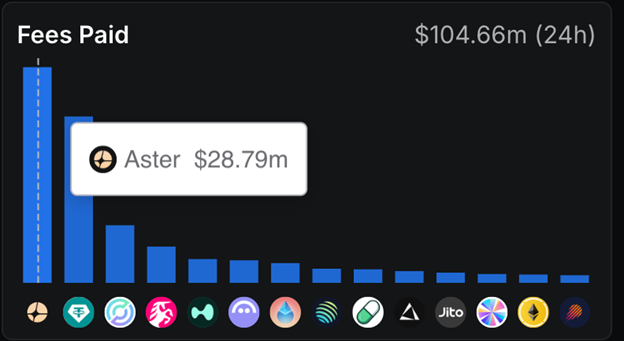

This Binance-backed exchange just became the highest-earning crypto project in a single day!

It pulled in $28.79 million in fees across 24 hours on a staggering $83.5 billion in perpetual contract volume.

Not bad for a platform that just launched this month.

To put that in perspective, Aster has just out-earned Tether ($22.21 million) and dwarfed Hyperliquid's daily $3.17 million.

Over seven days, Aster has accumulated $93.51 million in fees. Extrapolate that weekly run rate to a full year and you're looking at $4.87 billion.

Related Story: SpaceX, Magnificent 7 and … Tether?

That staggering figure is impressive. And indeed, some traders were able to pocket a piece of the action via its token.

But something this explosive happening this quickly? It begs us to ask the sustainability question.

That is, what's driving this explosion … and can it continue?

In Aster’s case, there are two factors at play: innovation and incentives.

The innovation is hidden orders.

See, most on-chain perpetual exchanges operate with transparent order books. That means everyone can see what you’re doing. It’s a feature many consider foundational to DeFi's ethos.

But Aster takes a new approach. It allows traders to place completely invisible limit orders.

For sophisticated traders executing large positions, this is a game-changer.

No more telegraphing your moves to the entire market!

And the incentive? A massive airdrop campaign turned Aster into a farming bonanza.

Which brings us to the elephant in the room: How much of this volume is real demand … and how much is just mercenary capital chasing tokens?

Because as an investor, you have to determine if Aster’s impressive traction will continue after the incentives end.

My opinion? There are reasons to be optimistic.

Namely because Aster has already onboarded three million users, built its infrastructure on the popular BNB chain and secured support from Binance itself.

Even if 70% of current trading volume evaporates post-airdrop, the remaining 30% would still represent a remarkable market presence.

The Bottom Line

As October unfolds with potential catalysts on the horizon, the smartest observers aren't just watching the headlines.

They're eyes are on platforms where actual usage is exploding.

Where communities are forming.

And where builders are creating infrastructure that operates on its own merits.

Perpetual DEXs are having their moment. Not because of what might happen next month. But because of what's already being built and used right now.

So while ETFs might bring the next wave of capital into crypto, it’s the perpetual DEXs that are building the infrastructure responsible for keeping capital in the ecosystem.

And they don’t have to wait for SEC approval.

While traditional finance slowly opens its doors to crypto, DeFi has already built an entire city.

And once you've experienced truly decentralized trading — with all its risks, rewards, and revolutionary potential — there's no going back to asking permission.

Best,

Marija Matić