|

| By Marija Matic |

Last week, I told you we could see Bitcoin (BTC, “A”) break above its November 2021 all-time high any day now.

The world’s largest crypto by market cap did just that a few days ago.

Bitcoin’s price even surpassed $72,000 today, shattering previous records and cementing its status as a financial powerhouse.

But that isn’t the only historic milestone it accomplished today.

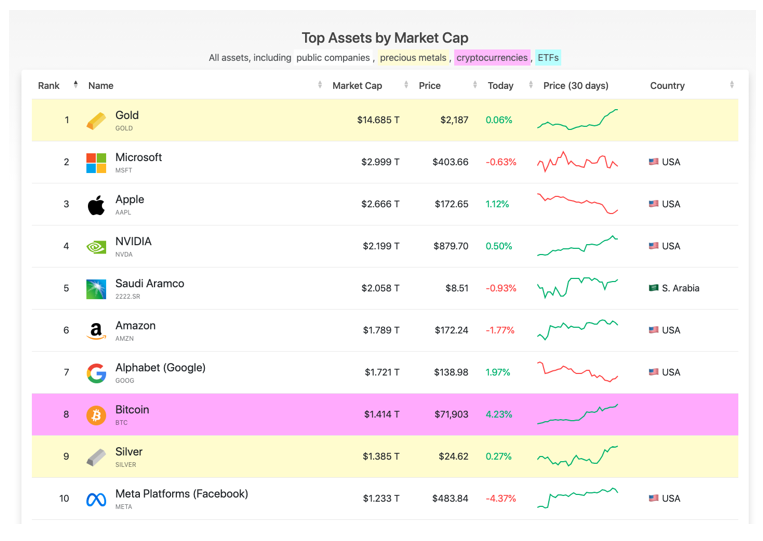

Its market cap has ballooned to over $1.4 trillion, surging beyond silver (at $1.3 trillion+) and Meta Platforms, the company that launched Facebook (at $1.2 trillion+) five years before the first Bitcoin ever traded.

This makes Bitcoin the eighth-largest asset in the world right now!

What would it take for Bitcoin to get to the No. 7 spot?

The next biggest asset by market cap is Alphabet (Google), with a valuation only 21% higher than Bitcoin's at $1.7 trillion+.

Yet, despite this triumph, Bitcoin's valuation is still less than 10% of gold's. This fact is not lost on the yellow metal’s fervent community, who adamantly argue for its continued claim to the top-asset throne.

Nevertheless, the race for dominance continues unabated. We have every reason to believe Bitcoin will keep asserting its influence, challenging the traditional financial order and, ultimately, overtaking some other names in that chart.

There are many factors that will continue to push Bitcoin higher.

For starters, Bitcoin demand is not slowing down. Last week's ETF inflows reached some $1.7 billion. This brings the total investment in Bitcoin spot ETFs to $9.6 billion since their launch in January.

And that’s just the traditional markets!

On-chain holdings by ETFs now represent over 4% of the BTC supply, valued at $57.8 billion. Notably, for the first time, the combined holdings of the nine new ETF funds surpass those of Grayscale (which holds 400,702 BTC).

BlackRock and Fidelity hold significant positions, at 191,132 BTC and 122,952 BTC, respectively. It took only eight weeks for institutions to become the biggest BTC holders.

Related story: Spot the Difference in These Spot Bitcoin ETFs

Even achieving these flow figures by year-end would be considered a success story. However, accomplishing this within just eight weeks is truly a remarkable sign of demand.

The strong institutional interest in Bitcoin is also accentuated by the recent revelation of BlackRock’s new plans.

The fund giant — with roughly $10 trillion in assets under management — said in a Thursday filing that it may buy shares of Bitcoin exchange-traded products traded on “national securities exchanges” for the BlackRock Global Allocation Fund.

The disclosure came a few days after the company added similar language to the prospectus of its Strategic Income Opportunities Portfolio and the BlackRock Strategic Global Bond Fund.

Analyst Scott Melker believes that “this could send Bitcoin far higher than $138,000 or $150,000.”

In addition to positive ETF developments, we are now seeing CME Bitcoin futures hit a record high, with over $10.3 billion in notional open interest and 28,899 contracts open.

Even though there was not much spot volume today, the BTC price has easily broken above the $72,000 mark. It appears to be staying there.

The BTC price is now in discovery mode. That means everything is possible. And with so many bullish factors at work over the coming weeks, don’t be surprised to see even more record-setting action.

Keeping pace with BTC's momentum, Ethereum (ETH, “B+”) has surged and is now trading only 17% below its all-time-high of $4,878 (blue line):

Despite Bloomberg analyst Eric Balchunas lowering the odds of Ethereum spot ETF approval in May to 30%, ETH has easily surged above the $4,000 mark.

Market-making firm GSR still holds that spot ETF approval in May is more likely than not. Various analysts share this sentiment.

We should get more signals about which direction the SEC is leaning over the coming weeks. I’ll keep you updated in this space and let you know what it means for you.

Notable News, Tweets & Commentary:

- Trump suggests he would not crack down on Bitcoin and other cryptocurrencies as president. When the former president recently launched a line of expensive sneakers, he “noticed that so many of them were paid for with this new currency.”

- MicroStrategy has purchased an additional 12,000 Bitcoins for approximately $821.7 million between Feb. 26 and March 10. MicroStrategy now holds 205,000 BTC bought for $6.9 billion at average price of $33,706.

- The South Korean phenomenon is back. The difference in price between Bitcoin in South Korea and the U.S. hit a two-year high last week.

What’s Next?

Inflation data due out tomorrow could cause some market volatility. However, with a 97% chance of the Federal Open Market Committee holding interest rates steady on March 20 (according to the CME’s FedWatch tool), the focus may shift back to Bitcoin.

Bitcoin remains bullish overall and is currently in price discovery mode. The nearest levels to watch are $71,000 as support and $73,000 as resistance. Significantly, reaching $75,000 could trigger liquidations of up to $1 billion in short positions.

With the Bitcoin halving event now just 38 days away, a healthy correction before a further price increase is also a possibility.

Exciting times are certainly ahead of us. If you’ve followed our lead, we believe things are about to get even more exciting … and potentially quite profitable. So, sit tight and enjoy the ride!

Best,

Marija Matic

P.S. While everyone else is rushing into crypto, there’s another alternative investment that may be worth your consideration. It’s a private, under-the-radar AI company that is disrupting a $4 TRILLION global industry.

In just a few days, Weiss Members will get the chance to claim shares … before angel investors, Wall Street insiders and venture capitalists. Even Dr. Martin Weiss plans to invest, after Weiss Members get a chance to invest first.

Get the full scale of this opportunity, and claim your spot at the investors’ table, here.