|

| By Marija Matic |

Friday hit like a sledgehammer.

In just one hour — sixty relentless minutes — President Trump’s latest tariff announcement detonated across global markets.

It sent shockwaves through crypto that will be studied for years.

What unfolded wasn’t just another dip.

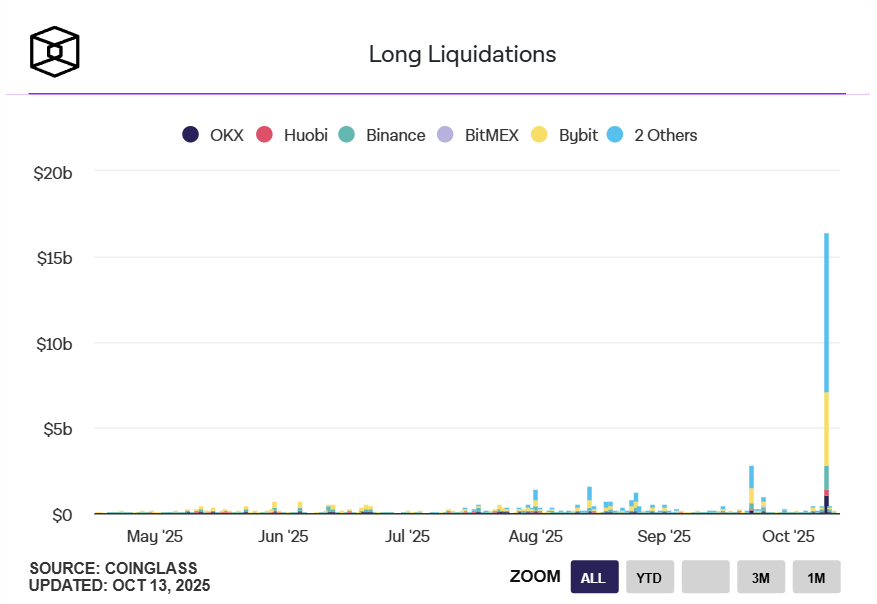

It was the single largest liquidation event in crypto history: $19.3 billion wiped out in a cascading avalanche of forced closures.

At first glance, it looked simple: Markets panicked. Traders freaked out. Sell buttons got smashed.

But this wasn’t a widespread response to a new macro headwind.

Rather, it was an example of how centralized systems can spiral …

And how DeFi can withstand the storm.

The Trump Tariff Playbook

You’d think by now everyone would know the script. It’s practically muscle memory.

Just think back to April of this year for another clear example.

Back then, the market panicked on the announcement of additional tariffs. That resolved in a few days as the tariffs were walked back.

With the headwind removed and the threat of more off the table, the markets found their momentum and soared to new highs.

Now, look at what’s happened over the past few days: Cryptic tariff threat → market panic → fake recovery → escalation → “solution” tweet → damage control → trade deal → new highs.

Rinse. Repeat.

Analysts like the Kobeissi Letter have mapped out this exact cycle, and right now we're at the "working on a solution with China” phase.

So yes, the market overreacted to the announcement.

But knowing the game doesn't make the gut punch any less brutal when $19.3 billion evaporates in an hour.

So, what sparked the overreaction?

A perfect storm of bad timing and a flaw in the largest centralized exchange.

Digging Beneath the Surface: The Bot Barrage

As I said, the timing couldn’t have been worse.

The tariff announcement hit on Friday just as liquidity was drying up — when major markets were “closing” and depth was thinner.

That’s when a $60 million USDe stablecoin dump hit Binance’s books and sparked the entire firestorm.

But the seeds of this crash were planted long before then.

Through the summer, leverage piled sky-high.

Open interest in many altcoins had ballooned to absurd levels. These were bets so oversized, they sometimes exceeded the entire market caps of the underlying tokens.

It was a perfect setup for volatility.

And when it detonated, it was ruthless.

Reconstructing the Crash

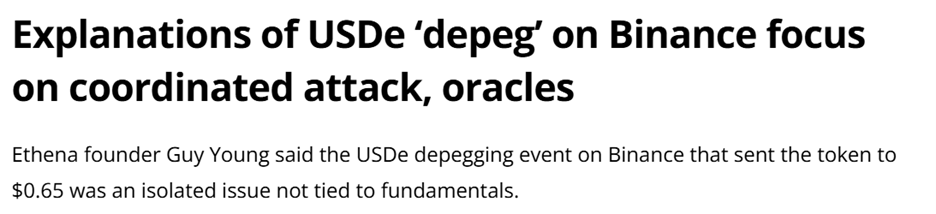

Headlines on Friday screamed: USDe crashes to 65 cents on Binance!

Panic spread as traders believed that Ethena’s (ENA, “B+”) stablecoin had de-pegged and fell from its $1 price.

But that’s not what really happened.

USDe isn’t a classic stablecoin. It’s more like a tokenized delta-neutral fund, built to maintain value stability through hedged positions, not a hard $1 peg.

And on the decentralized Curve (CRV, “B-”) platform, where most of USDe’s true liquidity sits, the price barely moved.

The cause of the confusion?

Binance.

The price of USDe wicked to 65 cents on the largest centralized exchange in the world due to its flawed oracle.

See, Binance's oracle relied on its own internal orderbook rather than balancing it with external sources. This meant its price data came from a single, potentially shallow liquidity pool instead of the broader market.

That error in Binance's oracle was a crack in the system. And with a little pressure, it burst wide open.

Furthermore, Binance had no direct mint-and-redeem channel with Ethena. No “primary dealer” setup.

So when liquidity vanished on Binance, there was no one on-platform to restore balance.

