|

| By Martin Weiss |

Martin Weiss here with a big question:

Would you have liked owning Ethereum (ETH, Tech/Adoption Grade “B”) when it was trading for $10 or less?

Yes? Then, I think you might like what I have to tell today even better.

No, I’m not talking about buying a new crypto before it’s listed on Binance and Coinbase (COIN).

Nor is my topic today about jumping into the wild-and-woolly world of crypto presales — before they’re even listed on a decentralized crypto exchange.

Sure, if carefully selected, up-and-coming cryptos have provided great opportunities in the past … and they probably will again in the not-too-distant future.

But right now, even large-cap cryptos have not yet taken off, and small caps usually lag behind.

So, it’s probably too soon to dive in.

That’s why my topic today is all about how much money could be made in another asset class — private equity investing.

In other words, owning an early stake in up-and-coming companies before they’re listed on any stock exchange.

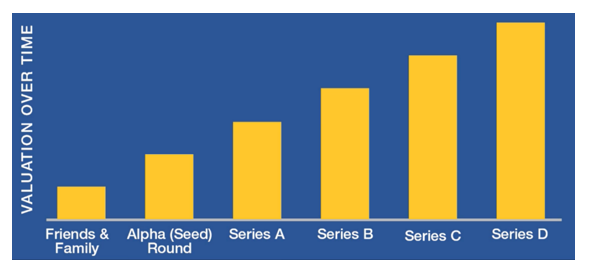

First, though, it’s critical to fully understand the five typical funding stages …

Stage 1. Friends and family. Too soon for outside investors; too risky as well.

Stage 2. Alpha Round (seed capital). This has historically been the earliest opportunity to invest. But until recently, it was essentially off-limits to average folks.

To participate, you had to be an accredited investor.

You had to have a net worth of over $1 million (excluding primary residence).

Plus, you need an individual income (excluding your spouse’s) of at least $200,000 in the past two years, with a reasonable expectation for $200,000 or more in the current year as well.

Now, however, with the advent of what’s called regulation crowdfunding, companies can raise up to $5 million over a 12-month period from nonaccredited investors too.

The companies have to use an intermediary that’s registered with the Securities and Exchange Committee — an online portal or broker-dealer.

And they must clearly disclose critical financial information to investors.

Then, after raising the first $5 million, they can move on to …

Stage 3. Series A. This is when the first venture capital firms usually get involved.

And if money pours in, it can drive up the valuation of the company.

Stage 4. Series B. If management reaches key performance milestones, this when we may see more and larger VC firms jump in. If all goes, well the company’s valuation goes up again.

Stage 5. Series C. This could be the time for major investment banks to take a strong interest. If so, this is when the valuation could really soar.

Later, as the company achieves other major targets, there may be a Series D, E and so on, typically with still higher valuations on each round.

What about an initial public offering?

Well, with all these other fundraising opportunities, many successful companies are postponing their IPO for years.

So, by the time shares are offered to the public, it’s often far too late for average investors to get the best bang for their buck.

Consider the trajectory of Airbnb, for example …

Average investors who got in after the Airbnb IPO could have seen gains of up to 125%.

Not bad.

But, going back a couple of steps — to the VC firms in Series A, we see a very different result indeed. They got in a lot earlier and could have seen gains of as much as 141,212%.

And even that was small compared to the gains Alpha Round investors could have made — up to 4,121,525%.

That’s 30,000x better than IPO investors.

Needless to say, Airbnb is a unicorn — a once-in-a-lifetime situation which is difficult to recognize until after the fact.

But I hope this gives you all the basics you need to explore further.

And I bring this whole discussion to your attention right now because it’s so timely.

Not only because private investing is transforming the financial marketplace …

Not only because it’s one of the few places where we can still find hype-resistant, undervalued assets …

But also because, in less than 24 hours, Weiss Ratings will be introducing a first-ever Alpha Round opportunity to members.

The company we’ve chosen and the crowdfunding portal they use have agreed not to mention the offering in any public venue until after Weiss members get a first crack at it.

And the page where investors can participate is hidden on the web. No search engine will find it.

In fact, for a limited time, it will be almost impossible for non-Weiss Members to get the needed info unless they get from us.

For more information, be sure to watch this video.

The deal opens tomorrow. So, today’s the last day to secure guaranteed first access.

And it closes at 12 midnight Eastern tonight.

Good luck and God bless!

Martin D. Weiss, PhD

Weiss Ratings Founder

P.S. Pressed for time? No worries! You can also refer to the transcript.