China’s Money Printer Is Fueling Crypto Bullishness

|

| By Juan Villaverde |

China is the world’s premier trading powerhouse and a manufacturing juggernaut.

It is also the host of the largest housing bubble in, well, the history of money.

Estimates of the extent of Beijing’s over-building and over-construction range as high as $100 trillion — a whopping 3.6 times larger than China’s GDP.

The origins of China’s housing bubble go back to the country’s ascent from poverty in the late 1970s to its current status. This rise was fueled by government-controlled infrastructure spending and lending through China’s quasi-government-owned banks.

Basically, the Chinese Communist Party, CCP, directed bank lending to various sectors in order to hit its ambitious growth targets. This strategy fueled growth well enough until around 2013.

By this time, Chinese people had become accustomed to one of the fastest growth rates in economic history, with promises of eradicating poverty nationwide.

To sustain growth, Beijing pivoted toward internal investment, redirecting bank lending to property developers. This looked good on paper and aligned with the Party’s objectives.

So, nobody made much effort to ensure the pool of likely property buyers was adequate to accommodate Beijing’s grand ambitions.

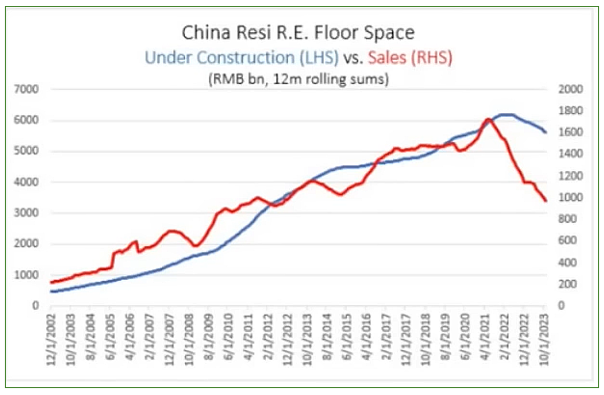

By 2021, this mismatch had resulted in an enormous property bubble. When that popped, it sent property sales into a nosedive down about 40%. So, the CCP simply ordered banks to cease lending to property developers.

Massive loans to now defunct construction projects across China left Chinese banks dangerously exposed to the brunt of the fallout.

With approximately $50 trillion in deposits, Chinese banks now have much of their assets tied up in millions of unutilized properties. The tales of Chinese “ghost cities” are a testament to this.

The saga of China's ballooning housing bubble isn't just a story of economic growth; it's a tale of ambition.

So, how will the Chinese government respond? By keeping the printing party going.

Beijing intervened with a dual strategy, to:

- Direct trillions into high-tech sectors to stimulate economic growth, thus propelling China to the forefront of electric vehicle production, and …

- Mandate the People’s Bank of China to extend unlimited funds to commercial banks to shield them from their real estate losses.

This aggressive financial maneuvering signifies China’s determination to support its economy … while also attempting to manage the deflation of its vast housing bubble.

However, high-net-worth individuals and entrepreneurs, flush with government stimulus or bank-mandated funds, can see the writing on the wall: impending devaluation of the yuan due to rampant money printing.

So, despite strict capital controls, a lot of nervous money is increasingly desperate to get to safety outside China.

This movement is a primary driver behind the resilience of crypto markets over the past year and Bitcoin’s (BTC, “A-”) surge so far in 2024.

Even so, Chinese capital flight is currently just a trickle. Going forward, you’re going to see a tidal wave of liquidity, from investors seeking refuge in hard assets — which provides even more rocket fuel for crypto.

But not all cryptocurrencies will offer the same opportunities. Some assets will stand above the crowd. To learn which cryptos have the potential to outperform Bitcoin in this bull market, I suggest you to watch my recent urgent briefing, 7 New Crypto Wonders.

So, buckle up for a tidal wave of liquidity set to underpin global markets for years to come, with the crypto market ready to ride the swell.

China’s economic juggling act is the gift that keeps on giving — to the crypto world, at least.

Best,

Juan Villaverde