|

| By Juan Villaverde |

The crypto markets have simmered down lately.

With no groundbreaking developments on the global liquidity front — the lifeblood of crypto asset prices — today seems perfect to dive into one of my favorite crypto activities …

Yield hunting!

In the sprawling realm of decentralized finance, the opportunities are boundless.

DeFi encompasses everything from lending and borrowing to decentralized exchanges and even zero-coupon bond trading.

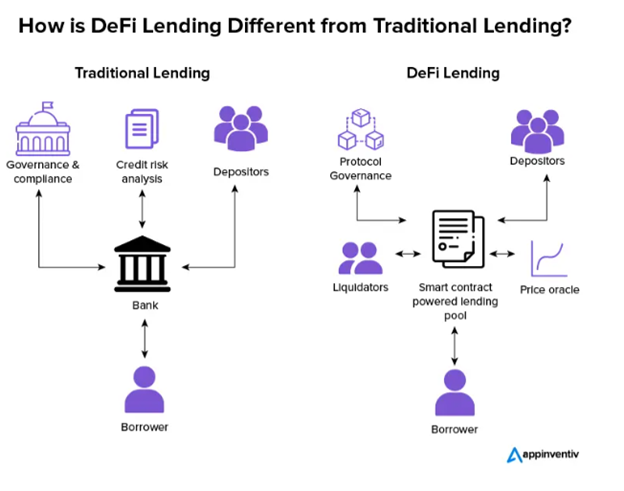

In traditional finance, these functions are facilitated by middlemen market makers.

But in the world of DeFi, anyone who wants can take the opportunity to step in and become the banks and market makers themselves.

This opens the door to yield opportunities beyond what TradFi investors could hope for even in the best of times.

However, there's a lot of misunderstanding outside the DeFi circles. Even among some so-called experts who have famously misinterpreted how yield works in crypto.

They often cite the collapse of the Terra ecosystem and use its defunct stablecoin UST as a cautionary tale of "artificially high yields" being unsustainable.

I've even heard claims that any yield strategy offering returns higher than Treasury notes — which currently hover around 5% — should raise immediate red flags.

Don’t listen to them.

Anyone who parrots these fears lacks a detailed understanding of how the yields are achieved and where they come from.

So today, I want to make sure you understand the size of the opportunity you might otherwise miss out on.

Yield in DeFi can indeed reach upward of 40% annually. Now, there's nothing inherently unsustainable about it. After all, many yields are variable in crypto, unlike in TradFi.

But to say it another way, TradFi yields tend to be low … and stay low. In crypto, you can spot higher yields … and go after them, again and again.

So, let’s break down these misconceptions. Then, you can decide if you’re willing to accept a TradFi yield of 5% … or if you would like to go for much higher rewards.

There are three main sources of yield in crypto:

- Interest rates

This is straightforward. If you lend your stablecoins — cryptocurrencies pegged 1-to-1 to a fiat currency — or crypto assets, you earn an annual interest rate.

Click here to see full-sized image.

Click here to see full-sized image.

While there are fixed-yield loans, the crypto world predominantly operates within a variable interest rate framework. The decentralized lending platform Aave (AAVE, “B-”) serves as a prime example of this type of yield-generating activity.

- Collecting fees

This involves pooling assets with other traders to act as a market maker.

Think of it like a currency exchange booth at the airport.

Say you need to convert your dollars to euros. Well, all you need to do is go to the exchange window, which has a cash drawer of both dollars and euros. They’ll swap your funds and take a small fee for their services.

In DeFi, it’s the same except that now, YOU are the exchange booth.

When crypto traders want to swap their Bitcoin (BTC, “A-”) for Ethereum (ETH, “A”), for example, they’ll go to a decentralized exchange. That DEX has a liquidity pool with both BTC and ETH inside, which is used to support the swap.

But since DeFi platforms don’t have reserves of their own, they rely on liquidity providers — DeFi users who deposit their cryptos into those liquidity pools. As a reward, those liquidity providers get a portion of the transaction fees proportionate to their deposit.

Yields you can target with this strategy will vary based on the assets in the pool, the liquidity of the pool and network and the trading activity for those assets.

And all of this is possible because of blockchain technology and smart contracts called automated market makers, or AMMs.

Source: Exponential. Click here to see full-sized image.

Source: Exponential. Click here to see full-sized image. - Token minting

This refers to yields generated through the minting of new tokens, distributed to participants for staking or performing specific activities within a DeFi application.

For example, by lending assets on Aave, one might receive newly minted AAVE tokens in addition to regular lending yields.

However, this model is often criticized, as its sustainability relies on token inflation to maintain yield levels.

As I said before, critics often highlight the risks associated with high yields in crypto, pointing to projects like Terra’s UST.

In that now defunct ecosystem, yields were funded through unsustainable token minting practices.

That’s why it’s crucial to differentiate between yields derived from economic activities — like trading fees or interest on loans — and those funded by inflationary pressures, which can be unsustainable.

On the other hand, yields derived from economic activities mirror time-tested business models seen in traditional exchanges.

The only difference, as I’ve said, is that you now have access to the higher-yielding opportunities reserved for banks, market makers and other middlemen in TradFi.

That’s why the high yields in DeFi are not a red flag … but a testament to the robust use and utility of these decentralized platforms. They reflect the vibrant activity and demand within these ecosystems, not a cause for concern.

As the DeFi space continues to evolve, so will the opportunities for savvy investors to capitalize on these high-yield strategies, which remain unmatched in traditional financial sectors.

So, while the crypto yield landscape may seem like the wild west to some, for those willing to understand its mechanics, it represents a frontier of abundant opportunity.

If you’re interested in learning for yourself …

And targeting yields of 40% APY or even higher …

I urge you to join Dr. Weiss’ urgent briefing scheduled for this coming Tuesday, June 11, at 2 p.m. Eastern.

He’s invited my colleague and DeFi expert Marija Matić to show him how he can target supercharged yields as high as 169%.

That is definitely not an opportunity you can find in TradFi.

The briefing is free, but seats are first-come, first served. So, save your seat now.

Best,

Juan Villaverde