|

| By Bob Czeschin |

Because servicing America’s huge debt now dwarfs defense spending, President Trump has been banging the drum for lower interest rates.

But Federal Reserve Chair Jerome Powell refuses to budge, despite consumer inflation trending lower.

That’s because, while Trump fulminates on the sidelines, there are indications monetary easing has already surreptitiously started.

An Arcane Banking Regulation

In June, the Federal Reserve quietly tweaked an obscure banking rule to accommodate the Treasury’s vast borrowing binge. It cut the Supplementary Leverage Ratio (SLR).

I’m not a gambling man. But I’m willing to bet you’ve never heard of it, right?

Well, SLR is basically the banks’ reserve requirement for loans to the government (that is, Treasury holdings). Under the old rules, banks had to retain about $5 in reserve for every $100 in Treasurys they bought.

The new SLR slashed that to just $3 to $4. Which means the banks’ existing capital can now support a vastly larger portfolio of Treasuries.

Goldman Sachs estimates this tweak could unleash up to $5 trillion in additional bank buying capacity for U.S. debt.

Incidentally, $5 trillion just happens to be how much new borrowing Trump’s recently enacted Big Beautiful Bill is expected to require over the coming years.

What a coincidence!

In a fractional reserve banking system, two things can increase the money supply …

- Making more loans.

- Reducing reserve requirements.

What the Fed did here hits both buttons!

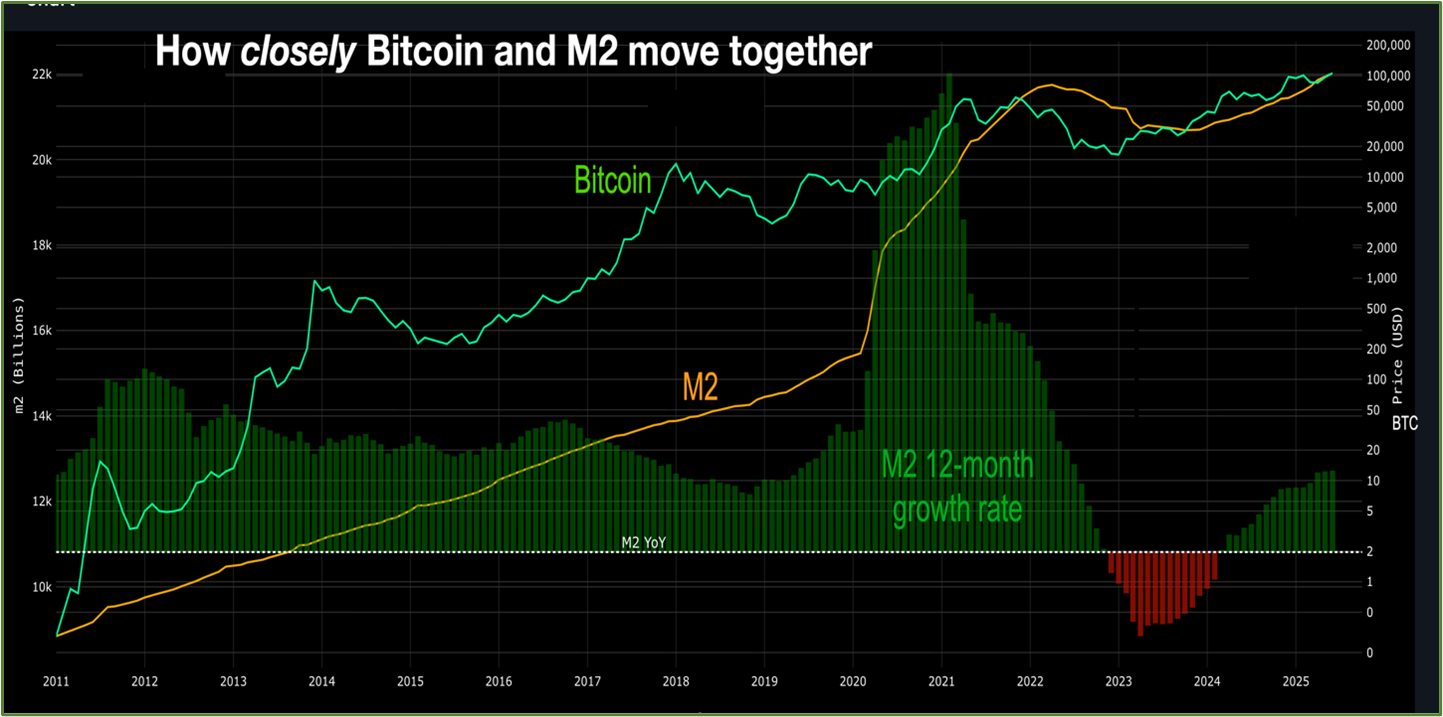

And sure enough, the M2 money supply stopped shrinking and started to expand. In fact, it just poked up to new all-time highs.

Specifically, the M2 money supply rose to a record $21.94 trillion. That topped the pandemic panic peak of $21.72 trillion (in March 2022). Year-on-year growth hit 4.5%, the highest in nearly three years.

This robust growth leads to two conclusions of critical interest to crypto investors …

First, the post-pandemic dip is very clearly over.

Second, a new, years-long cycle of monetary expansion has likely begun. And an expanding money supply correlates very strongly indeed with rising crypto prices.

But is there anything more specific we can infer from this information?

The short answer is yes!

Analysts have recently shifted their focus to the Global M2 Money Supply. This is the total stock of money and credit in the world financial system — including what’s created by central banks, commercial banks and other financial institutions.

It turns out that Global M2 — shifted forward by about 12 weeks — can indeed do a decent job of predicting turning points in Bitcoin’s (BTC, “A-”) long-term (320-day) cycle.

This is quite exciting because it promises a picture of what Bitcoin is likely to do for the next 12 weeks or so.

Sadly, however, Global M2 is not very good at anticipating shorter cycle turning points, like Bitcoin’s medium-term 80-day cycle.

However, Weiss Crypto Investor editor, Juan Villaverde, found a fix for this by narrowing his focus.

He replaced Global M2 with Central Bank Liquidity (CBL). That is, the liquidity only central banks contribute or remove from the global supply.

The result? A model that much better anticipates Bitcoin’s future price action.

Even better? It aligns almost exactly with what Juan’s Crypto Timing Model shows.

Both indicate that Bitcoin will climb modestly until late September, minus near-term volatility. Then, we’ll likely have one more corrective phase before the big run later this fall.

So, now is the time to finalize how you want to ride that wave.

And if you’re interested to hear how Juan has set up his portfolio, you can check out his Weiss Crypto Investor newsletter.

Best,

Bob Czeschin