Institutions Are Betting on Solana for 2 Key Reasons

|

| By Marija Matic |

The crypto market has experienced a correction in the past week, with most altcoin prices dipping. However, the total market capitalization remains healthy and is still 17.46% higher than on May 1.

And so, the waiting game continues. But while the market awaits a catalyst to kick prices higher, one blockchain network has been making waves: Solana (SOL, “B”).

Solana has been leading the bull market since the embers ignited back in Q3 2023. And now, investors are giving the Layer-1 network real consideration.

And there are two main reasons.

Reason 1: Accessible Token Creation

The surge in activity is partly due to its emergence as a major token launch hub.

May saw an explosion of token creation on Solana, with a staggering 455,000 new tokens launched, according to data from The Block Pro.

Even celebrities like Caitlyn Jenner and Iggy Azalea have launched Solana-based meme tokens, leveraging their significant followings to potentially drive token value.

This dwarfs the number created on competing platforms. For example, for the same month:

- The Ethereum (ETH, “A-”) Layer-2 Base saw the creation of 177,000 tokens,

- BNB Chain had only 39,000, and

- The Ethereum mainnet and its Layer-2 networks Arbitrum (ARB, “B-”) and Optimism (OP, Not Yet Rated) each saw less than 20,000.

In fact, Solana's surge in token creation is the highest monthly number recorded on any blockchain network to date.

Sure, a significant portion of the launched tokens were memecoins. But that doesn’t diminish Solana's popularity or even the reasons why it is so popular as a token launch hub.

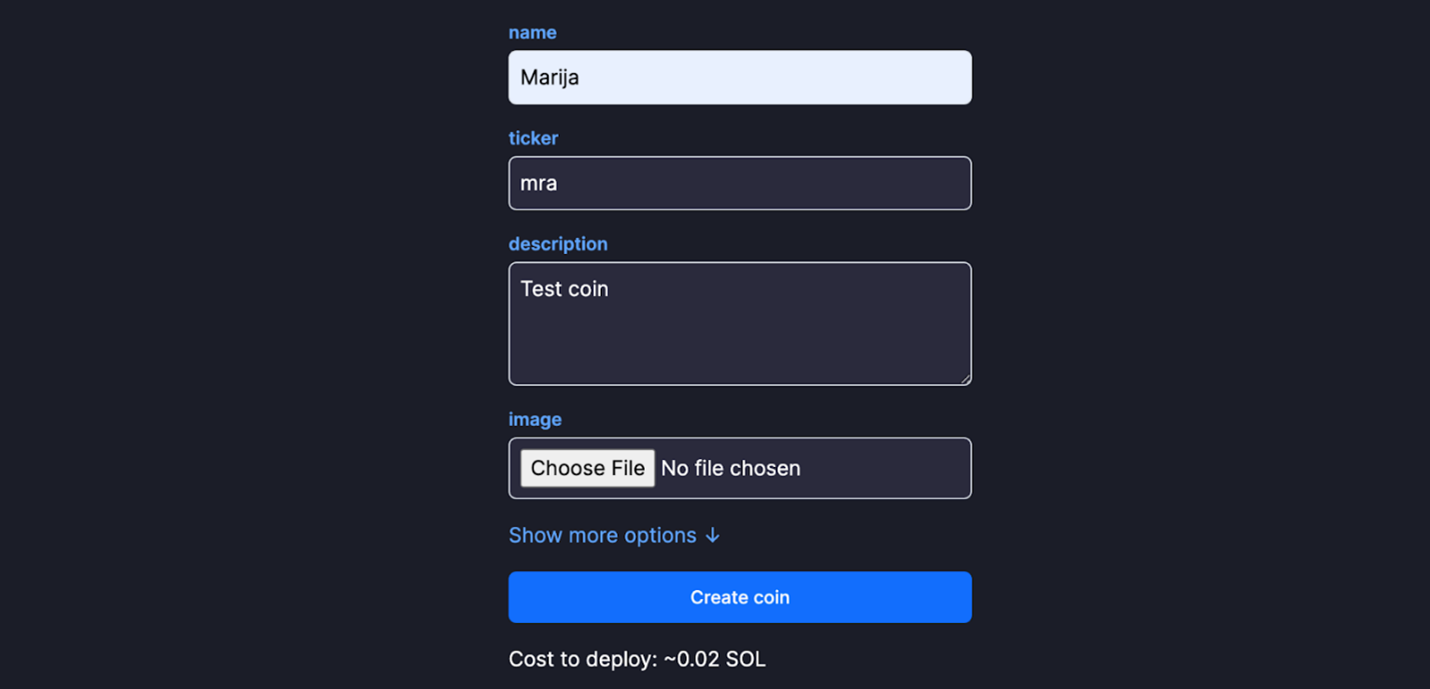

At the top of that list are Solana's low barriers to entry and its user-friendly platforms make token creation accessible.

