|

| By Marija Matic |

Bitcoin (BTC, “A-”) has drifted back toward a familiar line in the sand.

Slipping below $93,000, the market’s bellwether is now pressing against a multi-year trendline that has quietly guided its entire recovery since the 2022 bottom.

It’s the kind of level where a market decides what story it wants to tell next.

And this time, that decision arrives just as global liquidity tides begin shifting. And as U.S. markets stumble under the weight of their own contradictions.

A Market Hit from All Sides

Watching the TradFi markets over the past week has felt like watching a ship take on water from every direction …

- Hotter-than-expected inflation snuffed out hopes of near-term Fed cuts. Tariff threats resurfaced like a bad sequel and rekindled recession fears in nearly half the country.

- Tech stocks — long the oxygen tank for the U.S. market — finally ran out of breath.

- And even with the government shutdown ending, the aftertaste of dysfunction lingered.

The result?

The S&P 500 and Dow ended the week down several points each, volatility spiked and traders began whispering about “healthy corrections.”

All things that indicate the smart money is bracing for a bigger wave.

And it was against crypto that the wave broke first.

The Air Gets Thin in Digital Assets

Digital asset funds faced their worst outflows in months as $2 billion left the space in just a week.

That flight was almost entirely driven by U.S. investors pulling back from risk.

As capital left, market depth dropped by 30%. Bitcoin’s liquidity — its ability to absorb large trades without lurching — has thinned. And order books have become skittish, like a crowd that jumps at the smallest sound.

