|

| By Marija Matic |

In a space as fast-moving and noisy as crypto, it’s often hard to separate signal from noise.

Between flashy token launches, experimental projects, wild price swings and the occasional collapse, keeping up can feel like a full-time job.

That’s where on-chain data proves invaluable.

It cuts through the hype to highlight what really matters. And it offers real fuel for deeper research.

For seasoned analysts, metrics like wallet activity, user growth and smart contract interactions often tell a more compelling story than simple price charts ever could.

So today, I want to focus on crypto’s biggest gainers over the past week.

But not in terms of price action.

Instead, below are the top gainers in on-chain activity over the past week … and the stories that are driving their momentum.

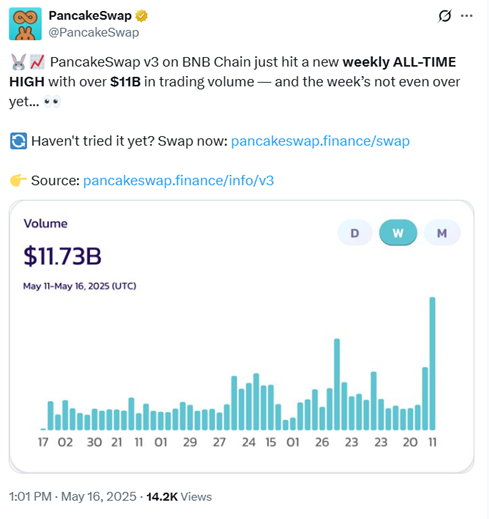

PancakeSwap Leads DEX Volume Surge

According to Token Terminal data, Binance's decentralized exchange, PancakeSwap (CAKE, Not Yet Rated) has once again overtaken Uniswap (UNI, “C”) — the largest DEX — in weekly trading volume.

PancakeSwap surged an incredible 138.7% to reach $21.8 billion.

This dramatic increase puts it ahead of Uniswap's $19.4 billion, despite the latter's own notable 17.5% growth over the same period.

PancakeSwap's resurgence is partly driven by its exclusive token generation events (TGEs).

The platform has helped launch 17 tokens to date. Its latest, Alaya AI (AGT, Not Yet Rated), blends artificial intelligence with blockchain tech to improve data management.

And in an unexpected twist, the Trump-backed World Liberty Financial (WLFI, Not Yet Rated) has entered the Pancake conversation, as well.

WLFI has decided to use PancakeSwap to acquire digital assets. Its recent purchase of 3.64 million EOS tokens for $3 million caught attention, given EOS’ controversial past.

However, the project’s rebranding to Vaulta (A, Not Yet Rated), with a patriotic "Made in America" narrative, may help explain the renewed interest.

Solana Ecosystem Accelerates Again

Solana (SOL, “B”) is regaining momentum in the DeFi space as two of its leading DEXes have shown strong weekly growth.

Meteora and Raydium (RAY, Not Yet Rated) saw trading volumes jump by 47.1% and 34.1%, respectively. It was a welcome development, as this growth reinforces Solana’s position as a key player in decentralized trading.

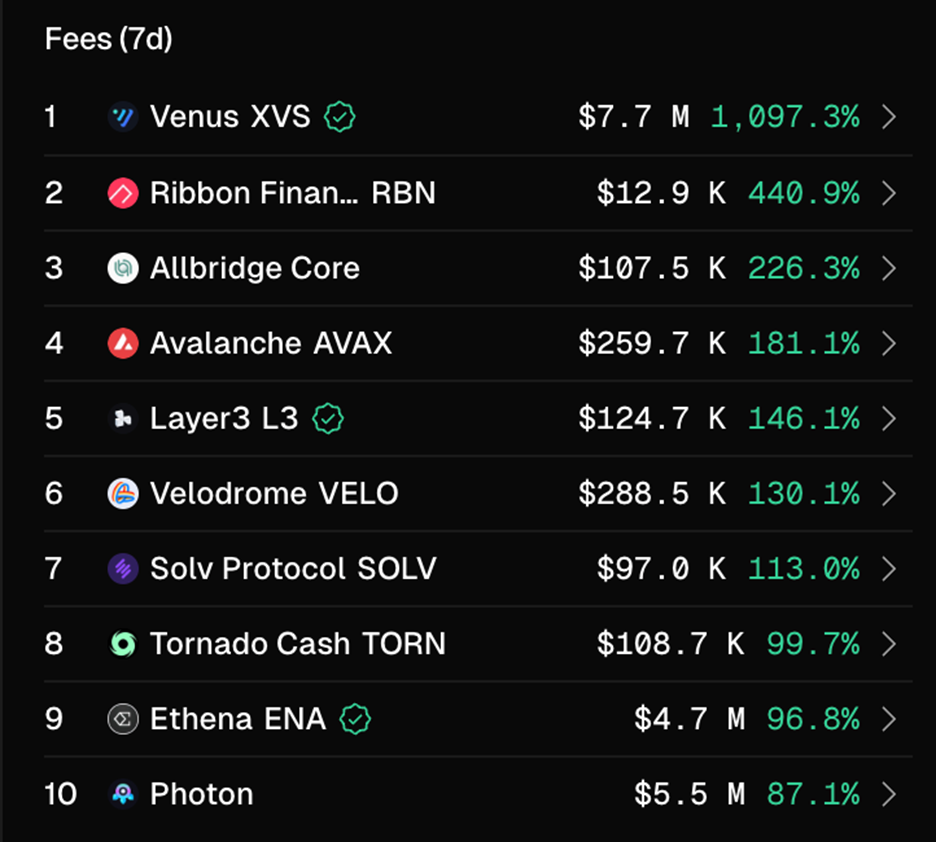

Also making waves on the network is Photon (PHO, Not Yet Rated). This token sniping platform is built for traders who want to grab newly launched meme tokens within seconds.

