Confiscation of Russian Cash Could Send Gold, BTC Ballistic

|

| By Bob Czeschin |

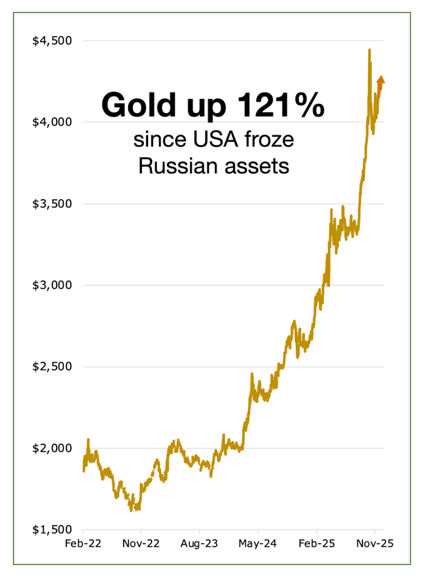

Gold prices have been on a tear ever since Washington froze Russia’s U.S. dollar balances to punish Moscow for invading Ukraine.

Frozen Russian cash cannot legally be moved or spent. But it can still earn interest. Which its custodians have been happily creaming off to fund aid for Ukraine.

But this leaves the principle technically intact. And subject to being unfrozen and returned to Moscow — as part of some future peace treaty.

But it now seems this is no longer enough.

In just days, the European Union (EU) members will vote on some version of outright confiscation of Russian assets.

That is, they essentially aim to seize and spend the entirety of Russia’s frozen principle. So, that even if peace breaks out, there would be nothing left to give back.

If merely freezing Russian assets caused gold to shoot up 121%, it’s a safe bet outright confiscation will have similar — if not even more profound — consequences.

The collateral effects of such a move wouldn’t end there.

Such an action would also be negative for the dollar and the euro … and put the wind at the back of Chinese and BRICS nations’ efforts to replace the greenback as the world’s reserve currency.

We’ve Seen This Response Before

Seeing America unilaterally freeze Moscow’s U.S. dollar deposits put the fear of a vengeful deity into the hearts of central bankers worldwide.

This includes many friendly to the U.S., bitterly opposed to Russia’s invasion and pleased to see Moscow punished, as a result.

The reason is simple: The U.S. dollar is the No. 1 asset central banks hold in reserve — to backstop the local currency they issue.

And in its move, Washington made very clear that it could suddenly freeze anyone’s dollars. Especially if they did something to annoy Uncle Sam.

And so, many began a determined move to radically reduce their dollar exposure.

But what other reserve assets could replace it? Any other currency — such as the euro — would come with similar strings attached.

That pretty much leaves gold and Bitcoin (BTC, “B+”) as the only feasible choices.

But, while many governments have begun to load up, Bitcoin is still too exotic for notoriously conservative central bankers. Which leaves gold.

So, here’s what happened …

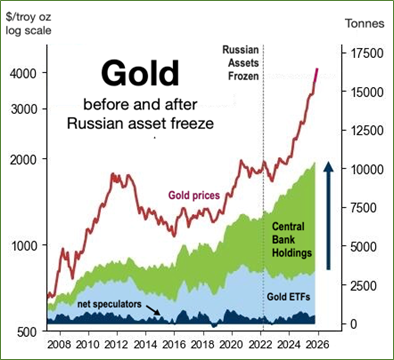

After the Russian asset seizure, the quantity of gold held by exchange-traded funds (ETFs) and speculators fluctuated in a narrow range.

But as you can see, central bank gold holdings shot up virtually in lockstep with gold prices.

Indeed, central bank buying presently runs 67 tons a month (on a 12-month moving average basis). That’s roughly quadruple their pre-2022 average.

Gold famously pays no interest. And when central banks’ buying spree began in 2022, as many investors were rotating out of gold and into fixed income to capture rising yields.

Fast forward to late 2025.

Central banks are still buying gold. But now, so are private investors as the Fed cuts interest rates and restarts quantitative easing (QE). Both of which play into the money-printing-debasement narrative steadily gaining traction with investors.

How High Could Gold Go?

So, private investors are now competing — rather than largely offsetting — central bank gold buying.

And central banks are showing no signs of slowing down. In fact, they could easily accelerate should the EU vote to confiscate Russia’s frozen cash.

This points to more robust and rapidly rising prices going forward.

Then, there is Russia’s potential response should that vote go through. Russian Security Council deputy chairman, Dmitry Medvedev, has declared confiscation of frozen Russian assets is tantamount to an act of war.

Is it likely Russia will go on the offensive while still embroiled in fighting in Ukraine? No one can say for sure.

But as long as such a possibility realistically exists, it’s hard to see gold prices ever going down significantly.

So, if you don’t already have gold in your portfolio, please add some forthwith.

One of the easiest ways to do that is to use exchange-traded funds like iShares Gold Trust (IAU). For even greater returns, check out Sean Brodrick’s red-hot gold mining shares in Resource Trader.

The Bitcoin-Gold Connection

Research by Weiss Crypto Investor editor, Juan Villaverde has uncovered something truly remarkable …

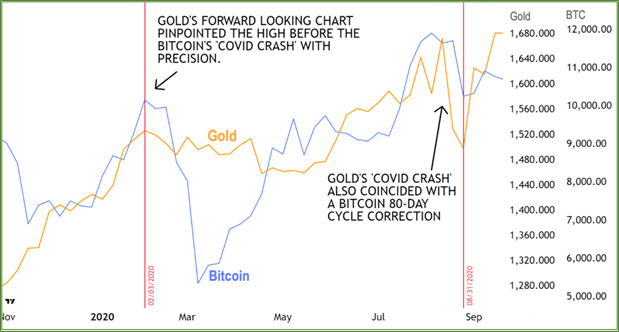

Bitcoin echoes gold’s price trajectory — after a lag of about 24 weeks.

Specifically, major highs in gold tend to occur 24 weeks before a corresponding high in Bitcoin. Same for major lows.

Perhaps the most dramatic demonstration of this relationship occurred during COVID-19.

As anyone who lived through it can attest, markets across the board — stocks, bonds, oil, crypto — convulsed together in pandemic panic.

This was a true black-swan event absolutely nobody saw coming. As such, it was not something the gold market could possibly price in ahead of time.

And yet, it did!

- The first red line (Feb. 3, 2020) marks gold’s early 2020 peak. It also correctly signaled Bitcoin’s Pre-COVID top.

- The second red line (Aug. 31, 2020) marks gold’s March 2020 plunge. Which somehow, still aligned with Bitcoin’s early September 2020 plunge.

As I write, central bank buying has once again pushed gold to within a couple percent of its all-time peak.

What this means is simple: A similar peak now lies ahead for BTC, in about 24 weeks.

For expert guidance on how best to trade this forecast, consider checking out Juan’s Weiss Crypto Investor.

In it, he uses a combination of key indicators to find forecasts like these. And his Crypto Timing Model targets specific “Buy” and “Sell” opportunities. This way, members can enter long-term positions with confidence.

Best,

Bob Czeschin