BlockFi Is the Next to Fall After FTX, But Nexo Attempts to Reassure CeFi Users

|

| By Marija Matic |

The crypto market was shaken today by the news that one of the largest centralized crypto lenders, BlockFi, has filed for chapter 11 bankruptcy as a latest victim of the FTX contagion.

This was expected though, considering how exposed BlockFi was to FTX. In fact, it had previously paused withdrawals due to the uncertainty surrounding FTX earlier this month.

This summer, FTX offered a bail out to BlockFi after the Celsius (CEL, Tech/Adoption Grade “C-”) collapse. FTX provided a $400 million revolving credit facility and the option to buy the lender for up to $240 million.

There were rumors that the loan, which was supposed to help BlockFi, was custodied on the FTX exchange and might have been misused for other purposes. BlockFi denied that “a majority of BlockFi assets” were custodied at FTX. But it did admit that it had significant exposure to FTX and its associated corporate entities. That exposure encompassed the obligations owed to them by Alameda, assets held at FTX.com and undrawn amounts from the credit line with FTX.US.

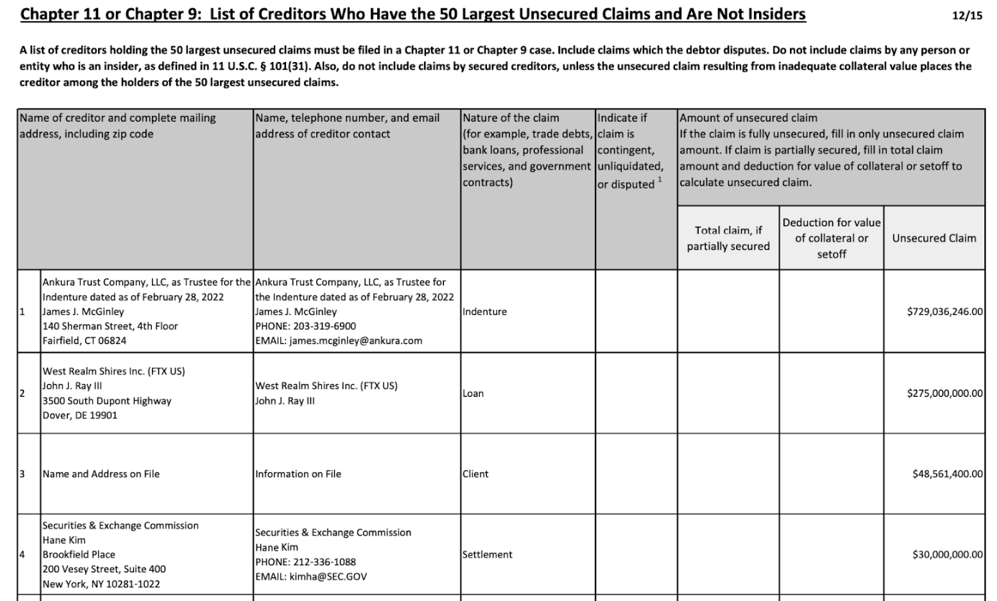

However, their filing shows FTX.US was among the 50 largest unsecured claims (under the name West Realm Shires Inc.), with the $275 million owed:

Among the creditors is also the Securities and Exchange Commission with a $30 million claim, but this is likely the remnant of February’s $100 million fine.

The company is hoping that the chapter 11 reorganization will help maximize the recoverable value for all stakeholders, including clients. BlockFi must focus on recovering all obligations owed to them by its counterparties, including FTX and associated entities, whose own recovery will be delayed.

Now, the centralized finance spotlight has turned to Nexo (NEXO, Tech/Adoption Grade “C”) as one of the last lending giants standing. As such, Nexo was quick to clarify its business model in order to prove solvency.

Since 2018, the core of Nexo’s business is the facilitation of collateralized credit. It claims to differ from other centralized lenders due to its battle-tested, real-time risk engine and requirements of highly liquid collateral at appropriate loan-to-value ratios — for both retail and institutional clients.

Nexo boasts the most efficient, price-based collateral liquidations engine, with an “automatic repayments system similar to decentralized finance protocols like Aave (AAVE, Tech/Adoption Grade “B-”) or Maker (MKR, Tech/Adoption Grade “B-”).”

Notable News, Notes & Tweets

- Crypto influencers flock to the Bahamas in search of Sam Bankman-Fried.

- Binance has officially launched its promised Industry Recovery Initiative with a $1 billion commitment.

- MetaMask collects IP addresses only if they’ve been used with the default Infura Remote Procedure Call, while 1inch unveils a new feature to prevent MetaMask users from getting hit by “sandwich attacks.”

What’s Next

All eyes are now on Nexo. If this last lender standing can prove it can weather this crisis — unlike its contemporaries — it will return a certain amount of faith in CeFi … and help with industry recovery.

If it’s true Nexo is using market-neutral strategies and its auditor can be trusted with liabilities, as stated in its audit, there’s a very high chance it is solvent.

Another crypto lender, Genesis, has not been so comfortable with their position, however, after it came out that it had $175 million worth of funds on FTX. An SEC investigation is set to begin soon.

Meanwhile, DeFi is functioning as usual. It has comfortably weathered out all the drama this year.

Undoubtedly, DeFi is the clear winner of this year. It held steady through several CeFi contagions, showing us exactly why we need DeFi in the first place!

Fundamentally, DeFi is stronger than ever.

Best,

Marija