Photon generated $5.5 million in weekly fees — an 87.1% surge. That’s a solid sign that a risk-on sentiment is spreading to a broader segment of investors.

To help mitigate some of that risk, Photon recently partnered with Bubblemaps to provide visual insights into top holders and hidden wallet clusters, giving traders a clearer view of token distribution.

Venus Protocol Sees Explosive Growth

One of the most eye-catching stats this week comes from Venus (XVS, “D+”), a lending protocol built primarily on the BNB Chain (BNB, “C+”).

According to Token Terminal, Venus’ weekly fee revenue soared 1,097%, reaching $7.7 million — a staggering tenfold increase!

This spike suggests a growing appetite for crypto lending, as traders begin to leverage up in response to improving market conditions.

But it’s not just organic demand driving the surge. Venus is also sweetening the deal with its Prime program, which offers generous rewards to users to help boost activity across the platform.

Telegram Integration Boosts Ethena’s Growth

Ethena (ENA, “B+”) — the project behind the synthetic dollar USDe — nearly doubled its weekly fee revenue to $4.7 million, thanks in part to a new integration with Telegram.

In short, Telegram users can now earn rewards directly from their Telegram wallets.

Launched on May 1, the initiative introduced tsUSDe, a stablecoin designed specifically for use inside the Telegram app built on the Toncoin (TON, “B-”) blockchain.

Ethena now offers users up to 10% annual yield on tsUSDe balances.

Related Story: Telegram Transforms Social Media with Blockchain Tech

This yield comes from Ethena’s delta-neutral strategy which involves balancing long and short trades across different exchanges to reduce risk from price swings.

The 10% APY is available for balances up to 10,000 tsUSDe per wallet, which makes it appealing to smaller users.

This is a big move toward making DeFi easier and more accessible.

Looking ahead, Telegram is also working on a debit card tied to tsUSDe, which would let users spend their crypto earnings in everyday life and help bridge on-chain finance with real-world use in a meaningful way.

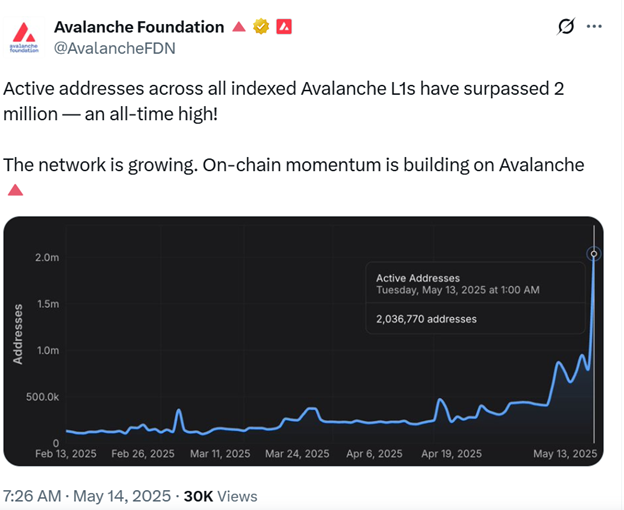

Gaming Breathes New Life into Avalanche

Avalanche (AVAX, “B+”) has experienced a major upswing in network activity, with weekly fee revenue jumping 181.1%, largely fueled by a surge in gaming. The network recently hit a new milestone — over 2 million daily active addresses — driven primarily by the success of MapleStory N.

This reboot of the iconic 20-year-old game, which boasts over 180 million registered users, has integrated blockchain features to let players truly own and trade in-game assets.

Its success marks a significant step toward mainstream gaming adoption of web3.

But Avalanche isn’t stopping there. Upcoming titles like Warden’s Ascent from the team behind Pixelmon hint at a growing gaming pipeline.

Meanwhile, Avalanche’s DeFi sector is quietly innovating. A standout is SolvBTC.AVAX, a yield-bearing Bitcoin (BTC, “A-”) product that combines tokenized Treasurys with stablecoin minting. These stablecoins are then deployed across Avalanche’s liquidity strategies.

While still modest in scale at $9.4 million in TVL, it’s a notable example of the network’s move toward more sophisticated, cross-asset financial engineering.

Conclusion: The Broader Picture Beyond Price

While price movements certainly capture attention, the real story in crypto often lies beneath the surface.

It’s written in the growth of ecosystems, the innovation happening in DeFi and web3 and in how users and platforms engage with blockchain technology.

From the rise in trading volumes to ecosystem expansions and lending booms, the signals over the past week are clear: Innovation is driving growth.

Projects like Photon and Venus show that the existing market's risk appetite is returning.

And at the same time, the surge in gaming activity on Avalanche and the Telegram-native yields from Ethena demonstrate that mainstream adoption is well within reach.

As crypto continues to evolve, savvy investors will want to keep an eye on these underlying metrics. They’ll be key for anyone looking to navigate the ever-changing landscape.

The most interesting stories — and investment opportunities — often aren’t the ones with the biggest price pumps. They’re the ones where innovation and real-world utility are creating lasting value.

Best,

Marija Matić