Bitcoin Open Interest Gives a Glimpse into the Future

|

| By Marija Matic |

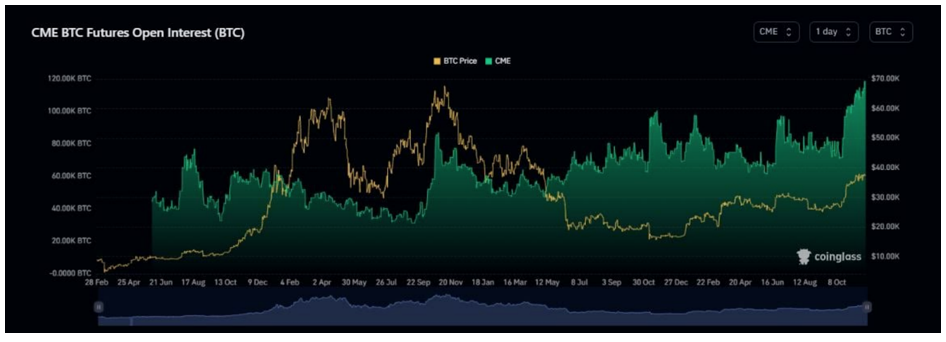

The Chicago Mercantile Exchange (CME) has emerged as a dominant force in the realm of Open Interest, surpassing Binance in scale and influence.

Notably, today's BTC Futures Open Interest on CME stands at a staggering $4.5 billion, marking a substantial 15% surge beyond Binance's figures. The significant shift occurred around September, solidifying CME's position as the primary arena for institutional Bitcoin (BTC, “A”) Futures trading.

This Coinglass chart illustrates this burgeoning demand on CME, which is indicative of a growing trend within institutional circles.

However, the significance goes beyond that.

The trading of CME Bitcoin futures at a premium compared to Coinbase's spot price, coupled with escalating open interest, signals a potential uptick in Bitcoin’s valuation in the near future.

As of last Friday, this premium almost touched $1,000 above the spot price, portraying a dynamic interplay between futures trading and the recent buoyant market sentiment.

The behavior of institutional traders clearly indicates a heightened confidence in Bitcoin's potential to surpass the $40,000 mark by year-end. But what's fueling this optimism?

The surge in sentiment aligns with the fervent anticipation surrounding the imminent introduction of a spot ETF for BTC. Additionally, the dwindling discount of Grayscale Trusts concerning Bitcoin's price further corroborates the prevailing optimism surrounding the ETF's potential approval.

Notably, the discount of GBTC to the net asset value — i.e., what Bitcoin is currently trading at — has now dipped below 10% for the first time since mid-2021, prompting questions about institutional investors' preferences.

Will they persist in acquiring it at such a minimal discount? Or will they pivot toward investing in Coinbase (COIN)?

Analysts are already debating whether the newfound demand for COIN stems from capital allocators' reluctance to purchase GBTC at a discount below 10% to NAV.

Meanwhile, recent events surrounding Binance have had a calming effect on the market. Former CEO Changpeng “CZ” Zhao's acceptance of a plea deal, departure from his position at Binance and the $4.3 billion settlement with U.S. authorities have collectively alleviated uncertainties within the crypto landscape.

This sentiment was particularly evident on Friday, as Bitcoin briefly breached the $38,000 resistance level, reaching a peak of $38,427. This is impressive as BTC was previously rejected by this level already.

Its next challenge is to cross and hold above this level with confidence.

After reaching these highs, the crypto market has shown a mild cooling trend over the weekend, followed by a 1.1% decline in the total market cap today. Presently, the crypto market cap stands at $1.46 trillion, reflecting this adjustment.

Notably, the 21-day exponential moving average — depicted by the orange line below — positioned at $36,500, continues to serve as a crucial support level:

Looking beyond Bitcoin, the altcoins are still impressive despite getting caught in the market-wide cooldown today. The total market capitalization of altcoins surged impressively since the start of October, escalating from $590 billion to $753 billion, marking a 27% increase in their collective value.

DeFi coins in particular demonstrated exceptional growth during this period. They saw a surge from $46 billion to well over $66 billion in market cap.

This signifies a striking growth rate of over 43%, surpassing the growth observed in other altcoins.

Curiously, amidst this altcoin fervor, Ethereum (ETH, “B+”) — often considered a cornerstone of the altcoin universe — has been quiet. Despite its prominence and significance, Ethereum’s performance has lagged behind the average altcoin, remaining on the brink of a breakout.

Namely, ETH is still fighting with overhead resistance at $2,140, which has been strong since April:

But once it confidently breaks this level, I expect ETH to fly!

Notable News, Notes & Tweets

- Cosmos (ATOM, “C+”) chain to split? What will happen to ATOM?

- Price prediction: Standard Chartered reiterates $120,000 price target for BTC in 2024.

- There’s a new crypto network being used to finance Hamas’ fight against Israel.

- Justin Sun’s response to accusations about Tron being used for terrorism financing.

What’s Next

The current sentiment is slightly less positive than last week, but remains in the Greed territory according to the Fear and Greed index, which measures Bitcoin’s dominance, volume, volatility, social media sentiment and relevant Google Trend search volumes.

Bitcoin's recent upswing has been supported by a weakening U.S. dollar, exerting a notable influence on overall market sentiment.

Historically, a weak dollar tends to enhance Bitcoin's allure, bolstering its value.

Adding to the positive outlook, both Bitcoin and Ethereum currently exhibit a trading pattern known as ascending triangles, widely regarded as a bullish indicator. However, the potential breakout from these patterns might be preceded by a corrective phase if these patterns maintain their validity.

It's important to note that in a bullish market, corrections present good buying opportunities. Indeed, Dr. Martin Weiss and Juan Villaverde just released an urgent video discussing the growth potential of altcoins in the coming bull market … and reveal their favorites.

If you missed it, you can watch it here. But they’ll be taking it offline soon, so I urge you to watch it now.

Keeping an eye on these evolving trends could pave the way for strategic investment decisions.

Best,

Marija