Crypto’s Quality Surge Drives Ethereum’s Weekly Rebound

|

| By Marija Matic |

After a shaky start last week — triggered by weak U.S. payroll numbers — the crypto market staged a powerful rebound.

Fueled by the U.S. government’s approval for crypto investments in 401(k) retirement accounts, the total market value has surged back above $4 trillion.

Naturally, bullish sentiment across the board has been reignited.

Bitcoin (BTC, “A-”) and Ethereum (ETH, “A-”) are once again flirting with their all-time highs. Bitcoin hit $122,227 today, while Ethereum notched a fresh yearly high, pulling up much of the Ethereum ecosystem with it.

Among the top 100 coins, the week’s biggest winners were LidoDAO (LDO, “C-”), Ethena (ENA, “A-”) and Chainlink (LINK, “C+”).

All are key players in Ethereum’s expanding network of projects. So today, let’s dive into their latest developments.

Lido: The Staking Giant Behind Ethereum’s Surge

LidoDAO has been on a tear. Its LDO token prices soaring nearly 70% over the past seven days, riding the wave of Ethereum’s rally and renewed staking enthusiasm.

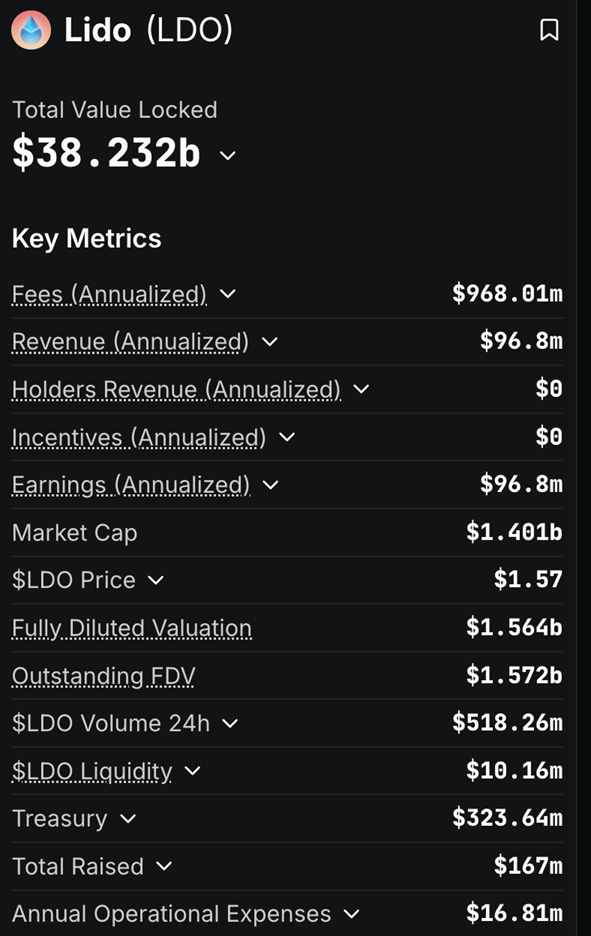

Lido secures a staggering $38.04 billion worth of ETH — more than any other protocol. And it controls about 87% of the liquid staking market.

Which got a huge boost last week, as the SEC officially ruled that Lido’s staked ETH — stETH — is not a security.

However, when factoring in all types of ETH staking (including solo validators, exchanges and institutions), Lido’s market share stands at around 25% — its lowest since early 2022.

This reflects a more competitive staking landscape. But one that does little to diminish Lido’s outsized influence.

The protocol generates just under $1 billion in annualized fees and has a treasury of $323 million to fund growth and development.

Those figures should grow as Lido prepares for major institutional integrations now that it has regulatory clarity.

These offerings will include custody-ready staking solutions for asset managers, fintechs and exchanges looking to offer ETH staking to their clients.

If executed well, Lido’s partnerships could expand the pool of staked ETH and cement its dominance in both the retail and institutional staking arenas.

The timing is impressive.

- Ethereum yields are ticking higher,

- Liquid staking tokens are gaining deeper DeFi utility and

- There is growing speculation that staking could soon be permitted in Ethereum ETFs.

Put those forces together, and it isn’t hard to see how Lido’s scale, liquidity and upcoming institutional push could make it a standout Ethereum play in the current market breakout.

Chainlink: Bridging Wall Street and Web3

Chainlink is the leading decentralized oracle provider. That means it moves data — such as prices — securely between blockchains, the outside world and traditional finance systems.

That’s how smart contracts pull in real-world information, send blockchain data to off-chain world and transfer data or value between different blockchains to make advanced financial applications possible.

And while LINK has been around a while, it recently announced a major partnership with Intercontinental Exchange, Inc (ICE), the owner of the New York Stock Exchange.

This integration allows over 2,000 blockchain applications to access institutional-grade pricing feeds — including foreign exchange rates, precious metals prices and more — with the speed and accuracy needed for capital markets.

More importantly, it makes Chainlink the data backbone for the growing market in tokenized assets, automated settlements and on-chain derivatives.

In effect, Chainlink is becoming the Bloomberg Terminal of blockchains. Where institutions will go for reliable, on-chain market intelligence and vice versa.

With global asset tokenization projected to reach hundreds of trillions in the coming decades, Chainlink’s infrastructure could become indispensable to both DeFi and TradFi alike.

Ethena: Stablecoin Momentum Meets DeFi Growth

Ethena has been riding strong technical momentum.

Its trading chart recently formed a “bullish cross” pattern. That is, its 50-day exponential moving average crossed above its 200-day exponential moving average. This suggests increased buying pressure.

Sure enough, prices are now pushing toward key resistance at $1.00. After that, the next resistance level is at $1.13.

Ethena’s core product, the USDe stablecoin, has exploded in adoption. It doubled in just the past month. But even more incredible is that it hit a $10 billion market cap in just 500 days.

Now, USDe is the third-largest stablecoin in the world.

This growth shouldn’t be surprising. USDe is partially backed by BlackRock’s USD Institutional Digital Liquidity Fund Ltd (BUIDL) fund, which lends credibility in both retail and institutional circles.

With over $5.7 billion in cross-chain volume and $475 million in cumulative protocol fees, Ethena has firmly established itself as a top-tier DeFi protocol.

And there is a key catalyst on the horizon that could spark even more bullish momentum: the potential activation of a fee switch.

This would allow ENA holders to share in protocol revenues. If implemented — and coupled with one more top-tier exchange listing — it could cement Ethena’s position as a yield powerhouse in the Ethereum ecosystem.

The Bigger Picture

Ethereum’s ecosystem is showing both market strength and fundamental growth.

From Lido’s dominance in staking and institutional expansion …

To Chainlink’s push into financial data infrastructure …

To Ethena’s rapid stablecoin adoption …

The network’s most active players are building real utility at scale.

Quality, fundamentally strong projects have been leading this latest leg of the rally as memecoins appear to be taking a pause.

This is a shift I am playing close attention to. Because it could signal a more substantial change in market preferences toward protocols with long-term value propositions.

Not only is that bullish for projects like the three I’ve highlighted above, but ut also for the broad ETH ecosystem.

With Bitcoin leading the broader rally, ETH flirting with yearly highs and catalysts like ETF rule changes, staking integration in traditional finance and asset tokenization all on the horizon, this breakout could be more than just a relief rally.

It could be the start of Ethereum’s next major expansion phase.

The biggest question for you to answer is how you want to ride it out.

Best,

Marija Matić