|

| By Juan Villaverde |

The market had built up a lot of expectations for Trump’s speech at the Bitcoin conference last weekend.

Anticipation was so high that the actual event was almost certain to disappoint.

And disappoint, it did.

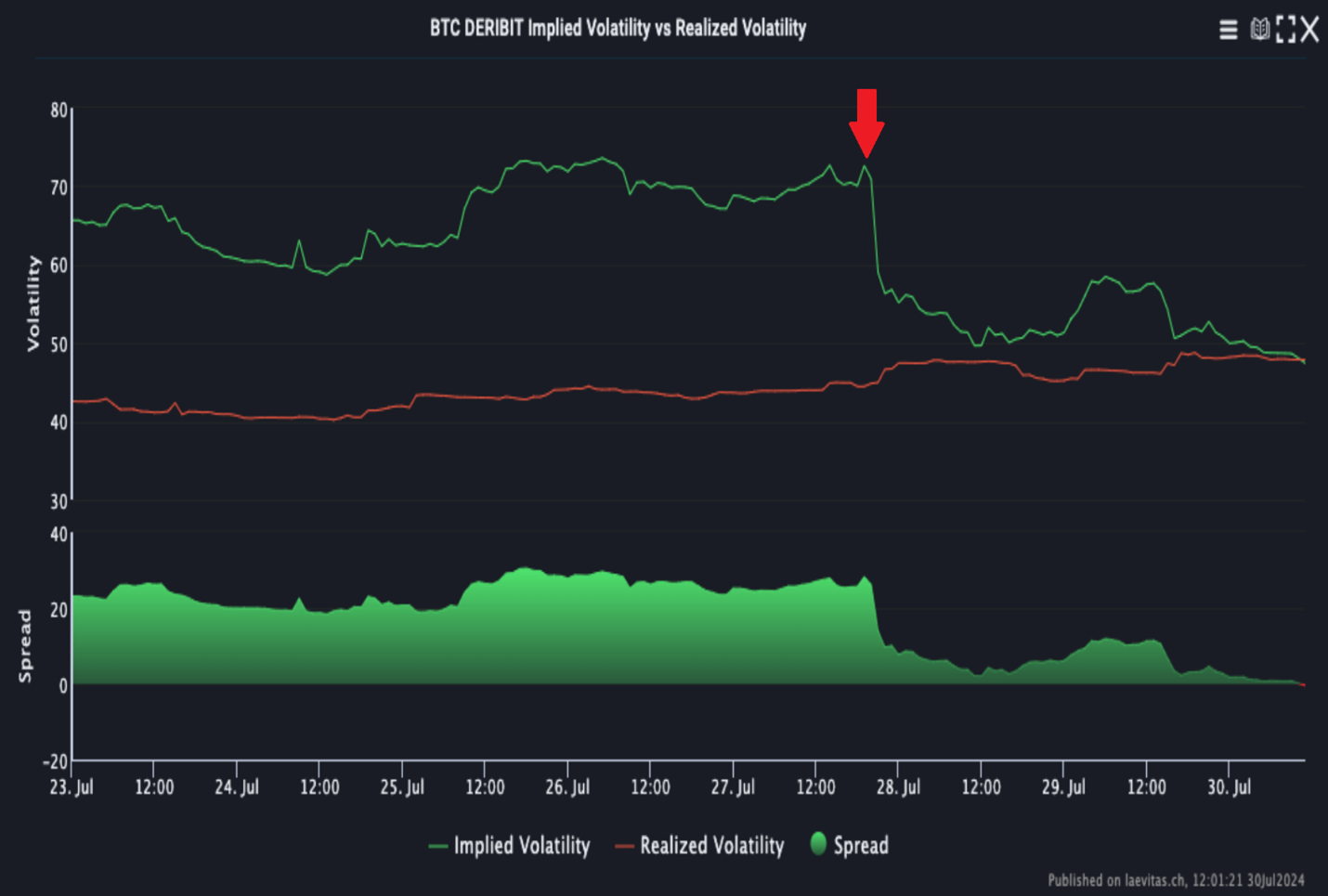

They say a picture is worth a thousand words, so here’s how the market felt as Trump delivered his speech in Nashville this past Saturday:

What you’re seeing is the implied volatility in 1-week Bitcoin options, according to Deribit.

After Trump spoke, volatility plummeted from the 70s into the low 50s. In option-speak, this means “a lot of people bought options expecting a big move and threw in the towel after the speech was done.”

Why the disappointment?

Market participants were buzzing with the rumor that Trump would announce plans for the Treasury to start buying Bitcoin (BTC, “A”) in large amounts to build a “Strategic Bitcoin Reserve,” similar to the Strategic Petroleum Reserve.

Instead, Trump merely stated that he wouldn’t sell the roughly 200,000 Bitcoin the U.S. government already owns.

But the market wanted more. As the old adage goes, “Buy the rumor, sell the news.”

However, beneath the surface, things are moving in the right direction for Bitcoin and crypto regulation in the USA.

For instance, pro-crypto Senator Cynthia Lummis (R-WY) announced she’d introduce a bill for the U.S. Treasury to build up a Strategic Bitcoin Reserve of about 1 million BTC over five years.

She even brought a copy of the bill to the stage at the Bitcoin conference!

Imagine the excitement of holding a piece of paper that promises future bureaucratic action.

And yet, excitement is exactly what this step sparked.

Years ago, when El Salvador announced they’d buy Bitcoin as part of a strategic reserve, many dismissed it as a passing fad. The consensus was that El Salvador was an isolated case, and the likelihood of other countries doing the same was slim.

But here we are, three years later, and the wealthiest nation in the world is moving in that direction.

And the best part? When the U.S. starts a trend, other countries usually follow.

Just days after Lummis presented her bill, Hong Kong announced they’d begin to “research and consider” creating a strategic Bitcoin reserve as well. Research and consider — a true commitment if there ever was one.

If this proposal becomes a reality and the U.S. truly commits to buying and holding Bitcoin as a strategic asset, we will see other nations follow suit.

Or maybe they’ll just keep “considering” it.

On the other side of the political spectrum, Kamala Harris’ campaign is seeking a “reset” with crypto companies.

After years of perceived hostility from the Biden administration, it looks like the presumptive Democratic nominee is looking to start fresh. This which could translate into a more positive regulatory environment for the crypto industry in the U.S.

Because nothing says “new beginnings” like turning over a fresh regulatory leaf.

What all this means is that the U.S. is warming up to crypto, regardless of who wins the election in November.

Moreover, it seems likely that the so-called “Strategic Bitcoin Reserve” may eventually come to fruition in the U.S. and other parts of the world, positioning Bitcoin alongside gold as a go-to safe haven for nations.

Imagine Bitcoin and gold, best friends forever in the vault.

These developments signal potential for Bitcoin’s price to climb higher as these events unfold.

However, it’s not the flashy headline the “hot money” was looking for. Because apparently, nothing short of a presidential decree will satisfy the crypto crowd these days.

Still, steady growth shouldn’t be overlooked. Long-term investors and HODLers see a bright horizon ahead of us.

If you’re interested in learning what assets I recommend long-term investors have in their crypto portfolios, I suggest you check out my Weiss Crypto Investor newsletter.

That model portfolio is already posting two triple-digit open gains. And I anticipate more big things this cycle if you have the patience to hold on.

Best,

Juan Villaverde