Crypto Offers Opportunity and Escape from This Monetary Maelstrom

|

| By Juan Villaverde |

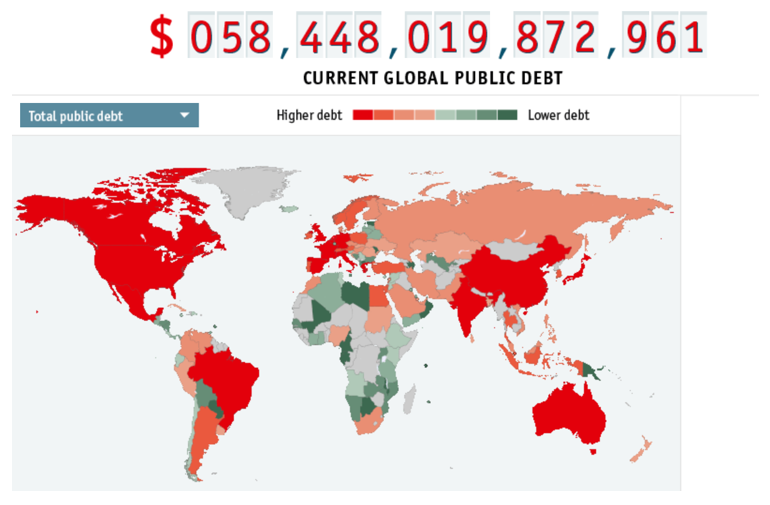

After decades of growing the economy by piling on ever-increasing amounts of debt, we’ve finally reached the point of no return.

How high is the global debt level?

Let’s just say that if we were all passengers on a Boeing 747, emergency oxygen masks would be coming down from the ceiling.

The debt pile is now so unwieldy, the only way to keep the globally interconnected economy afloat is … to issue still more debt.

Because of this, the cracks already in the foundation of the world economy just continue to worsen.

The central bankers’ grand solution is currency debasement — reducing the value of money so the mountain of debt looks a bit less intimidating.

This sleight of hand is supposed to maintain the illusion of wealth by keeping the sovereign debt markets — the bedrock of the 21st century economy — from crumbling into dust.

Entering the second quarter of 2024, we find the U.S. Federal Reserve, the European Central Bank, the People’s Bank of China and their international counterparts all taking part in this synchronized dance of monetary manipulation.

And while it may work for a while, it is not a permanent solution.

But theirs is an interesting side effect of this debasement alchemy: It makes asset values appear to appreciate as everything from stocks to gold seem to soar.

Don’t be fooled by the optics. When adjusted for the central banks’ expanding balance sheets, it’s like they’ve been on a treadmill: lots of motion, but no real advance since 2008.

That leaves the average Joe, like you and me, feeling the pinch.

Our incomes stagnate while asset prices skyrocket, making the future a little dimmer for everyone but the asset rich. As more and more folks wake up to this simple reality, they look for ways to protect their hard-earned wealth.

And amid this monetary maelstrom, an increasingly sought after beacon of hope has emerged: crypto.

That’s because crypto is not just another asset class. It remains unique as it exists outside the control of any of the central banks that caused this mess to begin with.

But not only does it offer a sliver of hope in the face of ever-mounting debt in the traditional markets …

Or provide the chance for people to protect their wealth …

Investing in crypto is a means to help you secure a stake in the future, in a system that promises more than just the mirage of prosperity to offer anyone, anywhere, a fair shot at securing and improving their wealth.

This is not hyperbole.

Crypto has vastly outperformed every other asset class known to man, and at the fastest pace in financial history.

In risk-adjusted terms, it dwarfs virtually the entire financial universe, making it an anomaly in a sea of mediocrity.

At a valuation pushing past the trillions, it's now set to skyrocket even higher, propelled by the forces of debasement, adoption and the allure of a system beyond the reach of traditional financial repression.

And that’s not even touching all the forces pushing the broad crypto market higher from within!

Let me be clear: Crypto is not just a “get rich quick” scheme — though the opportunity to target outsized returns is certainly part of its appeal.

Instead, investors should see that, in this grand currency debasing narrative, crypto stands as the ultimate macro play, an asset that defies conventional risk-reward paradigms.

In the current cycle we’re in, I foresee total crypto market valuation topping the $10 trillion mark over the next couple years.

And on the brink of this monumental shift, we’re being handed the keys to the kingdom. It's up to you to seize this opportunity in the face of generational debasement.

Crypto markets have traded down a little over the past month or so. Use this as an opportunity to escape the jaws of money printing and financial repression.

But there are a lot of crypto projects. And choosing what to invest in first can be a bit intimidating.

That’s why I’ve got you covered with three easy places to start …

First, I encourage you to use our Weiss crypto ratings to help you sort out the weak projects — rated “D+” or below — from the ones with real promise — rated “B-” or better.

Second, look through our Weiss Crypto Daily newsletters. These give you a broad overview of the crypto market, top-performing sectors and even select projects that have caught our team’s attention.

Third, watch my recent briefing with Weiss Ratings founder Dr. Martin Weiss.

In it, I explain my latest strategy for not only targeting the most promising growth opportunities in the crypto market … but also how I can turn those 2x, 9x and 10x crypto opportunities into 20x, 344x and even 816x winners.

Then, when you’re ready, take advantage of lower prices while you can.

There may not be another opportunity like this.

Best,

Juan Villaverde