|

| By Marija Matic |

Friday felt like a market crime scene.

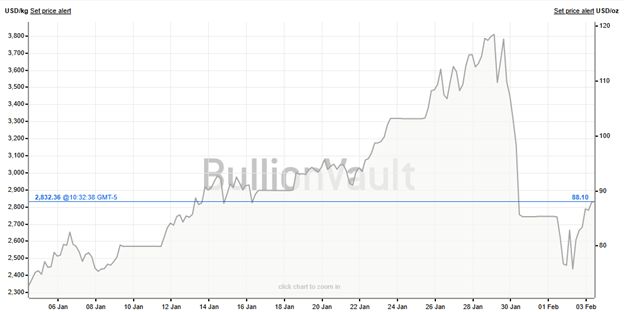

Gold saw a near-15% intraday swing. And silver printed a near-40% intraday move.

Let that sink in.

These are the so-called safe havens — the assets investors have leaned on for centuries when everything else breaks.

But on Friday, they broke too.

The scale was extreme by any modern standard: In the span of a few hours, over $7 trillion in value was wiped from metals markets — a number so large it barely registers.

For context, that’s almost three times the entire market capitalization of crypto.

This wasn’t random.

Metals were deeply overbought, positioning was crowded and CME Group rolled out a series of margin hikes in quick succession.

Leveraged longs were squeezed, stops were hit and forced liquidations cascaded.

That’s the real story.

Now, here’s the real lesson …

This Wasn’t Just About Metals

What we saw on Friday was a stress test for modern markets.

All of them.

Liquidity is thinner than most people want to admit. Positioning is tighter. And headlines now move prices faster than fundamentals ever could.

Together?

This is an environment where a handful of world leaders can inject volatility with a sentence, profit from the chaos and leave everyone else scrambling to adjust in real time.

That’s the same recipe that makes crypto so volatile.

In fact, if you pull up the silver chart after the dust settled last week, you’d be forgiven for thinking it was a meme coin on a bad day.

This is what low-liquidity, headline-driven markets look like.

Crypto, for once, wasn’t the main character in this story. But it still felt the shockwaves.

The Fed's Next Move

The headline that pushed this low-liquidity market into sell-off mode came from Washington.

President Trump moved to nominate Kevin Warsh as the next Federal Reserve Chair. And markets wasted no time repricing risk.

Warsh has called Bitcoin “a new gold” for younger investors. That’s a line that sounds bullish on paper …

But the subtext matters: Warsh is hawkish.

And hawkish Fed picks are almost always bearish for risk assets in the short term.

That’s why on Friday …

- Futures rolled over.

- Metals slid further.

- Bitcoin followed.

- The dollar surged.

Here’s the big takeaway:

Friendly crypto rhetoric doesn’t override tighter financial conditions.

That’s the lesson.

Regulators Paint a Silver Lining

Away from the price action, the regulatory backdrop is quietly shifting.

And for once, not all of it looks bad.

Commodity Futures Trading Commission (CFTC) commissioner Mike Selig relaunched the “Future Proof” Initiative, an innovation advisory committee focused on crypto, AI and prediction markets.

This time around, Selig brought in active market operators from across the industry to make up the committee. His goal is smarter oversight — the kind that engages with innovation instead of smothering it on arrival.

It’s a signal that some regulators are finally trying to understand what they’re regulating.

Then there’s the CLARITY Act.

Three weeks ago, the Senate unveiled an updated market structure proposal. The overlooked detail? Passive rewards on idle stablecoin holdings are being squeezed.

Activity-based yield is still allowed. Transactional incentives remain fine.

But hands-off yield?

That’s the pressure point, unsurprisingly, as it could compete with banks.

So, we can see that the regulatory fog is lifting, which is bullish for crypto’s long term.

And while the bank-friendly bias likely isn’t going anywhere any time soon, it’s a manageable headwind.

Bitcoin: Down, but Not Out

As I said above, the current market weakness is due to low liquidity.

But it’s important to keep in mind that nothing is fundamentally broken in crypto.

Zoom out, and the contrast between crypto and TradFi right now is striking.

Just look at how far sector leaders are down: Silver’s intraday fall on Friday is almost equal to Bitcoin’s entire drawdown since its October all-time high (through close on Friday).

And this is happening even as BTC drifts toward a key 320-day low … in what could be its longest monthly losing streak since 2018.

This context matters.

It helps us make sense of the market’s madness to stay one step ahead.

As cycles expert Juan Villaverde pointed out, timing this low could give your portfolio a big boost.

Right now, buy volumes are weak. There’s no aggressive dip-buying yet. In the short term, a move toward $84,500 — where a CME gap sits — wouldn’t be surprising.

But downside risk is still real. Geopolitics isn’t helping either.

With reports of potential U.S. strikes on Iran and macro pressure everywhere, it’s easy to imagine further slippage.

So, here are the levels to watch …

- The first level of meaningful downside support currently sits near $74,000.

- If that prices break below that, $69,000 comes into play.

If we get there, it likely won’t be a clean breakdown.

The more likely scenario would see BTC prices wick below prior highs (near $67,000) which would spark a brief panic. Following that, we’d see prices sharply reclaim that level in a classic fake-out.

Bitcoin has a long history of pulling this exactly stunt.

And while history doesn’t guarantee anything, it rhymes often enough to matter.

Takeaway for Savvy Traders

For now, traders shouldn’t waste their time on hero entries. Nor should they force conviction.

Yes, Bitcoin is looking to make a low. And yes, we are within the window of error.

Long-term investors may be able to shrug off additional downside moves in the short-term. But unless you plan to HODL, patience may be the best play for now while you keep a close eye on the levels that matter.

Because in markets like these, patience isn't passive.

It's a position.

Best,

Marija Matić

P.S. While low liquidity plagues TradFi and crypto, our founder Dr. Martin Weiss has tapped into something he calls “the secret lifeblood of the markets.”

And the numbers are off the charts.

It’s called The Infinite Income System. And using it, Martin is looking at 16-to-1 outperformance …

10,754% total gains …

46% of which came from a surprising source.

Martin will explain how it all works at his Infinite Income Summit on Tuesday, Feb. 10, at 2 p.m. Eastern.

It’s free to attend. Just be sure to RSVP to save your seat.