Curve’s Crash Could Put Crypto in a Tight Spot

|

| By Juan Villaverde |

Last Sunday, Curve (CRV, “B-”) — one of DeFi's premier exchanges — suffered through a hack.

Deep in the code of the exchange, a subtle vulnerability was discovered and exploited by some rather clever hackers.

They managed to make off with millions in Ethereum (ETH, “B”) and CRV, the exchange's native token. Owning CRV is sort of like having voting shares in a public company, only without the stability.

While hacks are as common in crypto and DeFi as coffee stains on an office desk, this one truly took the cake. There are two special reasons why ...

First, Curve was hailed as one of the bluest of DeFi blue chips. Imagine the shock when this shining star was caught with its digital trousers down, lacking sufficient safeguards.

Second, the vulnerability exploited was so sly, so hidden, that auditors missed it entirely. Makes you wonder what those audits are really worth.

You see, Curve’s founder, Michael Egorov — who is also the largest holder of the CRV token — awarded himself millions of CRV during the exchange’s creation. Currently, CRV is valued at approximately 60 cents each.

Now, he flirted with cashing out during last year’s bear market … but held back. Fearing backlash within the CRV ecosystem was certainly more important than those pesky millions.

So, he borrowed tens of millions of dollars from DeFi protocols, using CRV as collateral. Such a trick only someone with his prestigious standing could pull off.

However, in the wake of the hack, the price of CRV plummeted roughly 30% in 48 hours.

While a delicate balance of what we will optimistically call "stability" seems to have emerged as I write, this could change faster than a cat on a hot tin roof. Particularly if Curve's founder fails to cough up at least a partial repayment of his loans, CRV could take another nosedive of 50% or more.

And just to spice things up, short sellers smell blood in the water and are scrambling like hungry sharks to short CRV on derivatives exchanges. While it’s true that selling pressure has eased over the past few days, the situation is by no means resolved.

This mad scramble could force DeFi lenders to liquidate CRV loans, triggering automatic sales that could lead to a death spiral for CRV's token price. It's like a Shakespearean tragedy, only with less poetry and more algorithms.

Ultimately, I think this situation will be resolved favorably, and the founder’s willingness to repay his loans is an encouraging sign. Regardless, the drama surrounding Curve is definitely a developing event that you want to keep an eye on.

If anything is capable of derailing crypto markets over the next couple weeks or so, this is probably it.

|

Alex Benfield’s Notable News, Notes and Tweets

- We’ve been talking about Bitcoin’s (BTC, “A-”) uncharacteristically low volatility recently, and it is starting to affect some metrics. One technical trading tool you can use to gauge where the market is moving based on prices is called Bollinger Bands. And Bitcoin’s Bollinger Bands are as tight as they’ve ever been — indicating a big move could be coming.

- After the lawsuit from the Securities and Exchange Commission earlier this year, there were rumors that Coinbase (COIN) was drafting an emergency plan to leave the U.S. I can happily say those plans are scrapped.

- I mentioned in my Wednesday Weiss Crypto Daily article that the non-fungible token market is heating up, and I have three big examples of that from this week:

- Popular NFT artist Beeple — who is famous for his digital art collection, Everydays, which he creates daily — just purchased a CryptoPunk for over 100 ETH.

- If you think people buying digital art is a new weird phenomenon, consider that rapper Post Malone spent $2 million to buy a Magic the Gathering card this week.

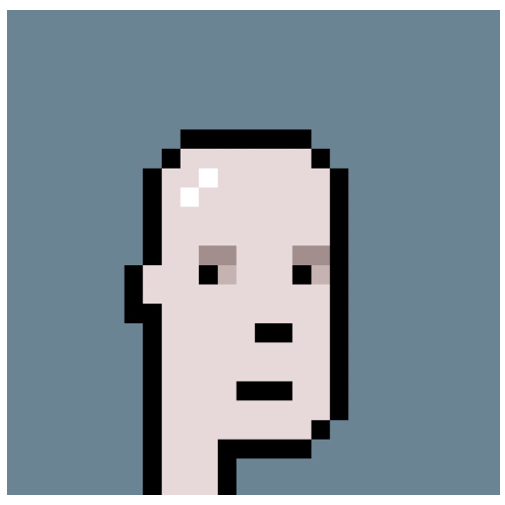

- If you thought either of those were impressive — or if you had any doubt that the NFT market is, in fact, not dead — somebody purchased this CryptoPunk for 500 ETH this week.

Click here to see full-sized image.

What’s Next

We’ve continuously been saying that despite the decrease in volatility and the relatively boring price action this summer, there is plenty of action brewing beneath the surface of the crypto market.

Speaking of the low volatility, that could be coming to an end in the near future. After all, tightening Bollinger Bands tend to end with an explosion in volatility.

Given that the crypto market is coming out of its bear phase and trending closer and closer to the next bull market, I’ll leave it up to you to decide which direction you think that volatility is going to send the prices of crypto.

After a frightening scare on the U.S. regulatory front earlier this year, things seem to be shaping up in a more positive manner. Look no further than the fact that multiple U.S. presidential candidates have already come out to say they will protect Americans’ rights to own Bitcoin.

Lastly, we’ve seen the NFT market act as a ramp to onboard retail users into the world of web3 in the past.

Now that NFTs are heating up again after a few incredibly bearish months, it is starting to look like they could once again act as a catalyst to bring new retail users into this market. These recent large sales do wonders to bring legitimacy to the world of collectibles, both digital and physical.

Remember that NFTs are a technology that goes far deeper than a profile picture image, and many large corporations have invested heavily into that tech over the past few years.

As we head into the next cycle, I expect to see some interesting use cases for NFTs.

Best,

Juan