Bitcoin’s Familiar Bullish Case Is Still in Play

|

| By Bob Czeschin |

Bitcoin (BTC, “A-”) was conceived in the dark days of the 2008 global financial crisis.

Back then, manic money-printing ran amok. Which is why Satoshi Nakamoto’s bold experiment aimed to recreate what was lost in 1971— when U.S. President Nixon severed the dollar’s fixed link to gold.

Prior to that, Washington could only spend what it taxed or borrowed from real savings. This put a natural limit on spending.

With it gone, nothing any longer stopped Federal Reserve officials from printing vast quantities of fiat (paper-only) dollars.

And print, they did.

Between 1971 and 2024, the Fed’s balance sheet expanded from $80 billion to over $8 trillion.

That’s a 100x increase!

Today, the U.S. is over $38 trillion in debt. Unfunded liabilities exceed $200 trillion. The Fed holds $8 trillion in assets it cannot sell without crashing markets. Annual interest payments exceed $1 trillion annually.

Numbers like these are neither sustainable nor manageable. And they can’t be fixed through simple economic growth.

Which means they can only represent one thing: the terminal phase of America’s fiat currency experiment.

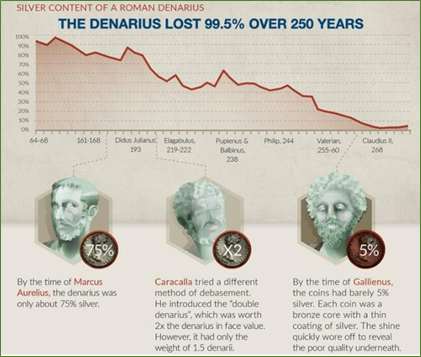

How do I know this? Because we’ve seen it before. A few times, in fact, with the collapse of …

- The Roman denarius.

- The Continental Currency, which left 18th-century American revolutionaries with worthless paper. (Fun fact: This gave birth to the derogatory expression, “Not worth a Continental.”)

- The French Assignat, which destroyed the wealth of the French Revolution’s middle class through hyperinflation.

- The Papiermark of Weimar Germany.

- The Argentine peso.

- The Zimbabwe dollar.

- The Venezuelan bolivar.

As currency historian Franz Pick observed: “In the end, all fiat currencies go to zero. Some just take a bit longer to get there.”

This is the familiar bullish case for Bitcoin, which stands beyond the reach of any government to print into oblivion.

Sunshine on the Day of Reckoning

When a fiat currency dies, the market responds with broad financial devastation.

Wholesale bankruptcies dominate headlines. Economic activity grinds to a halt.

But here’s the good news: Every fiat collapse in history has been followed by a return to some form of sound money.

Indeed, if you look about, you can already see glimpses of what the next sound-money regime might look like.

Observe the price action in Bitcoin and gold. There’s a reason both hit multiple all-time highs in 2025.

- A handful of central banks, led by People’s Bank of China, are on a bullion buying binge. Aggressively accumulating gold likely in anticipation of some kind of new gold standard.

- In the U.S., the advent of President Trump’s Strategic Bitcoin Reserve has already accorded the OG crypto the status of a Treasury reserve asset.

Now, Wyoming Senator Cynthia Lummis and the White House are pushing plans to convert at least part of America’s Fort Knox gold into BTC for the Bitcoin Reserve.

To me, this suggests one clear takeaway …

Both Bitcoin and gold will be at the heart of whatever sound-money regime emerges from the ashes of the fiat dollar standard.

What nobody knows, however, is how long it’ll take for this process to play out.

Which leaves the problem of staying solvent until stability finally reappears.

If you’re reading these words, you may already own Bitcoin. Maybe some gold, as well.

Terrific. I would recommend socking away more of both — whenever you can — on price pull backs.

But if you don’t hold either or are wondering what the best way to load up is, I suggest you check out Juan Villaverde’s Weiss Crypto Investor newsletter.

In it, he uses his Crypto Timing Model to help members maximize their potential long-term gains on top-performing crypto blue chips. All while minimizing risk exposure as much as possible.

Best,

Bob Czeschin