Look Outside Crypto for a Glimpse into Bitcoin’s Future

|

| By Juan Villaverde |

I want to share with you a lesson I learned in 2018 — which was the last time Federal Reserve Chair Jerome Powell tried to hike rates and trim the Fed’s balance sheet.

At first, the Fed’s efforts to rein in easy money took a toll on gold prices. Between January and August of 2018, gold fell 10%.

But in late August (and early September), something peculiar occurred. Despite the Fed’s tight money policies, a major rally in gold began to gather strength.

Like gold, bonds also trended lower most of early 2018. That makes sense, because the Fed was cutting its balance sheet via bond sales and raising interest rates.

But after following the Fed’s cue most of the year, gold and bonds reversed course, betting against the Fed.

Both began to rally robustly in the fourth quarter of 2018, in a move that appeared to signal an impending about-face at the Fed.

Sure enough, by the first quarter of 2019, Fed officials were done raising interest rates.

And by the fourth quarter, they were back to cutting interest rates again … and printing money.

Bitcoin (BTC, Tech/Adoption Grade “A-”) tends to follow the trend in gold and bonds — with a few months’ lag.

The correlation isn’t perfect. But the way it normally works is gold makes a low first, then bonds and, finally, Bitcoin.

And the best part is they begin to move before the Fed embarks on a new round of easing.

So, the obvious question is: What’s going on with gold and bonds now?

Gold’s Triple Bottom

Click here to see full-sized image.

Well, gold prices have broken out — which we can see using the same algorithm we use for our Crypto Timing Model — after making a triple bottom near $1,600 between September and November.

It’s trading at $1,800 an ounce as I write, which is a big enough move up to fully confirm this low.

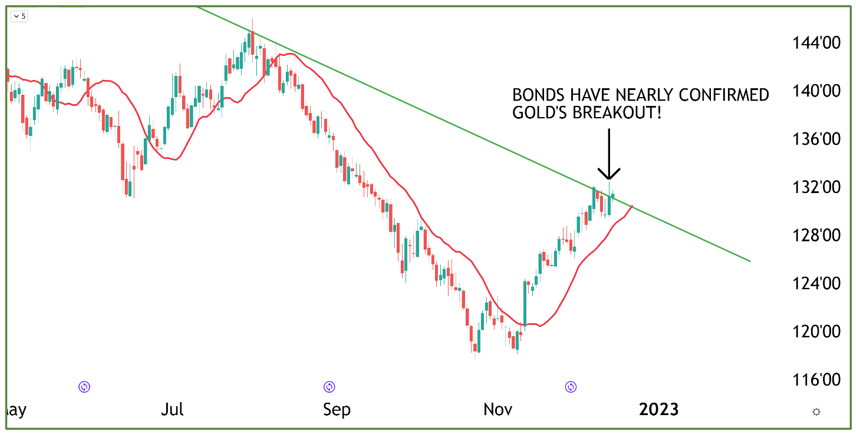

Bonds Closing in on a Similar Breakout

Click here to see full-sized image.

Here, the green downtrend line is the key indicator to watch. Bonds have been flirting with that level for a week, and they look poised to break above soon.

Once that breakout is confirmed, the message from these markets will be unequivocal:

Inflation is a thing of the past. A wave of deflation is coming that will force the Fed to end interest rate hikes. And likely reverse policy sometime in late 2023.

The markets own the Fed … not the other way around.

And just like it did in 2019, a Fed pivot is likely going to send crypto prices much higher again. As frantic central bankers scramble to prevent a cascade of defaults plunging the world into a deflationary abyss.

Best,

Juan