This ease of use, with costs as low as $3.20 for the creation of basic new tokens, contributed to the high volume of new tokens launched in a single month.

And May wasn’t an outlier. Over 1.1 million tokens have already launched on Solana so far in 2024.

With a streamlined interface and minimal steps involved, it's no surprise that Solana has seen such a high volume of memetoken launches.

While the majority of these tokens — over 99%, according to the data — are unlikely to have real staying power, Solana clearly offers a compelling environment for new projects … and established ones, as well.

Reason 2: A Thriving DeFi and Stablecoin Hub

Looking beyond token creation, you can see that Solana's true strength lies in its robust ecosystem for decentralized finance activities. With a vast array of financial applications, healthy liquidity and impressive transaction volumes driven by high user activity, Solana fosters a space for lucrative yields.

Starting again with accessibility. User-friendly wallets streamline the process of entering and exiting positions without hefty fees, unlike some other platforms where entry/exit costs can be significant.

In fact, Solana shines in terms of transaction speed and cost-effectiveness. Fees are typically less than one cent, making it one of the most affordable blockchain networks for users.

But this low cost doesn’t just make Solana more appealing for DeFi activity. It also makes it popular for real-world integrations.

That’s why Solana is a successful partner for stablecoins. And why the network is exploring the further integration of real-world assets into the blockchain.

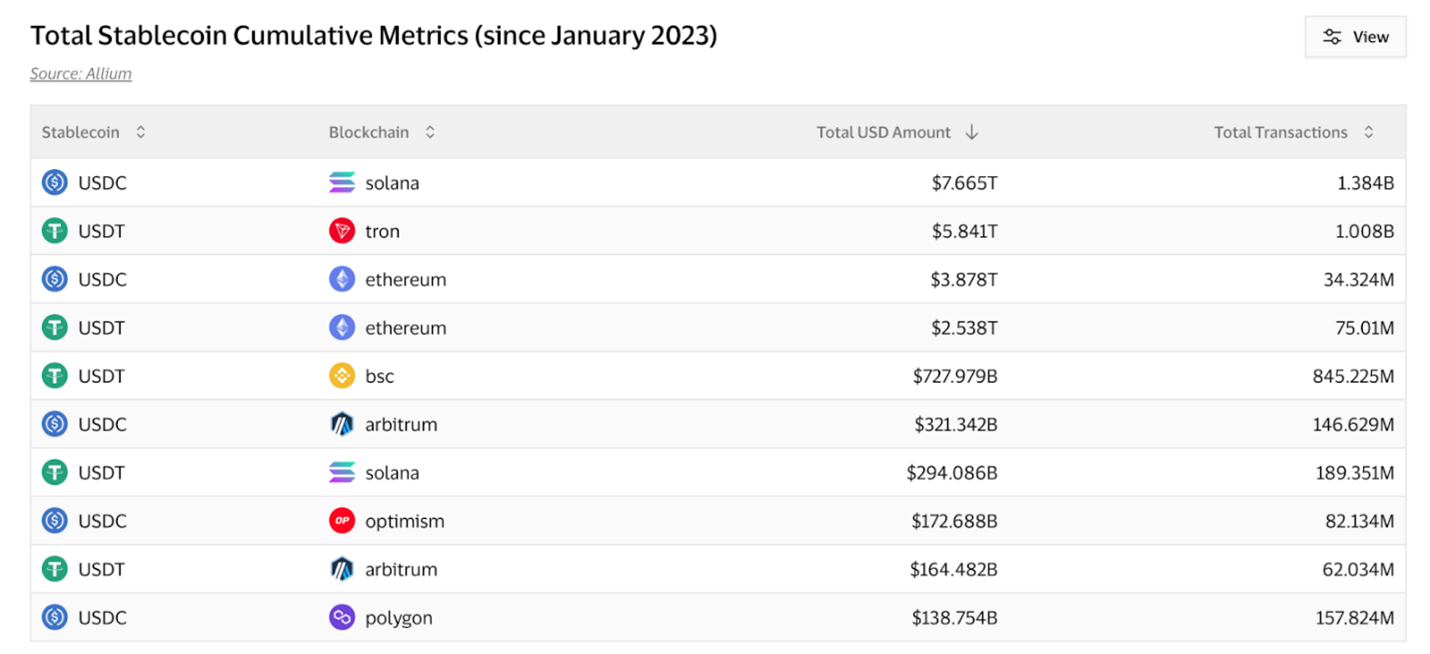

According to on-chain data provided by Visa (V), Circle’s USD Coin (USDC, Stablecoin) on the Solana network has registered more than 1.38 billion transactions since January 2023, worth around $7.66 trillion.

