|

| By Bob Czeschin |

Crypto markets famously never close.

But not every hour of the 24-7 trading day is created equal.

It turns out crypto markets — like all living things on earth — dance to a certain circadian rhythm.

Knowing that beat and how to move to it could help you boost your trading. On the other hand, ignoring it could come with unintended consequences to your portfolio.

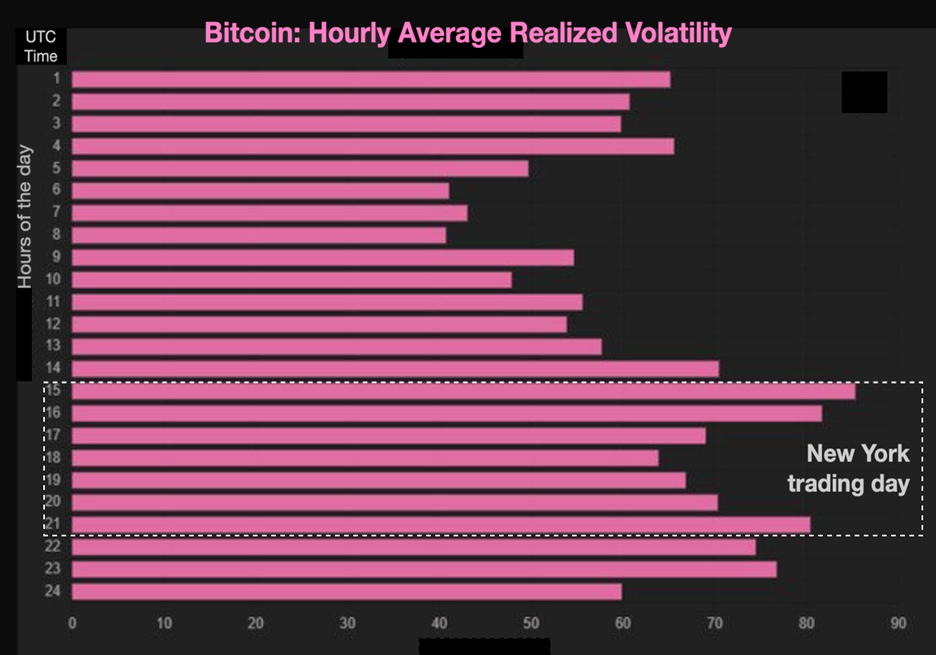

The chart below illustrates how widely the intensity of Bitcoin trading fluctuates around the clock.

And this ebb-and-flow has consequences.

The pulse of crypto’s round-the-clock trading is closely related to the open hours of major global financial centers in Asia, Europe and North America.

The biggest market is New York — famous for its liquidity, volatility and robust trading driven by institutional investors, hedge funds and retail investors.

That’s precisely why it boasts the biggest cluster of long pink bars above.

However, the last part of Europe’s trading day overlaps with early trading in New York. Their combined weight is what gives 1500 and 1600 UTC — or 11 a.m. and 12 p.m. Eastern — the longest pink bars of crypto’s entire 24-hour trading day.

Timing Benefits for Crypto Investors

The lowest-cost time of day to trade crypto is generally when trading activity is highest, order execution is fastest and liquidity is deepest.

That means even very large buy-and-sell orders can be easily accommodated without moving the prevailing market price.

Specifically, the 1200 - 1500 UTC — or 8 a.m. to 11 a.m. EST — trading window marks the sweet spot. Between the first hour of New York trading, and a coupled hours prior, crypto trading volume often surges 25%, 30% or more.

Momentum traders may see this as a window of opportunity.

That’s because price trends already underway in European trading often intensify and steepen as market participants in New York switch on their trading screens and climb aboard.

But there is also a strategy in targeting crypto’s wee hours.

0600 to 0800 UTC — 2 a.m. to 4 a.m. Eastern — is normally crypto’s dead zone. That’s when New York slumbers, Tokyo, Singapore, and Seoul are winding down and London and Frankfurt are not yet fully awake.

Because of this, institutional investors and professional traders are generally absent from the market. So, trading volume is low and liquidity is shallow.

However, this may appeal to certain traders on decentralized exchanges.

Particularly those who’ve been stung by sky-high gas fees during high-volume hours.

Gas fees are charged by major networks like Ethereum to process transactions. Low activity generally means minimal gas fees.

Low activity may also mean low slippage, which is the adverse price changes that can occur between when you place an order and when it gets executed.

Even on faster networks such as Solana (SOL, “B”) where transactions are processed in seconds, high-volume trading can still create enough slippage to cause your transaction to fail.

Market data suggests off-peak hours can produce 15%-20% less slippage on larger orders due to less competition.

There is, however, one key caveat to keep in mind when using this approach: Relatively low liquidity during crypto’s wee hours can materially increase effective transaction costs. Especially for large transactions.

And this can easily negate any hoped-for savings in slippage and gas fees.

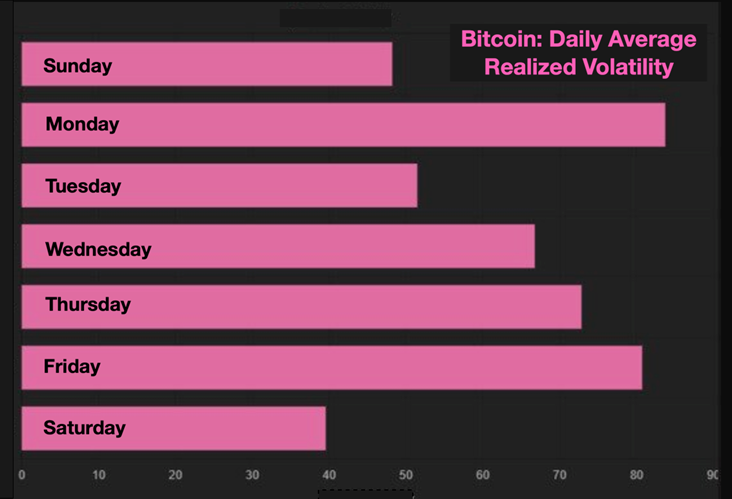

Best Days of the Week to Trade Crypto

Just as what time you trade could impact your transaction, the same is true of what day you trade.

