Bitcoin’s Latest Supply Shock Remains Unseen for Now

|

| By Bob Czeschin |

Scarcity is one of Bitcoin’s (BTC, “A-”) defining characteristics, famously guaranteed by the 21 million hard cap on the total coins that can ever be created.

But BTC is actually even more scarce than this would lead you to believe.

That’s because, included in that 21 million are all the BTC tokens that are lost — in forgotten accounts and misplaced hardware wallets, never to reenter circulation.

And now, for the first time in crypto history the volume of lost and likely irretrievable coins is increasing faster than miners mint new ones.

This means the useable supply of Bitcoin — coins immediately available to buy and sell — is now shrinking on a net basis.

This isn’t a flash-in-the-pan event, either. It’s rooted in the all-too-human ways people interact with Bitcoin. And those are unlikely to change any time soon.

In other words, Bitcoin’s shrinking useable supply is a long-term mega-trend. And that’s seriously bullish for prices.

But to know how bullish, we’ll need to identify how many lost coins there are. And why Bitcoin’s useable supply only started shrinking now — and not a long time ago?

Lost Private Keys

The Bitcoin blockchain is like a safe made of thick, bullet-proof glass. Anyone can look inside and see the coins it holds.

But the combination to the safe is a private key, a unique 256-bit cryptographic string. And without it, no one can spend or transfer the coins inside.

If you have a crypto wallet, you have a set of private keys.

Accordingly, lost keys, forgotten wallet seed phrases, overwritten files, corrupted drives, discarded hardware can all result in permanent irreversible inaccessibility.

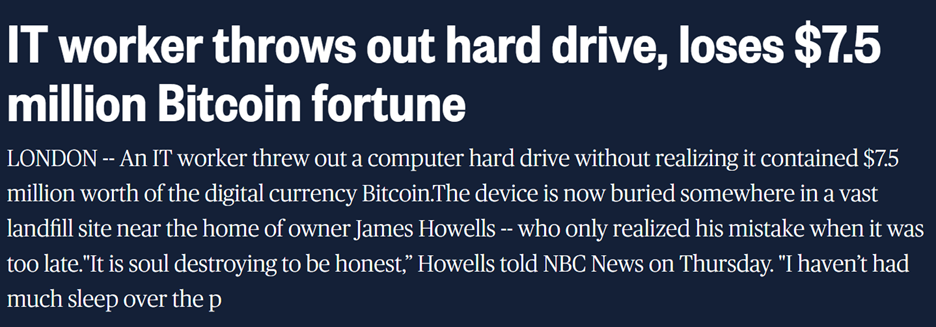

In 2013, IT engineer James Howells tossed an old hard drive in the trash — not realizing it still held private keys to 8,000 BTC.

Mined in the early days of crypto, when Bitcoin changed hands for just pennies, those coins are worth a whopping $900 million today.

The trash wound up in a nearby land fill. Which, realizing his mistake, Howells frantically offered to excavate. At his own expense. Or even buy it outright. But the matter wound up in court.

After a dozen years of legal maneuvering, local authorities still refused permission … and those coins are still out of circulation.

Even untimely death could cut supply even further.

Pioneering Bitcoin miner Mircea Popescu drowned off a Costa Rican beach in 2021. Rumored to have left behind a vast pile of Bitcoin, his private keys were never revealed or discovered.

So, his coins are “lost” forever.

Identifying and Counting Lost Coins

Irretrievably lost coins don’t announce themselves on the blockchain.

Instead, we have to do a little digging to ID them.

Blockchain analysts — like Glassnode and Chainalysis — scrutinize transaction outputs, wallet activity and a host of other factors to find lost coins.

But the most important predictive factor is the simplest: The longer coins sit dormant on the blockchain, the greater the odds their private keys are irretrievably lost.

On this metric, coins that have not moved for 10 years (or longer) are considered likely lost.

And these we can count!

Also, as you might expect, the number of likely lost coins rises steadily with time. This makes sense because almost every day, a few more long-dormant deposits mature past the 10-year threshold.

At the same time, however, new coins are also being created. After Bitcoin’s most recent halving, miners worldwide mint about 450 new BTC per day.

