Bitcoin’s Pullback Is Prep for Its Upcoming Halving

|

| By Marija Matic |

Historically, Bitcoin (BTC, “A-”) has always made pre-halving corrections.

Considering that the halving is only 86 days away — and the fact that the previous rally was overextended due to the spot ETF anticipation — it’s no wonder we are seeing one right now.

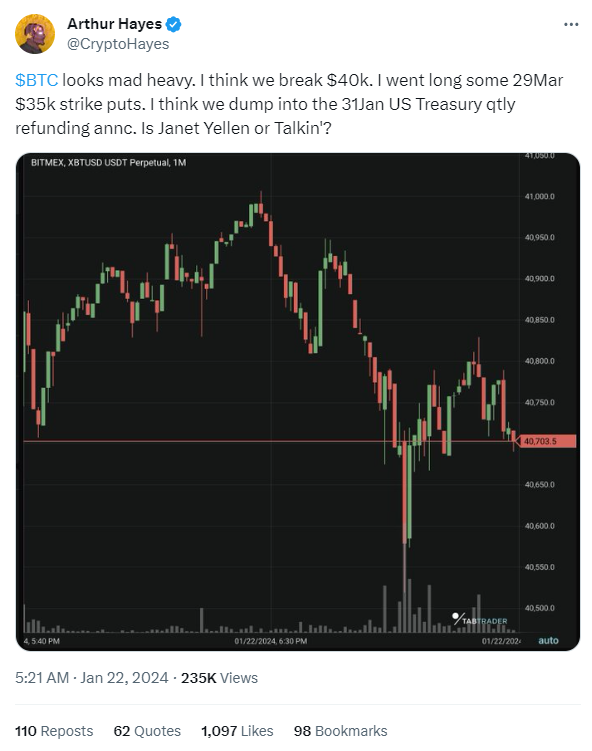

Bitcoin’s price has fallen over 10% since pre-ETF approval levels. At the time of writing, it is once again testing support at $40,450:

I’m not too worried if support doesn’t hold here. There are strong supports at $38,750, $36,700 and $35,940, in case there is enough pressure to push BTC below the $40,000 level with confidence. That means we'll need to see at least three consecutive closes below this level before we look for support lower down.

And that may be a possibility as a 10% correction is rather shallow for crypto, even in a bull market.

Indeed, BitMEX co-founder Arthur Hayes, a notable figure in the industry, predicts that a dip below $40,000 is likely:

He anticipates Bitcoin's decline to persist until the U.S. Treasury's quarterly refunding announcement on Jan. 31.

Many are attributing this downside pressure on the rotation out of the Grayscale Bitcoin Trust (GBTC).

See, GBTC was originally a trust that traded Bitcoin at a discount. It transitioned to a spot ETF with the SEC’s approval and set its fee at 1.5%.

But higher cost ETF issuers have suffered, seeing $2.9 billion in outflows. At the same time, newly issued ETFs — which tend to have lower fees — have now seen a total of $4.13 billion in inflows since launch, outstripping that lost from the higher cost incumbent ETPs.

The decision to set an unusually high fee has led to speculation that Grayscale was forced into setting their fees like that to channel the liquidity toward more aggressive players in the market.

Others call this a conspiracy theory and anticipate a fee reduction.

But a deeper look reveals this is likely another example of people letting fear, uncertainty and doubt get the better of them.

A key factor that they’re missing is that FTX — Sam Bankman-Fried’s failed centralized exchange — sold approximately $1 billion in GBTC. This accounts for a significant portion of that $2.9 billion outflow.

In theory, with FTX completing the sale of its considerable holdings, the selling pressure may alleviate, given that a bankruptcy estate liquidating holdings is a relatively uncommon occurrence.

How this liquidation will truly impact the markets is yet to be seen, however. And analysts are predicting varied outcomes.

One suggests that Bitcoin's price will stay flat or decline for weeks until the completion of GBTC's $25 billion liquidation.

Galaxy Digital founder Mike Novogratz, on the other hand, foresees a migration to other ETFs, driving Bitcoin higher in the next six months.

Dave Weisberger, Co-CEO of CoinRoutes, envisions an acceleration in new investor demand for Bitcoin ETFs.

He anticipates higher prices will be necessary to meet growing demand as supplies from miners, futures and GBTC dwindle.

And, as a reminder, that supply will dwindle by default with the halving. And after this spring, only 1.3 million out of 21 million BTC will remain to be mined.

This underscores the significance of halvings on available supply.

