|

| By Marija Matic |

In the fast-moving world of digital assets, momentum is everything.

But despite being the No. 2 crypto by market cap and the largest smart contract network, Ethereum (ETH, “B+”) hasn’t shown much strength of its own in this bull market.

Until now, that is.

Initially, Ethereum weathered a long period of uncertainty, marked by regulatory headwinds, bearish sentiment and stiff competition.

Recently, though, Ethereum has begun to show two unmistakable signs of revival.

Revival Sign 1: Smart Money’s Bold Rotation

After years of Bitcoin (BTC, “A”) dominance, institutional investors are now reallocating capital — quite rapidly in some cases — toward Ethereum.

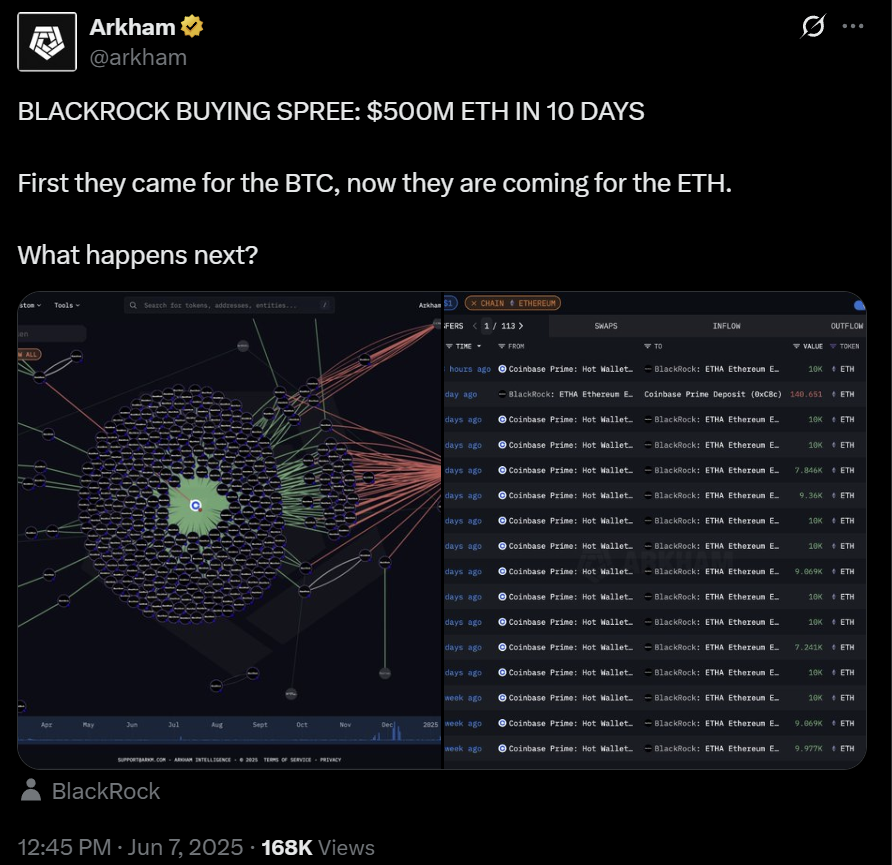

The clearest signal? BlackRock, the world’s largest asset manager, has acquired over $500 million worth of ETH in just the past 10 days.

It mirrors the firm’s early Bitcoin strategy. But this time, it’s Ethereum’s turn to step into the spotlight.

This move reflects growing confidence in Ethereum’s value proposition.

Unlike Bitcoin, often viewed strictly as digital gold, Ethereum offers wider utility: It powers decentralized finance (DeFi), NFTs, smart contracts, staking and a rapidly expanding Layer-2 ecosystem.

Its role as the most secure programmable blockchain makes it a foundational piece in modern crypto portfolios.

With the SEC staff’s opinion that staking is not a securities event — a concern that had many institutions waiting on the sidelines — ETH’s appeal has only grown.

As risk perception fades, Ethereum is emerging as a blue-chip crypto for institutional investors.

CoinShares’ latest report echoes this trend.

Digital asset investment products saw $286 million in net inflows just last week alone — which also happened to be the seventh straight week of positive flows.

But notably, it was Ethereum at the head of the pack with a massive $296.4 million in inflows. That makes last week the strongest for ETH since the U.S. presidential election back in November.

In contrast, Bitcoin suffered $56.5 million in outflows, its second consecutive week of losses.

Meanwhile, U.S.-based spot Ethereum ETFs have delivered four straight weeks of positive inflows to total more than $856 million during that period.

With ETH prices already up over 70% in the past two months, it’s clear that sentiment is surging.

Revival Sign 2: On-Chain Activity Shows Ethereum Is Thriving Again

Ethereum isn’t just attracting fresh capital. It's seeing record levels of real usage across its ecosystem.