However, the insight here is a bit murkier.

If you’re a day trader, you can safely anticipate that long pink-bar days like Monday and Friday will likely be your lowest-cost days to trade.

So far, so good. And more power to you!

But what if your time horizon extends several days, weeks or even months?

The impact of famously volatile crypto prices on your profit-and-loss statement … is likely to completely swamp whatever cost savings you might achieve by confining trading to Mondays and Fridays.

Best Months of the Year to Own Bitcoin

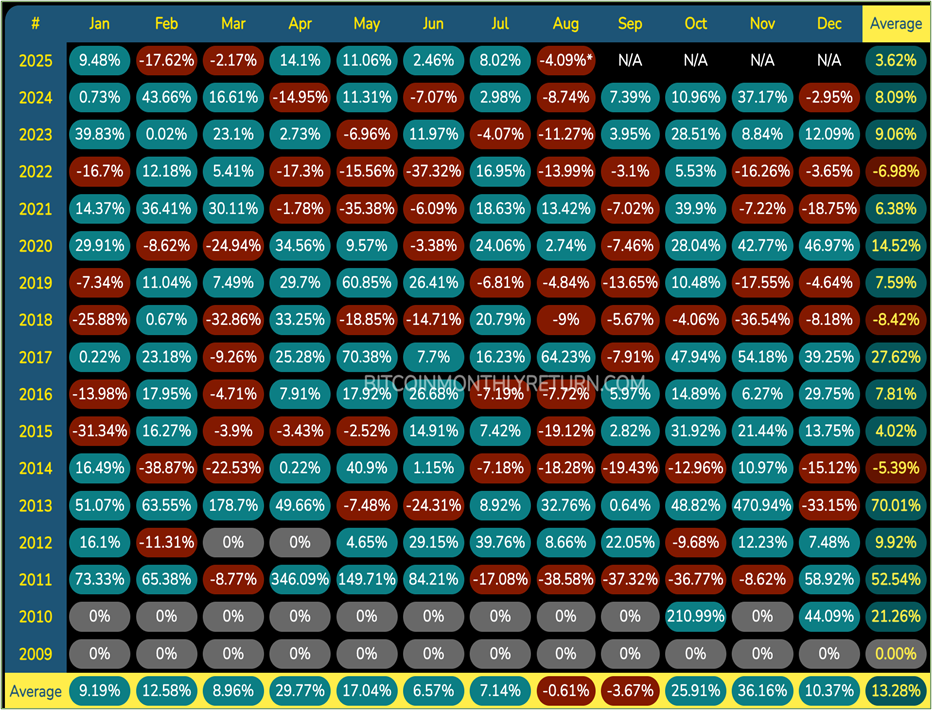

The table below shows the profit (blue green) or loss (red) of owning Bitcoin for every month it has existed as a financial asset.

And as you can see, interesting calendar effects abound. For example, in 10 of the 12 calendar months — a whopping 83% of the time — Bitcoin shows an average gain.

Its best-performing months are November (average gain 36.16%), April (up 29.77%), October (up 25.91%) and May (up 17.04%).

BTC Gains/Losses Per Month Since Inception

By contrast, in only two months — August and September — does Bitcoin actually post an average loss.

And they’re very small — 0.61% and 3.67%, respectively.

Notice September has historically been Bitcoin’s worst month. And it’s only a few days away!

Does this mean you would be wise to sell all your Bitcoin — to avoid a 3.67% average loss?

Certainly not!

In the context of crypto, a 3.67% loss is utterly trivial! And not worth the opportunity cost of not being in the market when Bitcoin — which is famously full of surprises — shoots up again!

So, what if anything, do these calendar effects — interesting as they are — actually reveal about the best times to buy Bitcoin?

Well, October/November and April/May are the two consecutive-month intervals with the highest average returns.

So, I suppose you could say it makes sense to focus your Bitcoin buying during these intervals.

But to me, the main thing this final chart provides is dramatic, empirical evidence that Bitcoin may indeed be the world’s best-performing financial asset.

For example, for 16 straight years …

- Profitable (blue green) months outnumber losing (red) months more than 1.4 to 1.

- Profitable (blue green) years outnumber losing (red) years more than 5 to 1.

This is no flash-in-the-pan opportunity. It’s a burgeoning profit juggernaut.

If you don’t already own some, you’re passing up one of the most potent financial opportunities of the 21st century.

But that’s not all.

Our research shows a massive shift is taking place in the crypto markets right now.

Billions of dollars are moving OUT of Bitcoin as we speak … and INTO smaller coins.

And not just trivial amounts.

We've tracked Wall Street giants like BlackRock and Fidelity moving hundreds of millions of dollars into these opportunities. And that's just over the past couple of weeks.

It might seem like an aberration, but it's not.

It's a well-documented pattern that's happened during every crypto bull market of the past 10 years. And for savvy investors who knew where to look, the results have been nothing short of remarkable.

That’s why this coming Tuesday, Sept. 2, at 2 p.m. Eastern, my colleague Mark Gough will break down how this pattern will likely unfold in the current market. And he’ll reveal three coins he believes could leave Bitcoin in the dust when it does.

To learn about them for yourself, just be sure to save your spot for this urgent crypto briefing.

Best,

Bob Czeschin