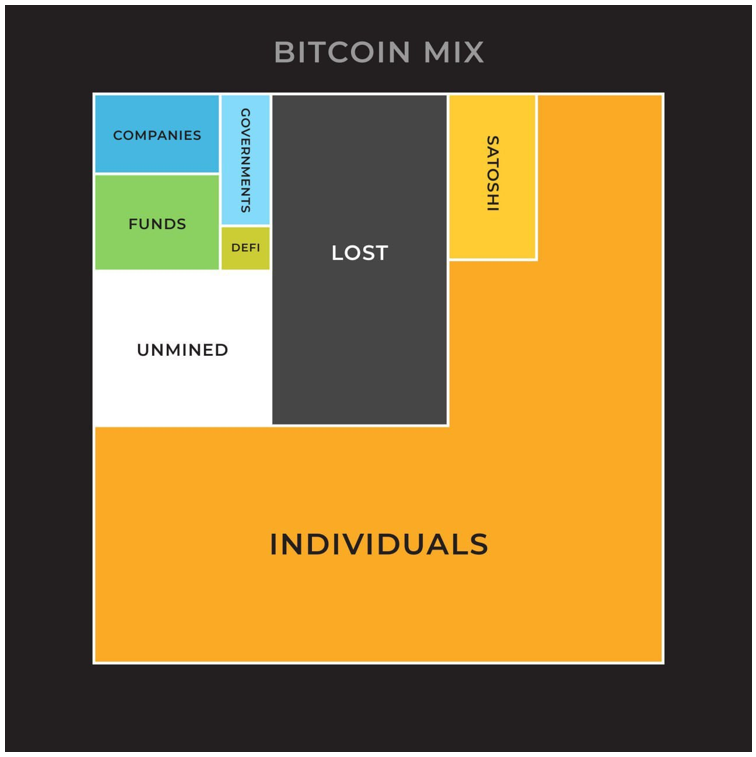

Compounding the future supply shock, it's worth acknowledging that the amount of Bitcoin lost is double the quantity currently held by institutions and governments:

Over time, billions of dollars’ worth of Bitcoin have been lost due to inadequate inheritance planning, improper safekeeping of seed phrases or accidental disposal of hard drives.

While these events are unfortunate for those affected, they contribute to a reduction in the circulating supply, ultimately benefiting those still holding.

On top of that, 9% of the Bitcoin supply has never moved since it was mined. It’s believed a large portion of which was mined by Bitcoin creator, the mysterious Satoshi Nakamoto in the early days of Bitcoin’s history.

There's a substantial likelihood that it will remain untouched, particularly if Satoshi’s real identity was the late computer scientist Hal Finney.

Overall, it is estimated that over 20% of Bitcoin supply is lost or inaccessible forever. And this percentage will grow.

Pair that with a growing institutional demand, and we could see increased demand and limited supply potentially drive up the value of the remaining coins drastically.

So, despite the pre-halving correction, it's crucial to remember that the halving is perceived as a bullish indicator.

It augments BTC's scarcity, bolsters its supply-demand dynamics and positively impacts its value.

This correction will likely wash out the weak hands and give Bitcoin a solid foundation to start its next rally.

With the halving on the horizon, crypto funds and investment firms are actively accumulating BTC at its present price, augmenting their holdings and strategically positioning themselves for favorable price movements.

Notable News, Notes & Xeets

- Cumulative spot Bitcoin ETF volume crosses $11 billion on fourth day of trading.

- Crypto’s Terraform files for bankruptcy as Do Kwon awaits his fate.

- Tinder for crypto? This new app lets you swipe left and right on cryptocurrencies.

What’s Next

Come Jan. 31, the U.S. Treasury will release its quarterly refunding announcement. This will outline the amount the U.S. Treasury intends to borrow through instruments like bonds and bills.

Market uncertainty during such announcements can influence liquidity or sentiment, potentially resulting in temporary price fluctuations.

Now that the ETFs are here and their volumes are huge, we are poised to witness a greater influence of traditional finance — what we in the crypto sphere call TradFi — narratives shaping immediate BTC price movements than ever before.

Hence, the reason why we may see BTC breaking below its $40,000 support level in the lead up to the refunding announcement.

Combined with the outflows from GBTC, the upcoming weeks may present an opportunity to acquire Bitcoin at the most favorable price this year.

Especially considering the increased demand and lessened supply we know will be in store following the Bitcoin halving in the spring.

Remember, historical trends suggest a genuine bull market usually follows a halving event. And the ETFs are likely going to act like fuel on fire.

If you’re not fully leveraged to Bitcoin as you’d like to be, I’d say now is the time to do so.

Indeed, just this morning, my colleague Juan Villaverde said much the same to Dr. Martin Weiss on a Zoom call.

He explained this is why Bitcoin is up 26% in just under two months.

But Juan also pointed out another crypto that’s up 325% in that same timespan.

Juan and Martin recorded that call. And they’ve posted it here so you can watch it and learn the name of that impressive crypto.

I hope you do. And soon. That recording won’t be available for long, and neither will the current crypto prices.

Best,

Marija