Expect Rising Liquidity to Lift Crypto in 2024

|

| By Juan Villaverde |

There are three events I expect will hit one after another in early 2024.

It’s what I’m calling the Crypto Convergence.

Together, these events could drive Bitcoin (BTC, “A-”) to new highs, perhaps even $140,000 or higher.

And a number of altcoins could do even better.

Sure, the bull market has already begun, even before any of these three events have happened. Since the cycle low was established in the fall of 2024, Bitcoin has nearly tripled.

But if you missed out on those gains, don’t sweat it. At least not yet.

Because all the signs tell me that what’s happening right now will make those gains seem like small potatoes.

And right now — this very moment — is actually one of the best times to start investing in cryptocurrencies.

Because we’re in the first inning of a much bigger, much more important ball game.

And to explain why, I’ll dive into the third of the three events set to converge: A pivot Federal Reserve policy.

In 2023, the Fed’s official policy was to reduce its balance sheet. I expect that to change in 2024.

Now, to be fair, it has sort of already changed.

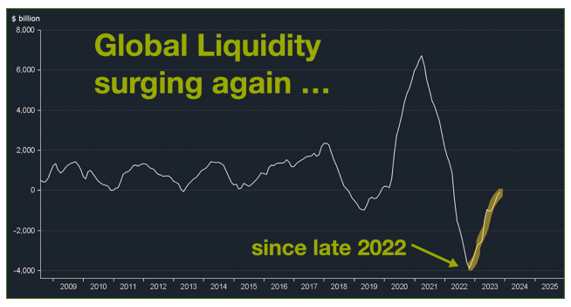

The yellow highlighted line (above) — starting in late 2022 and extending to December this year — shows a steady rise in liquidity.

That’s because, all over the world, sky-high government debt levels have forced central banks to intermittently prop up their sovereign debt markets with massive money printing to prevent a debt meltdown.

That’s why, as the Fed was reducing its balance sheet with one hand last year, it was offsetting it with cash injections via facilities like Reverse Repo or the Treasury General Account.

In the end, the Fed added around $300 billion in liquidity in 2023.

And the Fed isn’t the only central bank increasing liquidity.

China is grappling with a $50 trillion housing bubble, leading the People’s Bank of China to inject about $500 billion (4 trillion freshly printed yuan) since June.

That’s roughly $100 billion a month!

And very close to what the Federal Reserve was doing at the peak of its 2020-2021 printing frenzy.

How does all this impact crypto?

To put it simply, when central banks print money, financial asset prices go up.

This impacts every asset class. But none more so than crypto.

In fact, crypto prices tend to magnify changes in global liquidity 5-to-1.

That makes crypto assets essentially a leveraged play on the increase — or decrease — of central bank global liquidity.

Can we expect this trend of rising liquidity to continue next year? Absolutely.

The U.S. is running massive fiscal deficits of about 8% of GDP (unprecedented outside of a recession) and will need funding. A task which falls to the Fed.

In addition, 2024 is an election year. So, the current administration will seek to ensure reelection, which means more money printing.

And what about China? Well, its massive debt bubble is not going to disappear overnight. Beijing's response in 2023 — more money printing — will likely be ongoing.

Convinced that China is heading for a deflationary hard landing, an increasing number of Chinese investors are scrambling to get their money to safety outside the country.

Indeed, this massive outflow of capital from China is a primary driver for the rise of Bitcoin and gold’s surge to new all-time highs.

Imagine the impact when American investors finally wake up and realize Washington’s fiscal situation is not so different from Beijing’s.

You think you saw Bitcoin go up a lot at the end of 2023? You ain’t seen nothin’ yet!

So, if you’re curious about the other two events set to converge this year …

And when you should expect them to hit …

I urge you to join me this coming Tuesday, Jan. 9 at 2 p.m. Eastern for my Crypto Convergence briefing.

There is very little precedent for this convergence.

But if history is any indicator, just one of these events could be a once-in-a-lifetime opportunity.

All three at the same time could take Bitcoin to a new, historic level.

And when Bitcoin excels, select altcoins often outperform.

That’s why, on Tuesday, I’ll reveal the names of three altcoins I believe folks should buy now, ahead of the convergence.

You’ll have to tune in to learn more. See you there!

Best,

Juan Villaverde