BTC Bounces! Is THIS the Big Bottom?

|

| By Martin Weiss and Juan Villaverde |

Martin and Juan here with an urgent update:

Bitcoin (BTC, Tech/Adoption Grade "A-") just bounced to its highest level after days of doldrums.

Is THIS the big bottom we're on the lookout for?

Is THIS timeframe roughly equivalent to the big bottom Juan called back in mid-December of 2018?

Those are profit-packed questions because, as soon as he called that big bottom …

- Coin Intel News broadcast it all over the internet, saying, "Weiss Ratings calls the bottom."

- Bitcoin News wrote, "Weiss Ratings declares now best time to buy Bitcoin."

- Countless blogs and websites picked it up and spread the news.

Sure enough, just three days later, Bitcoin hit rock bottom.

And that marked the beginning of the largest crypto bull market of all time (so far).

From bottom to top, Bitcoin surged 20.1 times, enough to turn a $10,000 investment into $200,832.

Ethereum (ETH, Tech/Adoption Grade "A"), our highest-rated crypto, surged 54-fold, enough to turn $10,000 into $545,760.

Cardano (ADA, Tech/Adoption Grade "B"), also among our top-rated coins, surged 102 times, enough to transform $10,000 in starter capital into $1,020,648.

And Chainlink (LINK, Tech/Adoption Grade "B+") topped them all. It rose 234 times, which could have grown a $10,000 initial investment into an asset worth $2,338,746.

What about the next time around? What should you buy and WHEN should you buy it?

We're going to give you our answers tomorrow at our urgent crypto forum.

If you've already got your ticket, great! If not, you have only a few hours left to secure with a single click here.

How high could BTC go this next time around?

Well, if you believe the hype, you might think something north of $1,000,000 per Bitcoin might be possible.

Our recommendation: Don't believe the hype!

Instead, check out this sneak preview of one of the most important topics we're going to cover tomorrow.

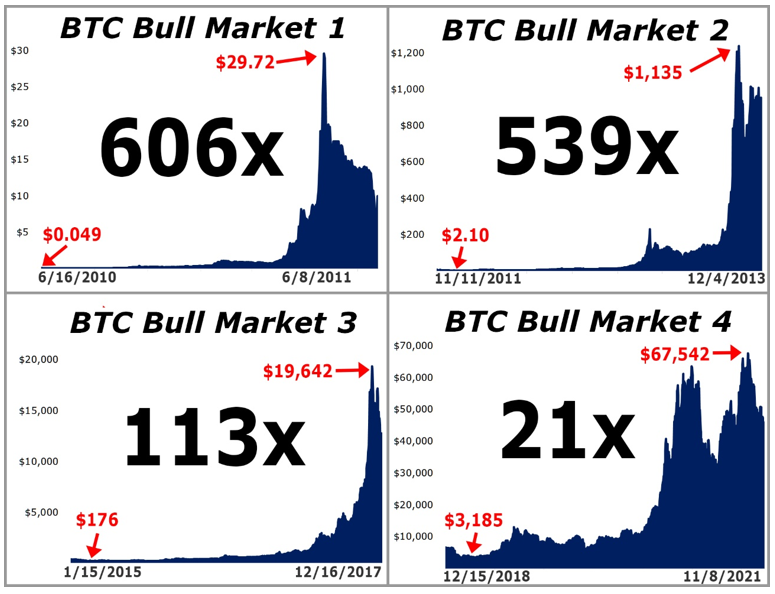

Check out these charts:

In Bitcoin's first bull market, it surged 606 times.

In its second bull market, it surged 539 times.

In its third bull market, it rose up 113 times.

And in the fourth bull market, only 21 times.

We say "only" with a big smile because we don't think any investor would complain about making 21 times their money.

And even if it goes up less than 21 times next time, investors can still make a heck of a lot.

But the pattern is clear: Diminishing returns in each successive bull market.

All the more reason investors need to move beyond just Bitcoin!

All the more reason investors need to include the most promising altcoins in their crypto portfolio!

Tomorrow, we name our top six candidates to be among the biggest winners.

Plus, Juan shows you precisely how he called the big bottom last time, and how he intends to do it this time.

To answer our opening question: No, not yet. The big bottom is not yet confirmed …

Which is precisely why you need to sign up for tomorrow's Weiss crypto forum — so you can get a very specific answer, backed by our studies.

Another big reason: Don't expect there be another better buying opportunity ever again.

Best wishes,

Martin Weiss

and

Juan Villaverde