MicroStrategy Sits on $2 Billion Open Bitcoin Gains

|

| By Marija Matic |

Over the weekend, Bitcoin (BTC, “A”) soared above resistance to sit at the time of writing around $42,000.

That means MicroStrategy finds itself perched atop unrealized gains amounting to a staggering $2 billion!

Former CEO Michael Saylor was mocked for his relentless Bitcoin acquisitions across bull and bear cycles. Now, MicroStrategy stands poised to have the final say as its investments surge.

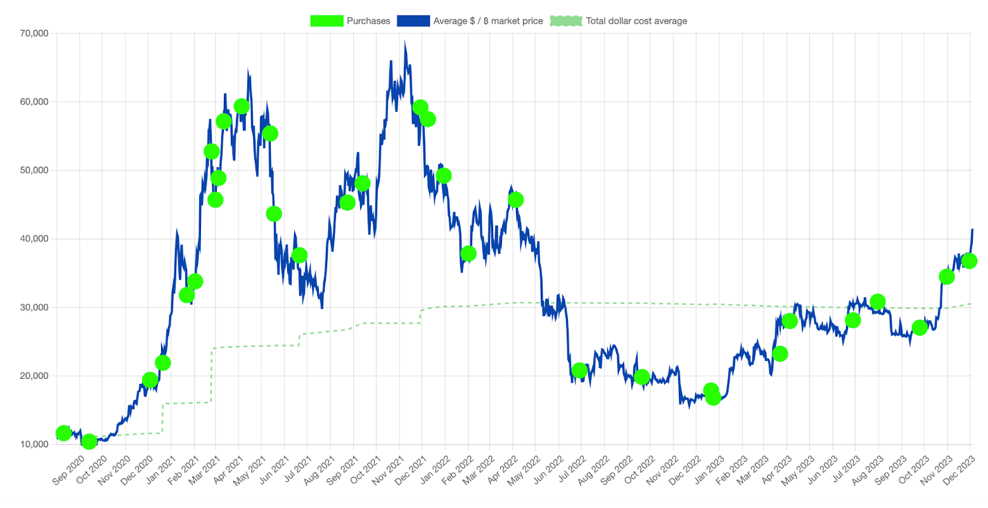

And a lot comes down to its stubborn adherence to a dollar cost averaging strategy has proven its worth, despite cynics scoffing at any purchase above $59,000. The green dots marking MicroStrategy’s purchases over three years reveal that payoff, with an average acquisition cost of $30,512 for its 174,530 BTC.

Yet, the spotlight doesn't shine solely on MicroStrategy.

Notably, another famous portfolio belongs to the Central American country of El Salvador, boasting 2,762 BTC valued at $115 million at the time of writing. Acquired via the DCA strategy through tumultuous times, this portfolio is on the brink of becoming profitable.

President Nayib Bukele, credited for El Salvador's adoption of Bitcoin as legal tender, has celebrated this with a tweet, after prior ridicule endured for two years.

While recognizing the future volatility of Bitcoin’s price, Bukele also urged critics and media outlets to recognize the shifting reality regarding the investment and advocated for responsible reporting following numerous negative statements.

Beyond Saylor and El Salvador, there are crypto whales who, despite remaining anonymous, have risen to the spotlight today.

One such mysterious address, who had quietly amassed $1.6 billion in BTC over the course of a year, was observed buying roughly 100 BTC — equal to $4.5 million — per hour today.

Within a mere 24 hours, it witnessed a staggering $50 million surge in holdings, adding significant intrigue to the crypto landscape.

This has contributed to Bitcoin rising by over 5% today.

BTC encountered resistance at the expected level, but intriguingly, it appears to be shaping a parabolic curve within a shorter time frame, as I’ve drawn out for you below.

This is a pattern worth noticing. It’s a curved trend line that appears when price accelerates its rise. The more it rises, the quicker it rises.

The parabolic curve has five bases, or steps. It seems that we might have just reached third base today, which means there could be two more to go before the potential correction if the pattern plays out.

Nevertheless, the next main target for BTC is $48,600, while the supports lie at $41,540 and $38,760.

Meanwhile, Ethereum (ETH, “B+”) has broken the $2,140 resistance level, which had burdened it since April:

Examining the second-largest cryptocurrency through an on-chain perspective reveals fundamental reasons that contribute to its bullishness.

For a start, those who are staking ETH are, on average, now comfortably profitable for the first time since May 2022.

Based on CryptoQuant data, the average unit price of staked ETH stands at approximately $2,000, a level likely to solidify as support. This represents the price at which investors started staking, ready to hold ETH for the long term.

The bullish sentiment is also intensified by ETH supply becoming more deflationary, coupled with a notable narrowing of the Grayscale Ethereum Trust (ETHE) premium gap.

These combined factors contribute significantly to the currency's positive outlook.

Notable News, Notes & Tweets

- BBC comes under fire for its “biased and misleading” Water Bitcoin Study.

- Bitcoin prices should “logically” correct in January, but crypto’s a “wild card,” according to Cointelegraph.

- Soccer star Cristiano Ronaldo faces a $1 billion lawsuit over Binance ads.

What’s Next

The crypto exchanges' spot market is heated. Consistent multimillion-dollar buy orders dominated throughout the day. Even a substantial sell wall on Binance at around $42,000 swiftly disappeared when the level was attacked by bulls.

The widespread sense of FOMO — that is, the fear of missing out — is evident in the bustling order books.

Despite BTC's price action significantly outpacing that of the S&P 500 and other assets in 2023, signaling the end of the crypto bear market, skepticism persists.

But the fundamentals and cycles tell a different story. That’s why it's crucial to overlook this skepticism and recall that dips are opportunities for purchasing.

Remember, in 2000, the Daily Mail labeled the internet a potential "passing fad," as millions seemingly abandoned it. The current skepticism toward cryptocurrencies mirrors this misjudgment, echoing a historical tendency to underestimate transformative technologies in their early stages.

After all, Warren Buffett once said he wouldn’t take Bitcoin if you gave him the entire supply for $25, and I have to wonder if that quote gets a chuckle out of Michael Saylor now.

The good news for you is that it’s not too late to get into crypto. Bitcoin is on the rise, and we expect it to go higher in this bull market. Especially with the spot ETF approvals hanging over head and the next Bitcoin halving scheduled in just a few months.

And beyond Bitcoin, there are plenty of opportunities in top Weiss-rated altcoins, which gave even more growth potential.

The tools are in your hands, and the time to act is now.

Best,

Marija