Gold’s Pause Isn’t a Pullback. It’s a Paradigm Shift

|

| By Bob Czeschin |

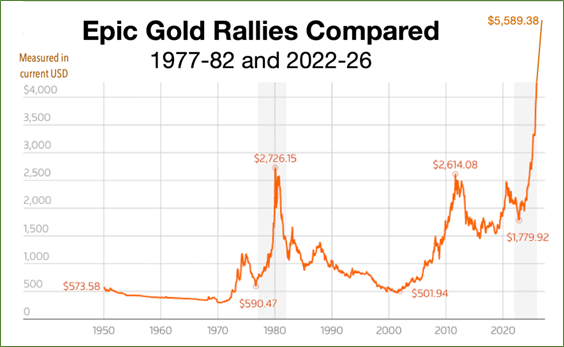

After several slow weeks in early January, the gold market suddenly erupted with all the force and melodrama of a Wagnerian opera.

Prices shot up $800 in a week — to new all-time highs above $5,550.

A move like that surely commands attention. And not just because it makes a lot of investors a lot of money.

But because it also seems eerily similar to the epic, blow-off top that ended gold’s fabled run in the late 1970s.

Parabolic moves — powered by leverage and compressed momentum — don’t quietly fade away. They end with a bang, typically inflicting immense P&L pain among the still invested.

That’s what happened to gold post-1979.

Over the next two years, prices plunged a whopping 63%. And they didn’t get back to their 1979 highs until 2024.

But what if the current parabolic rise does not signal another long drought for gold prices — as it did back in 1979?

What if there is another possibility?

What if what gold is really signaling … is actually a paradigm shift?

A Bubble in 1979. A Paradigm Shift in 2026

Conventional wisdom says gold moves inversely to real interest rates.

Historically, gold goes down as long-term interest rates go up, reflecting the opportunity cost of holding a non-yield bearing asset.

This is why we saw gold prices under persistent pressure during the Federal Reserve’s tightening monetary policy in early 2022.

But after an extended low near $1,600 in Q4 of that year, gold took its first couple baby steps into what would be its next major move up.

What’s interesting about that is it occurred despite dwindling inflationary pressures and rising inflation-adjusted bond yields.

On one hand, you have tame inflation. On the other, you have real interest rates ticking up.

Both of which were supposed to be bearish for gold.

But instead of gold going down, a new bull market began to gain traction and accelerate.

This was the first hint a paradigm-shift had taken place in the metaphysics of money.

What was once a rate-sensitive asset had become a fiscal risk hedge. And gold’s correlation with Treasury yields flipped from deeply negative to positive.

Under the new paradigm, gold rises along with higher long-term rates. Especially when those rates reflect growing stress in sovereign bond markets.

Looking back on the first half of 2022 — with the benefit of hindsight — it’s not hard to discern what likely fomented this paradigm shift …