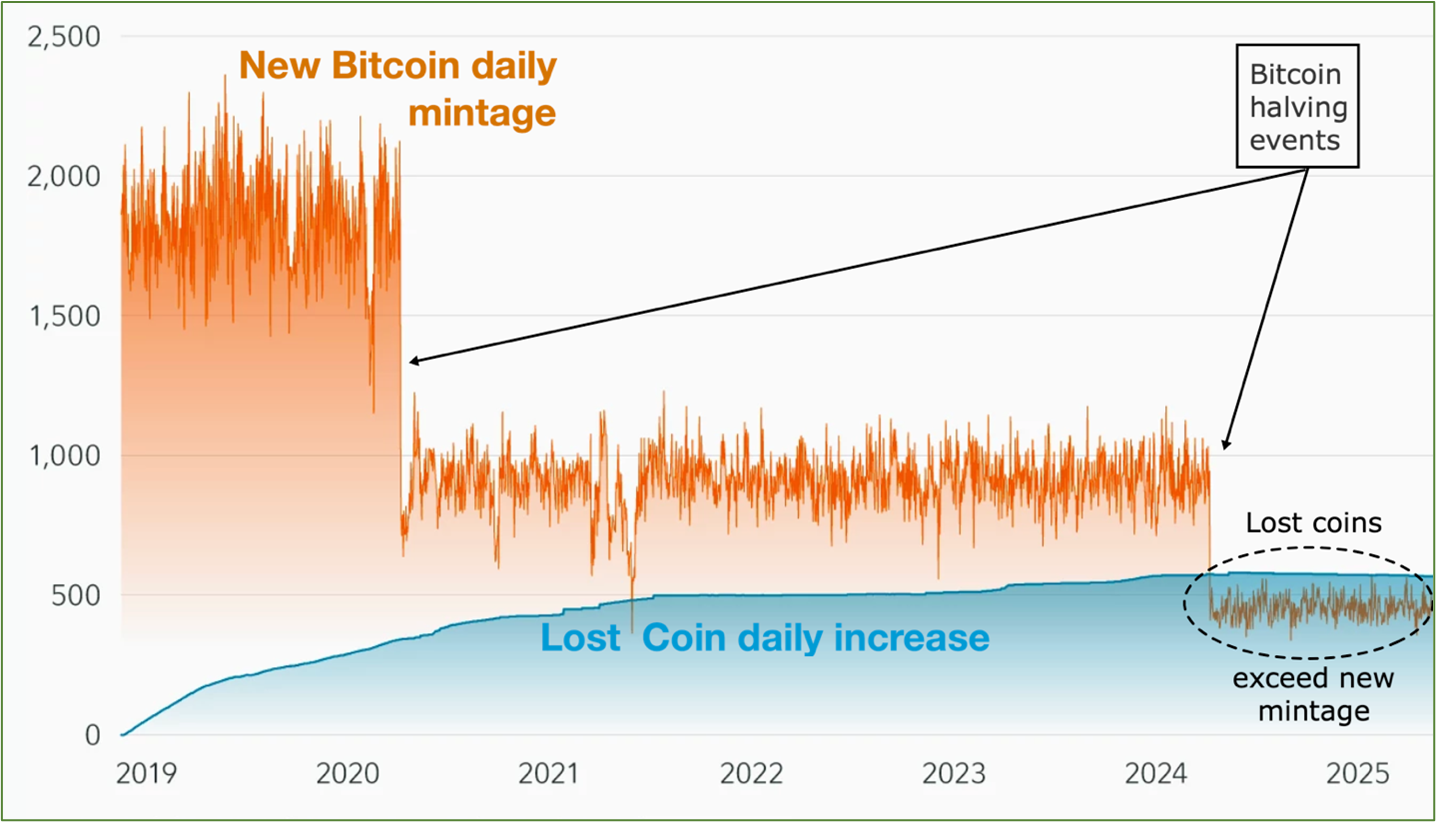

New BTC Creation vs. Lost Coin Supply Growth

As you can see, since Bitcoin’s last halving, lost coins have outpaced new supply.

In short, likely lost coins are now accumulating faster than they can be replaced by miners minting new ones.

That’s why Bitcoin’s useable supply is shrinking.

More importantly, it’s why …

This Decline in Useable Supply Will Accelerate

- Halving cuts production of newly mined BTC 50% every four years, or so. That means fewer and fewer new coins will be available to offset the steadily growing quantity of lost coins going forward.

-

More coins will end up lost. Negligent, careless behavior can be reduced via education, training, etc. But no amount of well-intentioned information can ever completely eradicate it.

No matter what, there will aways be folks who lose their private keys, forget encrypted disk passwords or die without passing on access credentials.

-

Bitcoin’s unforgiving password policy stems from its irreversible, decentralized design. From the ground up, the blockchain was built to withstand attack — ensuring transactions are forever beyond the reach of any government to influence or corrupt.

This requires there be no central authority to attack or subvert. But that also means there’s no one to reverse mistakes or recover keys.

- Murphy’s law. Even hardware wallets — secure as they are — sometimes fail. Or get corrupted. Indeed, Chainalysis and Fortune say hundreds of thousands of unused wallets exist — some never to be opened again because of this.

Implications for Investors

Chainalysis’ estimate of total lost coins is 3.7 million. Glassnode puts the present number at 7.8 million. Splitting the difference yields 5.7 million.

Even so, that’s still a whopping 27% of Bitcoins total 21-million cap — already gone forever.

Like dark matter in the universe, this silent supply shock may be largely invisible to most investors. But its gravitational effects — on prices — are profound, long-term and accelerating.

Every coin lost makes each Bitcoin you safely hold onto … correspondingly more valuable.

Accordingly, the surest, safest way to profit from the steadily expanding number of irretrievably lost coins is to double down on digital wallet hygiene.

That includes …

- Using your own wallet rather than storing your crypto on an exchange. Those are magnets for hackers.

- Having backup copies of your digital wallets and private keys. But don’t keep these on a computer. They should be written and stored in secure, fireproof locations.

- Remove any access for DeFi platforms if you are not currently using them. This will make it harder for hackers to get to your wallet.

- Triple-checking the recipient address when you send BTC (or any crypto) to another wallet. You may even want to do a test transfer first, to see if everything goes through. Because one typo in a long character string … is enough to burn your Bitcoin forever.

And, ultimately, the most important step is to make sure you plan for the future of your Bitcoin beyond you. In fact, the nature of private keys makes estate planning far more important for Bitcoin than any other asset.

In the absence of a succession plan, lawyers and probate courts can still transfer ownership of bank accounts, real estate and other assets to your heirs.

But not Bitcoin.

Unless, that is, you’ve made arrangements to safely pass on your private keys.

So, if you have not already done so, I encourage you to make them now. Even if the dollar value of your stash presently seems somewhat less than impressive.

Few assets have greater potential to pile up and transfer generational wealth than Bitcoin.

Which the inevitably growing number of lost coins … only augments further.

Best,

Bob Czeschin