|

| By Juan Villaverde |

The U.S. and China agreed to a ceasefire in their trade war last week — as both claimed victory, insisting the other side caved in.

The TL;DR of it all?

U.S. tariffs on Chinese imports will drop to 30% (from 145%). While Chinese tariffs on U.S. imports will fall to 10% (down from 125%).

U.S. officials hailed the deal as a breakthrough. Chinese officials declared it a win.

But in reality, the war is far from over. What was agreed is nothing more than a temporary ceasefire.

That’s because neither country can fully decouple.

Chinese imports are important enough to the U.S. that any big reduction could drag the economy to the brink of recession.

In fact, the White House was warned 145% tariffs would likely choke off about 20% of inbound Chinese shipments in May alone.

So, time was running out for Trump.

But at the same time, Beijing also faced mounting internal pressure.

In the run-up to trade talks with Washington, the People’s Bank of China (PBoC) poured roughly 1 trillion yuan of liquidity (about $140 billion) into the tottering Chinese economy.

PBoC officials slashed reserve requirements, cut key rates and rolled out tens of billions of dollars in aid … all aimed at propping up domestic demand.

It was a much-needed lifeline to sinking real estate and propping up ailing banks.

In short, neither side was in a position to fight a prolonged trade war without severe consequences. So, they both rushed to find something to agree on and frame it as a victory.

The result was basically another 90-day pause in the trade war. With hope a more substantial agreement would follow.

But don’t hold your breath!

As I have argued, the real economic damage comes not from mutually hostile tariff regimes in Washington and Beijing.

Instead, it stems from the massive uncertainty dueling tariffs create: Harsh measures, followed by temporary pauses, then by new measures — with no lasting predictability in sight.

Moreover, the full paralyzing impact of unstable, rapidly shifting tariffs on businesses and consumers may take time to show up.

In the meantime, however, global liquidity keeps going up.

China has resumed money printing. As a result, we are likely to see asset prices climb at least into June. And maybe longer — thanks to an important development in early May.

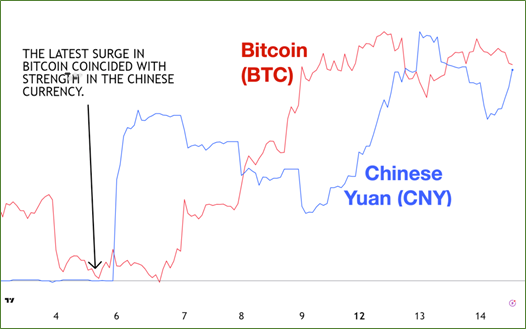

Observe the chart below.

Bitcoin and the Chinese yuan both began their latest rally on May 5 — just before the PBoC’s fresh stimulus.

A Rising Yuan Is Fuel for Crypto

In other words, the Chinese yuan’s strength gave Beijing room to fire up the money-printing presses without risking a crippling collapse on world FX markets.

This torrent of fresh Chinese liquidity ignited Bitcoin’s run — which then spilled over into other crypto assets.

Usually, large liquidity injections weaken the yuan. That’s why, despite a deflationary slump driven by a broken real-estate sector, Beijing has recently been reluctant to “roll out the monetary bazooka.”

But this time, a trillion-yuan infusion coincided with a stronger currency — a promising sign for the rest of the year.

What’s even more interesting is that both Bitcoin and the yuan have actually been going up since April 9.

That’s just two days after my Crypto Timing Model identified Bitcoin’s 320-day-cycle low!

This makes me think Washington and Beijing quietly came to an informal consensus to allow the yuan to strengthen against the dollar. And this let China print money to rescue its economy … while lifting crypto and other risk assets.

Judging by the price action, these “secret” talks may have begun in early April — just days after President Trump’s “Liberation Day” announcement.

For weeks, I’ve been saying the most important chart to watch is USD versus CNY. Now, you can see why.

If the yuan keeps gaining on the greenback, the current crypto rally is likely to accelerate. In this case, the yuan’s strength is tantamount to money printing, which has historically translated into higher crypto prices.

No surprise, then, that Bitcoin has reclaimed $100,000.

The next key level to watch is Bitcoin’s all-time closing high near $106,000. A decisive break above this level before May 23 would likely carry the rally toward at least $150,000.

For now, at least, whatever happens — or doesn’t happen — with Bitcoin hinges on the strength or weakness of Chinese currency.

Best,

Juan Villaverde

P.S. Bitcoin’s outlook is quite bullish thanks to the yuan’s strength. But the impact of this trade war has definitely shaken more than a few portfolios.

And, as I said above, it’s weakening the dollar … which can cause a cascade of problems for your TradFi investments.

You know when that happens, it’s time to turn to alternative investments, like crypto.

But there’s more to avoiding the dollar than diving into DeFi. And time to do so is running out.

That’s where the Emergency Wealth Conclave comes in.

It’ll be held this coming Tuesday, May 20, at 2 p.m. Eastern. And in this free presentation, you’ll learn more about various off-the-grid assets and how they can help you navigate this delicate market.