Bitcoin Nears $100K with Rising Utility and Growing Scarcity

|

| By Marija Matic |

Bitcoin (BTC, “A”) is on the cusp of a historic milestone.

It recently achieved a record price of $99,645. That’s just $355 shy of the psychologically significant $100,000 mark.

This breakthrough comes as the original cryptocurrency solidifies its position as the seventh-largest global asset, with a market capitalization of $1.947 trillion — already surpassing industry giants like Saudi Aramco and targeting tech behemoth Google.

One factor fueling this momentum is …

Bitcoin's Emerging Role as a Global Reserve Asset

Bitcoin's potential as a reserve asset is gaining unprecedented attention.

MicroStrategy (MSTR), led by Michael Saylor, pioneered corporate adoption by accumulating 386,700 BTC to get a 70.91% unrealized profit. This validated Bitcoin's value preservation potential on a large scale.

Now, the institutional interest in Bitcoin is accelerating. Allianz, Europe's second-largest insurer, demonstrated growing confidence by purchasing a significant portion of MicroStrategy's $2.6 billion convertible note offering.

But it’s not just companies turning to Bitcoin. Countries are, as well.

El Salvador became the first nation to integrate Bitcoin into official reserves in 2021. Acquiring 6,167 BTC at $44,524.51, the country has seen its holdings appreciate by over 118%, sparking global interest among nations wrestling with currency instability.

Even developed countries are showing interest.

In the United States, Texas — already a leader in Bitcoin mining, thanks to its abundant energy resources — is now considering the possibility of using Bitcoin as a state reserve asset. The state’s lawmakers are exploring legislation to formally establish Bitcoin reserves in the future.

This trend signals Bitcoin's transformation from a speculative asset to a serious financial instrument, akin to gold.

And, of course, there are President-Elect Donald Trump’s promises to establish a national Bitcoin reserve once in office.

But its use as a reserve asset isn’t the only source of demand for BTC. In fact, Bitcoin has seen …

A Surprising DeFi Rise

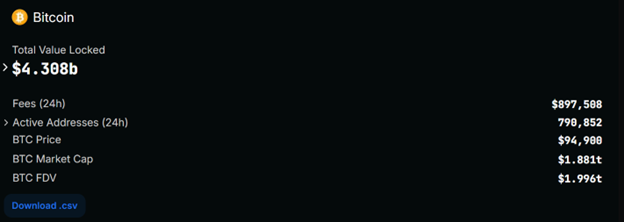

Bitcoin has emerged as the most dramatic blockchain network in terms of decentralized finance adoption, having surged an impressive 77.22% in total value locked (TVL) over the past 30 days.

From a modest $306.35 million at the start of the year, Bitcoin's network now commands a robust $4.3 billion in TVL — a remarkable 14-fold increase!

While Ethereum (ETH, “A-”) and Solana (SOL, “B+”) continue leading absolute growth in this area, Bitcoin’s performance stands out for a big reason: It is the start of a massive transformation. One that will take Bitcoin from a mere store of value to an active decentralized finance participant.

Related story: Make Bitcoin Fun Again with Merlin Chain

Before this, Bitcoin’s utility was limited to just a store of value. Now, it has the chance to increase its ability to participate in the wider decentralized economy.

This shift is epitomized by innovative staking protocols like Babylon, led by Stanford professors, which has become the dominant Bitcoin staking platform with a $2.34 billion TVL.

Babylon's groundbreaking approach allows self-custodial Bitcoin staking without wrapping, bridging or pegging. Users can secure proof-of-stake chains and earn yields, effectively using Bitcoin as collateral across blockchain networks.

Though risks exist — as staked Bitcoin can be slashed — many holders find the potential returns compelling.

These DeFi innovations for Bitcoin are still new and require careful evaluation. They’ll need to be battle-tested before they can prove themselves.

But as they are right now, they signal Bitcoin's evolving role in the cryptocurrency ecosystem, and the push to move it beyond a static asset to a dynamic, productive financial instrument.

Between the two — and Bitcoin’s limited supply — available BTC could grow rather scarce.

Remember, only 21 million BTC will ever exist. And already, a significant portion of these coins has been lost or remains inaccessible.

According to a 2023 report by Unchained Capital, as many as 3.8 million BTC may have been permanently lost due to forgotten passwords, hardware failures or unfortunate events such as the death of the owner without proper succession planning.

Some estimates even place the total number of lost BTC at 6 million or more, accounting for over 30% of the total supply.

And, as time goes on, the number of lost BTC will increase and further tighten the available supply. This scarcity will continue to put upward pressure on Bitcoin's price, making it even more valuable for those fortunate enough to hold it.

As more Bitcoin is locked up and utilized as collateral or reserves, the circulating supply will shrink.

This increasing scarcity, combined with growing utility, creates upward pressure on Bitcoin’s price over time, benefiting holders as the supply becomes ever more limited.

As Bitcoin's supply continues to dwindle due to lost coins and increased usage in DeFi and collateralized applications, the asset’s scarcity will be even more pronounced.

With so few individuals holding significant amounts of Bitcoin, the market dynamics help to increase value for those who have managed to secure their holdings.

Indeed, that is why investors are lining up to …

Ride the Crypto Greed Wave

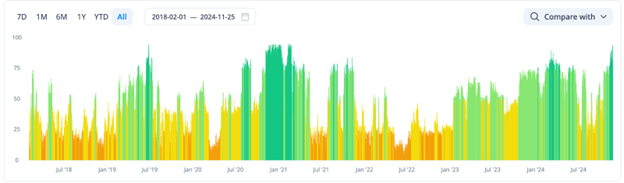

The cryptocurrency market has entered a phase of "extreme greed" for much of November, signaling heightened investor enthusiasm, as tracked by the Fear and Greed Index (FGI).

It provides a sophisticated lens into market psychology, synthesizing diverse signals, including:

- Trading volume

- Market volatility

- Asset dominance

- Whale activity

- Search trends

- And social media sentiment

By integrating machine learning models, the FGI captures nuanced investor behavior across platforms like Twitter and Reddit.

Now, this latest period of market exuberance is still relatively brief compared to historical patterns.

For example, the "extreme greed" phase that ran from November 2020 to March 2021 (highlighted in dark green) lasted significantly longer and coincided with the early stages of one of the most explosive bull runs in crypto history:

But counter to what you may expect, the historical data suggests that seemingly overheated markets can sustain "extreme greed" for months, often preceding significant price movements.

This pattern indicates that current market optimism might not just be noise. Rather it could potentially be a harbinger of larger rallies.

But the FGI isn’t the only indicator pushing this bullish narrative. Decentralized finance (DeFi) is, too. Daily transaction volumes have consistently exceeded $10 billion since the U.S. elections. Meanwhile, the total value locked in DeFi applications has rocketed to a yearly peak of $120.47 billion.

These converging indicators suggest the current market sentiment — marked by extreme greed — could signal prolonged bullishness, which could potentially lead to more upward momentum in the weeks and months ahead.

The road ahead for Bitcoin and the broader crypto market is still unfolding.

Bitcoin’s growing influence across various sectors positions it as an increasingly integral part of the global financial system.

With each new milestone — whether it’s breaking price records or advancing innovations — crypto becomes an ever more compelling transformative financial force.

For those positioned to capitalize on these changes, the potential rewards could be significant.

Stay tuned: the future of Bitcoin and the broader crypto market is just beginning to take shape.

Best,

Marija Matić