As you can see, this far outshines the usage of stablecoins on other networks:

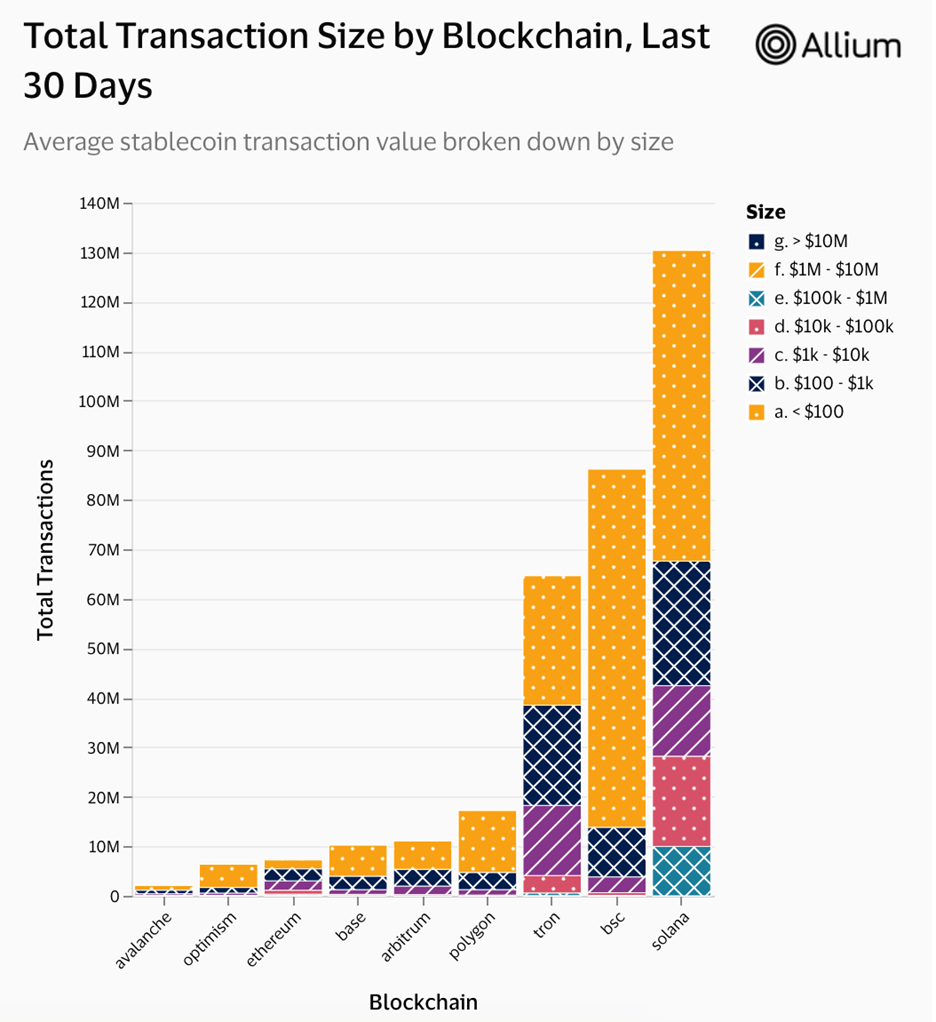

The more recent data, which narrows the scope to just the past 30 days, also displays the huge gap between Solana and other networks:

It really is no wonder that Solana has emerged as an institutional favorite, be it for digital gold projects, credit card partnerships with payment processing giants Visa and Mastercard (MA) partnership or the most recent PayPal USD launch.

Solana's attention to speed, affordability and fostering innovation has positioned it as a strong contender in the ever-evolving blockchain landscape.

While Solana's long-term stability is still being tested, recent network upgrades have addressed past congestion issues, paving the way for a more robust future.

This focus on continuous improvement strengthens Solana's position as a major player in the blockchain space.

And there are several ways you can benefit as an investor.

First and the most straightforward is to gain exposure to Solana’s native token, SOL.

Second is to gain exposure to the tokens built on Solana as a sort of leveraged play. For example, if you invest in a Solana-based memecoin, you’ll be riding two major narratives and potentially benefiting from both.

Third, is to target DeFi opportunities on Solana.

As I said, these are more accessible than on other networks. And with activity on the Solana network on the rise, you could target impressive DeFi yields that may not exist on other networks.

In fact, I’m sitting down with Weiss Ratings founder Dr. Martin Weiss tomorrow, June 11, at 2 p.m. Eastern to show him how to do exactly that.

If you’re interested in joining us to learn about the supercharged yields available on Solana, I suggest you save your seat now.

Best,

Marija Matić