Binance’s latest Proof of Reserves snapshot from June 1 reveals a 1.05% increase in user ETH holdings. Meanwhile, BTC holdings fell 1.82% in a month.

It’s a subtle but telling shift in user preference.

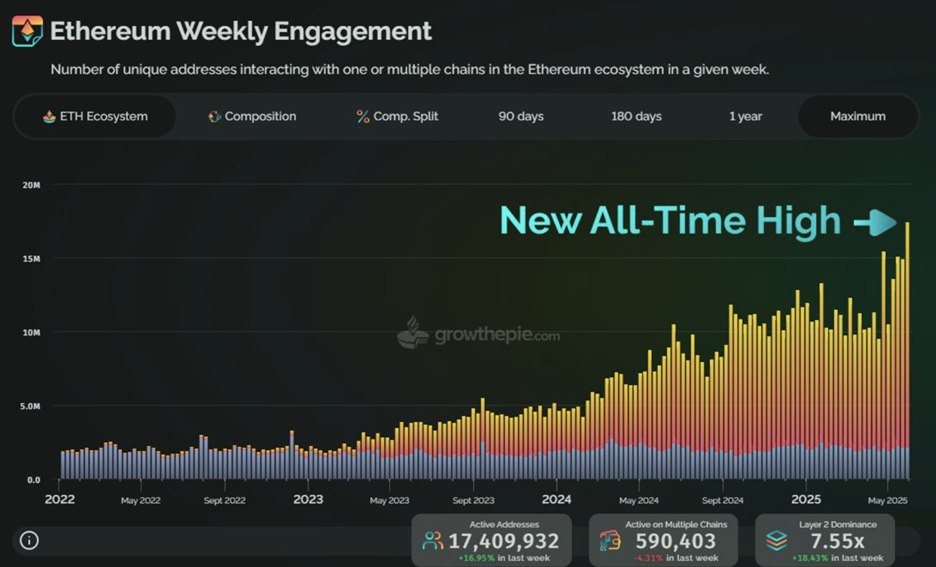

One that is reflected in Ethereum’s network engagement, which is hitting all-time highs.

Last week alone, over 17 million unique addresses interacted with Ethereum’s ecosystem, a 16.95% increase week over week.

A large part of this activity is being driven by Layer-2 networks, especially Base, which accounted for 11.67 million (or 70.91%) of all active addresses. Base also recently surpassed 3 million daily active users — a staggering number for any blockchain.

Even zooming in to the past seven days, usage across multiple Ethereum-connected chains is up 24%, signaling continued growth.

May brought all-time highs in several other key metrics, including …

- Transaction Count: the number of transactions happening on Ethereum. More transactions = more activity.

- Throughput: how fast the network processes transactions. Higher throughput means Ethereum is handling more data, faster.

- Ethereum Blobs (Data Posted): Introduced recently, blobs help Ethereum store more data efficiently and reduce costs —important for scaling the network.

This activity surge is reinforced by Ethereum's dominance in the stablecoin economy.

Over the past year, the total stablecoin market cap on Ethereum's mainnet has grown by almost 50%.

That is a clear sign of lasting developer and user trust in its infrastructure.

Which is why today, 50% of all stablecoins in circulation are secured by Ethereum. And 90% of the stablecoins in the Ethereum ecosystem are on Layer-1.

This foundational role in decentralized finance makes Ethereum the go-to settlement layer for stable, tokenized assets that power trading, lending and payments across the ecosystem.

Is ETH Still Undervalued?

Institutional capital, investor sentiment and on-chain activity are all converging around one message: Ethereum is back in the spotlight — and it’s gaining serious strength.

And with its infrastructure stronger than ever, Ethereum looks like it might be entering the early stages of a major resurgence.

That’s why, despite recent price gains, ETH still appears undervalued.

While analyst views vary widely — from Standard Chartered's conservative $4,000 target to more bullish independent forecasts reaching $8,000–$15,000 — there is a significant upside potential.

However, there are some headwinds investors should be mindful of.

For example, Ethereum still faces competition from its own Layer-2 networks, as well as other cheaper Layer-1 alternatives, like Solana (SOL, “B”).

Additionally, scalability of its mainnet has yet to reach optimal levels, and shiny new ETF approvals of other altcoins might take away some of ETH's shine.

Still, Ethereum remains the most secure programmable blockchain with unmatched developer mindshare and institutional trust.

That means in the next leg up, a doubling from its current price near $2,500 isn't just wishful thinking.

It’s a strong possibility.

One that any crypto investor should be watching with interest.

And for other developments to watch in this next leg up, I suggest you check out our Crypto All-Access Summit.

Best,

Marija Matić