Bitcoin-Based Stablecoins Could Unlock $1.5 Trillion

|

| By Marija Matic |

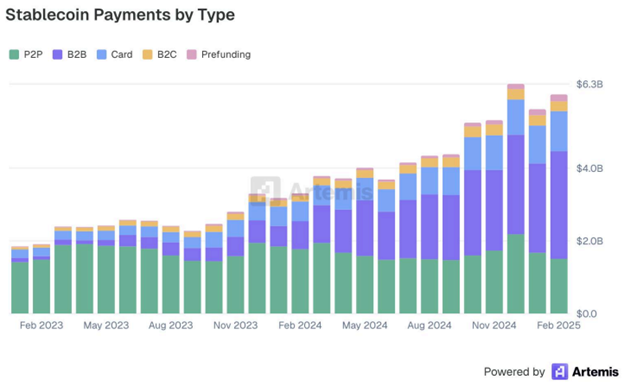

Stablecoins aren’t just having their moment in the spotlight. They are rapidly becoming a cornerstone of global payments.

Between January 2023 and February 2025, transaction volumes soared to $94 billion, according to Artemis.

And much of this surge is thanks to businesses, not retail users.

Business-to-business (B2B) payments jumped to 49% of all stablecoin activity, while card-linked stablecoin spending more than doubled, reaching $1.1 billion in February 2025 from $543 million a year earlier.

This growth marks a transformation: Stablecoins are no longer just tools for crypto traders. They’ve begun their evolution into critical infrastructure for real-world finance.

So far, networks like Ethereum (ETH, “A-”) and Solana (SOL, “B”) dominate this space. And Bitcoin (BTC, “A”) — the world’s most secure and recognizable cryptocurrency — remains largely untapped.

But that may change soon.

Why Bitcoin Has Been Left Out

Bitcoin’s absence from the stablecoin boom isn’t due to lack of interest. Rather, it stems from the blockchain’s foundational design.

Bitcoin prioritizes security and simplicity over programmability and speed. Its simple code and slower transaction times make it harder to build the complex mechanisms stablecoins require — like automated liquidations or smart collateral systems.

That narrative is shifting.

At the Bitcoin2025 conference in Las Vegas, stablecoins unexpectedly took center stage. Projects focused on Bitcoin-backed or Bitcoin-native stablecoins drew serious attention.

This signals the Bitcoin ecosystem is gearing up to join the stablecoin revolution.

Bitcoin-Backed Stablecoins

Bitcoin-based stablecoins take two main approaches …

- Build on Bitcoin's infrastructure to leverage its security properties, or

- Use Bitcoin as collateral to back stablecoins.

Some projects feature both.

By anchoring stablecoins to Bitcoin in either way, these projects aim to combine Bitcoin’s unmatched security with the flexibility and utility of dollar-pegged assets. With this, projects can unlock new use cases — such as lending, borrowing, payment processing and trading — all while retaining Bitcoin exposure.

In short, users will be able to unlock the value of their Bitcoin without selling it. This would offer a new path toward what many are calling Bitcoin-native DeFi.

And that’s a big deal. Because, as of writing, most BTC just sits in wallets, useless. That leaves over $1.5 trillion in capital lying idle.

The rise of Bitcoin-backed stablecoins could change that. And there are three main ways these stablecoins can be structured:

- Custodial: A company holds your Bitcoin and issues you stablecoins in return. You trust the company to keep Bitcoin safe while you use the stablecoins across the ecosystem.

- Decentralized: Your Bitcoin is locked in smart contracts rather than held by a company. The system runs on code and economic incentives, not human discretion.

- Synthetic: Bitcoin is part of a broader collateral system used to create stablecoins. The stablecoin isn’t directly backed 1:1 by BTC, but BTC still supports the peg.

New Upgrades Prove Promising

As I mentioned, building stablecoins on Bitcoin is hard. That’s thanks to Bitcoin's code, which makes complex financial applications difficult to build directly on the base layer.