Here’s the chain reaction in simple terms:

- A $60 million USDe dump hit Binance’s books.

- Accounts started getting liquidated and nuked based on Binance's internal oracle prices — where USDe had dropped to 65 cents — even though USDe maintained its peg near $1 on other platforms and deeper liquidity pools.

- Cross-asset margin positions (wrapped ETH, SOL, etc.) began auto-liquidating.

- The overload triggered cascading API failures.

- Arbitrageurs were locked out.

- Prices plunged into a vacuum.

- $19.3 billion in positions were liquidated in minutes.

Then the exchange's safety mechanisms kicked in.

When the sell-off began, it triggered Auto-Deleveraging (ADL) — the exchange’s emergency kill switch.

When prices fall faster than liquidations can clear, the exchange forcibly closes even winning positions to stabilize exposure.

Yes, you read that right — even some profitable traders got liquidated.

This has caused cross-margin carnage.

Traders who used altcoins as collateral — often at over 50x leverage — saw their collateral nuked as the system sold everything it could, no matter the price.

That’s how Cosmos (ATOM, “C”) briefly wicked to one cent, and Sui (SUI, “B”) plunged to 56 cents on Binance.

It was not humans selling those tokens.

Many even couldn’t. The centralized exchanges themselves were glitching.

This was pure algorithmic logic: Machines liquidating machines in a self-feeding spiral with no pause button.

For a few terrifying minutes, retail traders were mere spectators while the bots tore each other apart.

Then, silence.

The storm passed as fast as it came. But the wreckage for leveraged traders was enormous.

The Truth About USDe’s Backing

Despite the disruption on Binance, USDe’s collateral stayed solid.

Within hours, Chainlink (LINK, “B”) and other independent attesters verified it was actually overcollateralized by $66 million.

In plain English: This was not Terra 2.0. There was no magic math or fake collateral.

The backing was real.

The verdict?

This was a Binance-specific flash crash that better market structure could’ve prevented.

Simple as that.

While DeFi worked, some CEXs glitched. There, users saw systems freeze, APIs brake and arbitrageurs get locked out.

Dragonfly’s Haseeb Qureshi said it best:

“It’s like a fire broke out on Binance, but all the roads were blocked and firefighters couldn’t make their way in.”

Binance’s Response

This is why Binance is now refunding some of the affected users.

So far, $283 million has been refunded.

But if Binance wants to keep USDe and similar products in its collateral framework, it needs better mechanisms.

The refund was the apology. But a new oracle will be the real test of this platform’s resilience.

Binance’s single-venue oracle leaned too far toward hyperresponsiveness. A properly designed system would’ve smoothed that data across multiple sources.

Instead, Binance’s looped feedback created internal implosion. When that $60 million dump hit, it overreacted by design.

The result? A $19 billion self-inflicted liquidation loop.

But the real surprise in all this was the timing.

Binance was aware its oracle needed an upgrade. In fact, it had announced a new oracle upgrade five days before this crash.

That’s what makes the insanely bad timing almost suspicious.

See, the announcement created a window of vulnerability — a roadmap for anyone watching. Binance basically announced the fix before patching the hole.

Which means we can’t rule out the possibility that this was the impact of intentional market manipulation.

Roughly $60 million in USDe was dumped on Binance just before a pivotal oracle upgrade and right after a market-moving tariff announcement.

Whether this was intentional or just catastrophic timing remains unclear.

What is clear is that Binance’s looped feedback created internal implosion. And it’ll be imperative that its fix, which has already been deployed, holds up if it aims to hold its market share.

DeFi’s Finest Hour

While centralized exchanges buckled, DeFi held firm.

On-chain systems worked as designed:

- USDe on Curve had only a 0.3% deviation.

- Aave (AAVE, “B-”) saw no disruptions and no large surprise liquidations.

- Hyperliquid (HYPE, “D”) continued to operate smoothly, even under stress.

But it was the Solana (SOL, “B”) network that stole the spotlight.

It handled a record 100,000 transactions per second without breaking a sweat!

This performance was even more impressive when compared to its main competitor: Ethereum's (ETH, “A-”) network choked on high gas fees.

It’s a painful reminder that scalability still matters when the world catches fire.

This was a stress test of philosophy: centralized fragility vs. decentralized resilience.

And DeFi won, decisively.

The Aftermath

The full picture is still being assembled.

On-chain investigators are combing through transaction logs and wallet movements …

Builders are running simulations …

Risk teams are stress-testing scenarios.

The verdict on whether there be contagion risk — such as large market makers on CEXs going broke or loop strategies breaking — will take time.

For now, it seems the system absorbed a $19.3 billion shock and kept running.

The rebound was swift. Bitcoin snapped back to its range. Selling pressure evaporated.

The weak hands are gone.

What remains is conviction. Battle-hardened traders and crypto enthusiasts who just survived the crypto equivalent of a once-a-century storm.

Let's be clear: real people lost real money.

Some played it right, managed risk, followed their plan … and still got crushed by infrastructure failures beyond their control.

That pain is real. This wasn't a fair fight.

But every crash reshapes the landscape. This one will, too.

The weak points are visible now. We've seen what breaks under pressure.

Now, it’s time to rebuild it stronger.

And in the meantime, I hope more users venture deeper into DeFi.

After all, it proved itself when it mattered most.

Best,

Marija Matić

P.S. Cycles expert Juan Villaverde says this black swan event has not changed what his new and improved Crypto Timing Model 2.0 says is ahead for crypto in Q4.

To hear his outlook, and which coins he believes will outperform Bitcoin, you should watch his latest crypto briefing.