Israel/Iran Conflict Reveals a Key Bitcoin Strategy

Editor’s Note: We are deviating from our regular Weiss Crypto Daily schedule today. Juan will still bring you his usual weekly market update on Tuesday, June 17.

But as part of our international team, Bob Czeschin was wide awake and following Israel’s raid on Iran in real time.

He was also watching Bitcoin’s reaction.

And to him, a correction here isn’t just expected. It’s part of a pattern that shows in times like these, Bitcoin may just be your best bet …

|

| By Bob Czeschin |

In the pre-dawn stillness of early morning Friday, squadrons of Israeli fighter-bombers came screaming out of the darkness over Iran.

Their target: Iran’s nuclear explosive-making infrastructure and personnel.

It was the biggest military assault on Tehran’s ruling mullahs since Iraqi strongman Saddam Hussein used poison gas to stop the Ayatollah’s fanatical Revolutionary Guards in 1980.

Back then, the Iran-Iraq War quadrupled oil prices almost overnight. And sent gold roaring up to all-time highs.

And now, something similar is going on.

Oil prices, slumbering near $65 a barrel since March, shot up to $72. As gold scrambled back up to within a percentage point of new all-time highs.

How little things have changed in 45 years!

But there is one big change. Now, there’s another safe haven asset that moves with gold.

Bitcoin (BTC, “A”).

But, where the history of the 20th century tells us quite a lot about the nature of oil and gold in times of war, Bitcoin’s history is shorter.

After all, it’s only been a tradeable asset for a little over a dozen years.

So, what can we say about it when bitter political quarrels let loose the dogs of war?

Bitcoin in the Early Days of the Ukraine War

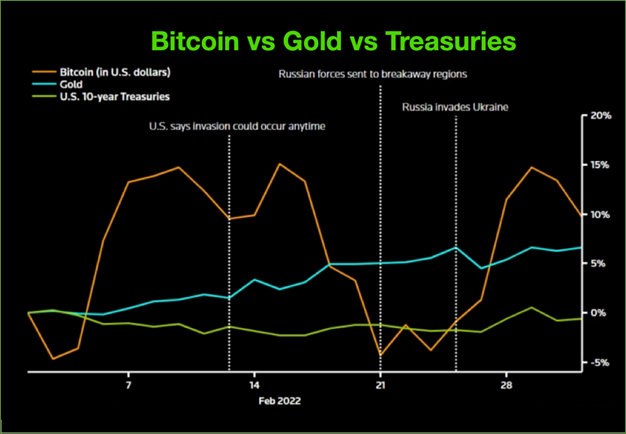

This chart shows the relative performance of Bitcoin, gold and 10-year U.S. Treasurys in the immediate run-up to Russia’s invasion of Ukraine and the first few days thereafter.

As you can see, Bitcoin was the superior safe haven asset.

And against stocks? You’ll see a similar pattern …

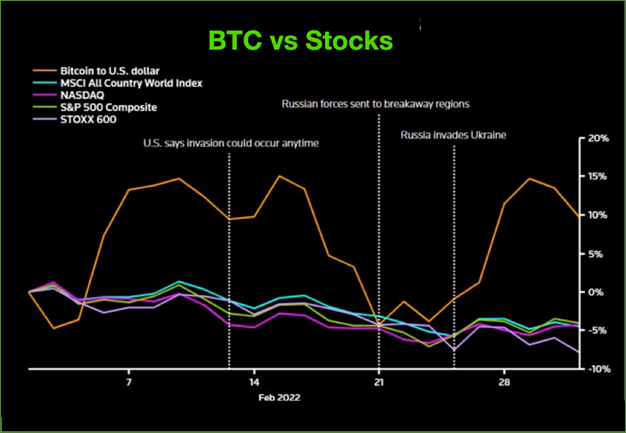

This chart shows the relative performance of Bitcoin and four leading stock indices: Morgan Stanley Capital International (MSCI) All Country World Index, the Nasdaq, the S&P 500 and Europe’s STOXX 600.

Again, Bitcoin was the best-performing safe-haven asset.

Time-Horizon Sensitivity

But earlier today, Bitcoin fell $5,000 (to $103,000) as the first wave of Israeli F-35s pounded their targets … before bouncing back by about $1,500.

In short, Bitcoin initially sold off as Israeli fighters began their bomb runs.

That’s because it’s very sensitive to market sentiment.

And the advent or escalation of some global conflict is almost always perceived bad news.

You can see in Figure 1 that the same thing happened back in 2022. Despite holding its value when rumors of war circulated, BTC fell when the news that Russian troops were deployed spread across the world.

But notably, it did not take long for BTC to recover.

Of course, two similar reactions to geopolitical conflict is a coincidence, not a pattern.

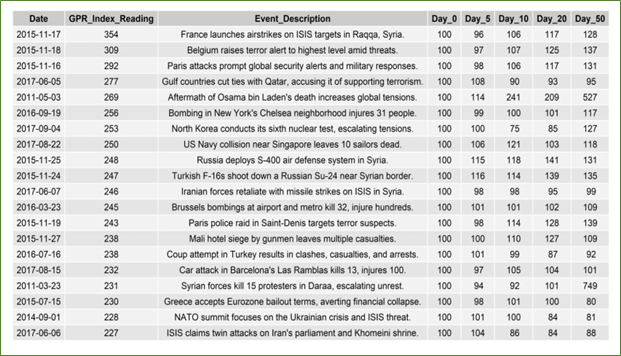

That’s why a team of crypto researchers closely examined Bitcoin’s reaction to a whole slate of notable geopolitical crisis events between 2011 and 2017.

They set Bitcoin’s starting value at an index value of 100. And then recorded the price five, 10, 20 and 50 days out.

20 Geopolitical Risk Events

and Bitcoin Performance

Notice how common it was for Bitcoin to react negatively five or 10 days out.

But by the 50th day — in 14 out of 20 cases — Bitcoin was higher than it was before the crisis.

Much higher — fivefold and sevenfold — in two cases.

This actually makes quite a lot of sense. At the beginning, Bitcoin is almost always reacting to a negative surprise. So, it sells off.

But over the longer term, geopolitical conflicts and war time spending generally lead to …

- flagrant money printing,

- roaring inflation,

- supply chain disruptions, and

- commodity price spikes.

All of which benefit Bitcoin handsomely.

In other words, investors who resist the urge to sell within the first few hours or days of a major global conflict will — more often than not — be rewarded for their conviction.

This is why our experts hammer home one important lesson all crypto investors should remember: Strategy, not sentiment, will win the day.

Crypto is a volatile market. The soaring rallies and quick, steep corrections are a feature, not a bug.

To keep a strong stomach on this ride, you’ll need a sound investment strategy to get you through.

One that takes into account an asset’s fundamental strength and technical support and resistance levels.

Members of Juan Villaverde’s Weiss Crypto Portfolio and Weiss Crypto Investor are still holding their Bitcoin, for example.

Because the cycles and Juan’s technical analysis still point to another bullish rally in 2025. One that could very well take BTC to $150,000, if not higher.

So running scared now would mean leaving a lot of money on the table.

In fact, if you’re not in Bitcoin yet, you could even consider this a buying opportunity. When Bitcoin’s next run begins, we may not see prices this low for a while.

And those brave souls who buy the dip when crisis hits … could find themselves laughing all the way to the bank a few months down the road.

Best,

Bob Czeschin