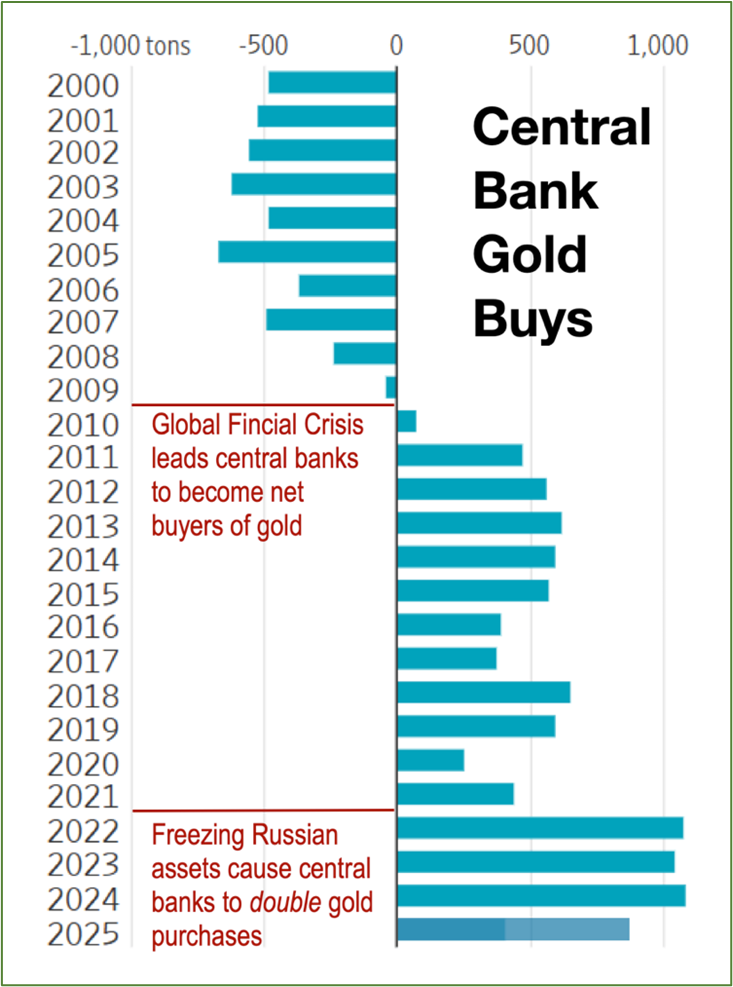

In February 2022, U.S. President Joe Biden froze Russia’s dollar foreign exchange reserves to punish President Putin for invading Ukraine.

But this also jerked the rug out from under the dollar-based global monetary system — which has prevailed since the end of World War II.

Under it, virtually all central banks hold dollar balances as a reserve asset to back the local currencies they issue.

So naturally, they worried what Uncle Sam might do to their dollar balances if a U.S. president got mad at them. (Especially one as famously mercurial as Trump.)

So, they almost immediately began swapping as many dollars as they could for other reserve assets. Assets that couldn’t be frozen or seized by any government.

However, the list of such assets is very short.

Basically, there’s Bitcoin (BTC, “A-”) and gold. And Bitcoin is still too avant-garde for most central bankers to embrace. (Though that hasn’t stopped TradFi firms from loading up.)

The monetary and fiscal climate in 1979 could hardly be more different than it is today ...

- Back then, the U.S. was a major international creditor. Today, it's the world’s largest debtor.

- In the 1970s, U.S. government debt was around 30% of GDP. Today, it’s nearly four times higher.

- In recent years, the U.S. fiscal deficit has run about 6% of GDP — also roughly four times higher than the budget shortfall in 1979.

- By the end of that year, the Fed Funds Rate was at 14% and rising. Today, it’s below 4% and falling.

- In 1979, Paul Volcker, a legendary inflation hawk, was Fed Chair. Today, President Trump has made it clear his next chair will cut rates and run the economy hot.

In other words, the playing field has changed drastically.

And because of it, gold behaves differently.

Years from now, market historians will look back on gold’s descent from $5,500 in early 2026. And I suspect they’ll see nothing more than a hefty, healthy correction evoked by an overheated, overbought market.

And perhaps, they’ll see it as the last major window of opportunity … to get in before gold pokes above $10,000.

Investment Implications

Last year was gold’s best since 1979.

And 2026 is set to be even better.

If you don’t already have some gold in your portfolio, it’s time to add some straightaway.

There’s even a way you can take your gold with you anywhere: By keeping it in your crypto wallet with the PAX Gold (PAXG) stablecoin.

It’s pegged 1-to-1 to the price of gold per ounce, giving you access to gold with all the benefits of the blockchain.

If you want to dive deeper into this gold rush, I suggest you listen to my colleague Sean Brodrick’s latest briefing.

Sean has spent decades building his “boots-on-the-ground” expertise in resources, particularly precious metals.

And he has one strategy to help you boost your gold gains without buying a single ounce.

Best,

Bob Czeschin