Additionally, Bitcoin transactions are slower and more expensive than newer networks.

In short, it hasn’t been a welcoming environment for developers or users.

But recent Bitcoin upgrades have opened new possibilities.

The Taproot upgrade, for example, has enhanced Bitcoin's smart contract capabilities, allowing for more sophisticated financial applications directly on Bitcoin.

Meanwhile, developers are exploring how Bitcoin’s Layer-2 networks could enable instant, low-cost stablecoin transfers while maintaining Bitcoin's mainnet security.

Additionally, cross-chain tools enable stablecoins like Avalon Lab’s USDa (USDA) to move across chains while still being Bitcoin-backed.

Here are the projects I’m watching in this rapidly developing space …

USDa (Avalon Labs)

- What: A fast-growing stablecoin that lets users turn BTC into dollars without selling—and earn yield.

- How: BTC is deposited with custodians (e.g., Coinbase Prime), and users mint stablecoin USDa, which circulates across various networks such as Ethereum and BNB Chain.

- Earning option: Users can stake USDa to receive sUSDa, which pays ~5% APY.

- Adoption stats: Over $100 million USDa minted and $200 million in BTC collateral. It’s currently the largest Bitcoin-backed stablecoin by market cap.

- The trade-off: You get convenience, yield, and multi-chain access, but you're trusting institutional custodians with your Bitcoin rather than holding the keys yourself.

DOC (Dollar on Chain, RSK)

- What: Allows Bitcoin purists who want their stablecoins as decentralized as their Bitcoin - no custodians, no compromise.

-

How: DOC is built on the RSK sidechain, which is secured via Bitcoin’s own mining network. Bitcoin is pegged-in and locked in smart contracts.

DOC is part of a three-token system that automatically balances risks and keeps everything stable through economic incentives rather than hoping some company does the right thing.

- Adoption: It works exactly as advertised and is fully functional. The catch? RSK hasn't exploded like Ethereum or other major chains, so you're dealing with smaller liquidity pools and fewer DeFi options. Daily volume is under $50K on most platforms, such as Sovryn DEX.

- The trade-off: You get true Bitcoin-native decentralization and keep control of your funds, but at the cost of ecosystem size and ease of use.

USDh (Hermetica)

- What: Hermetica operates a synthetic dollar protocol called USDh on the Stacks Network, which is secured by Bitcoin.

- How: USDh maintains its dollar peg through synthetic mechanisms designed to track the U.S. dollar value. That means there’s no direct BTC collateral, but the stablecoin remains Bitcoin-secured. It benefits from Stacks’ unique security tie to Bitcoin.

- Adoption: Early-stage project with around $5.6 million in total value locked (TVL).

- Trade-off: Interesting hybrid design, but newer and smaller than its peers.

Together, these innovations are making Bitcoin-based stablecoins more realistic and powerful than ever before.

The Bottom Line

Bitcoin-native stablecoins and stablecoin-fueled projects could unlock otherwise idle BTC.

Instead of users forced to sell their BTC to access liquidity, they will increasingly be able to collateralize it to mint stablecoins, earn yield or participate in DeFi.

All without losing their long-term exposure.

As Bitcoin matures and institutional interest increases, the demand to make Bitcoin productive will only grow.

Custodial, decentralized and synthetic models each offer different trade-offs at the moment, but they all point toward the same trend: Bitcoin is becoming more than just a store of value. It’s becoming a financial foundation.

For those watching Bitcoin’s evolution closely, this may be the most exciting shift since the invention of Bitcoin itself.

And one that opens a broader avenue of opportunity for the OG blockchain.

If your Bitcoin is just sitting in your wallet collecting dust, I suggest you keep a close eye on this sector. I know I will be.

Best,

Marija Matić

P.S. I also suggest you join my colleague Juan Villaverde tomorrow at 2 p.m. Eastern for our special Crypto All-Access Summit.

It’s the first step to take advantage of the current market, which could offer the ideal opportunity to build a true foundation of wealth that can be passed on for generations.