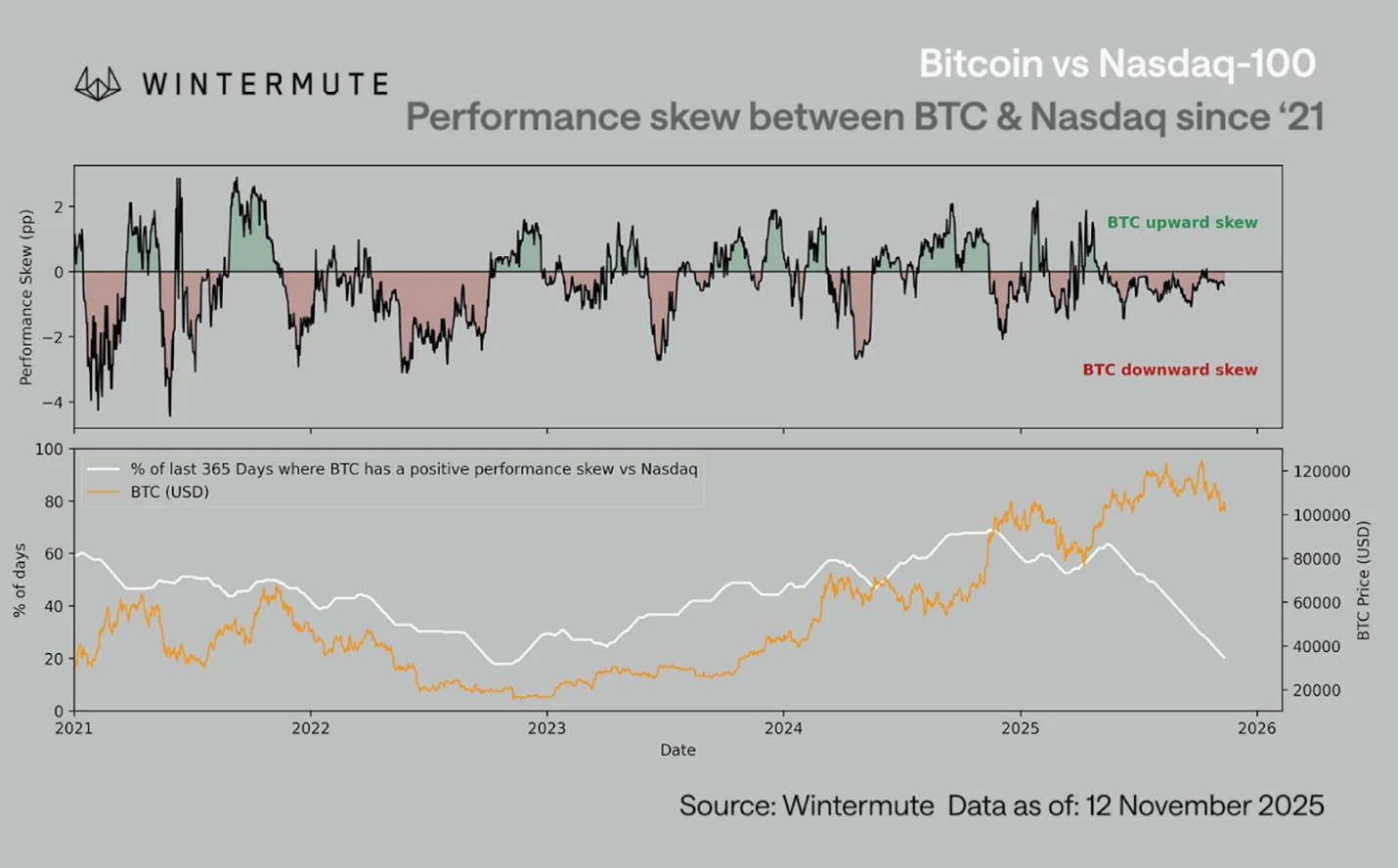

The Nasdaq Shadow: Correlated, But in Only One Direction

Bitcoin is still tightly tethered to the Nasdaq-100, but the relationship has taken a toxic shape.

The two assets move together, sure. But only when the Nasdaq falls.

When tech stocks climb, Bitcoin barely nods. When they dip, Bitcoin tumbles faster.

It’s like watching two dancers tied by a rope, except Bitcoin only gets pulled in one direction.

Wintermute’s skew indicator above captures this imbalance vividly.

The small green bars show how the Nasdaq rallies were mirrored in BTC. And the red spikes reveal when it slips.

At a glance, you can see the red peaks are higher and they last longer.

This performance profile hasn’t appeared since late 2022. That was deep in the bear market, not near major highs.

Historically, this kind of negative asymmetry emerges when investors are tired.

That’s why Bitcoin feels heavy today. Not enough to feel like a collapse, but like the asset is just weighed down by investor doubt.

Institutions Split: Some Flee, Others Feast

Not all institutions are retreating, however.

While traditional investors are de-risking, crypto-native giants are acting like it’s Black Friday.

- BitMine continues to hoover up Ethereum (ETH, “B+”), marching toward its goal of owning a material share of the supply.

- Strategy is doing the same with Bitcoin, adding billions to its already massive stash with a kind of mechanical discipline that ignores noise entirely.

These firms are not buying dips; they’re buying time.

Their horizon stretches past elections, CPI prints and weekly candles.

BitMine now holds almost 3% of ETH, while Strategy holds over 3% of BTC’s supply.

It’s a stark contrast: Wall Street flinches while crypto-born institutions double down on scarcity bets.

A Global Liquidity Wave Forms Offshore

Here’s the twist: While the U.S. wrestles with inflation and tariffs, the rest of the world is building what looks like a liquidity wave.

- Japan has launched a $110 billion stimulus,

- China is pushing ahead with $1.4 trillion in support,

- And central banks worldwide have delivered over 300 rate cuts in the past two years. Even the Fed’s upcoming end to quantitative tightening on Dec. 1 adds to the global shift.

This kind of backdrop normally breathes life into risk assets.

The Technical Knife-Edge

Against this macro backdrop sits Bitcoin, coiled at a trendline that has mattered for three years.

It’s the kind of level where buyers have historically stepped in with conviction. And it’s on its third retest.

A bounce keeps the entire bullish macro structure alive.

A break suggests the first major momentum shift since 2022.

But what makes this moment strangely poetic is that Bitcoin’s next chapter will be written not by miners and not by fees.

Instead, its fate lies outside the crypto community, with the mood of global markets, liquidity and the decisions of U.S. policymakers.

The Inflection Point

Bitcoin is balancing on a thin edge between global optimism and U.S. anxiety.

The mood feels tired, cautious and defensive.

If the global liquidity tide overwhelms U.S. headwinds, this trendline bounce could mark the beginning of the next leg higher.

If not, the wedge will break … and the market will rewrite its story.

Right now, Bitcoin is holding the pen.

Fortunately, your personal investment story is a “choose-your-own adventure.”

Meaning while we wait for this next BTC chapter, you should already be planning on how you’ll respond once we learn which way Bitcoin will go.

If you’re a long-term “HODLer,” I suggest you check out cycles expert Juan Villaverde’s latest presentation.

In it, he explains how the market has changed in his time as a trader … and how he plans to help his Weiss Crypto Investor members navigate this volatile period.

Best,

Marija Matić