New U.S. Monetary Policy Sparks Crypto Surge

|

| By Juan Villaverde |

Counter to what my Crypto Timing Model initially suggested, Bitcoin (BTC, “A-”) began to rally this week.

It even broke above notable resistance near $95,000.

And it’s not alone. Gold and stocks are also seeing strength.

If you’ve kept an eye on the latest headlines, there are several macro factors at play.

But only one fully explains this broad rising tide.

Monetary Policy, Under New Management

A country’s monetary policy are the actions taken by a central bank to manage the money supply and interest rates to achieve economic goals.

Every time the Federal Reserve announces rate cuts or hikes, that’s the U.S. monetary policy in play.

And this process is supposed to be independent of a country’s fiscal policy — that is, how Congress decides to use spend our budget each year. The idea is to prevent term-serving politicians from prioritizing short-term gains to farm votes … at the sacrifice of long-term economic stability.

If you’ve ever paid attention to the election cycle in the U.S., you understand exactly why this is important.

Or, I should say, was important.

Because we no longer live in an era of monetary independence, but one of fiscal dominance.

That’s when a country’s monetary policy is no longer set by its central bank … but dances instead to the tune of government spending and federal budget deficits.

Why?

Because there’s a hard ceiling on how high interest rates can go without threatening the solvency of the government itself.

To see the big picture, let’s go back to the start.

Western governments have been borrowing far beyond their ability to repay for decades — especially since the 2008 Global Financial Crisis.

Back then, real economic growth collapsed. Yet governments continued borrowing against “future growth” with little regard for reality.

Fast forward to the present.

Today, the global debt markets are immensely bloated. So much so that financial assets (especially crypto) no longer trade on fundamentals.

Instead, they trade on how much liquidity is required to continuously roll over existing debt.

Here’s a simple analogy …

Imagine your credit card debt equals 130% of your annual income. When repayment comes due, you simply borrow from a second credit card to cover it.

You then repeat this process for decades, rolling the debt forward and adding interest each time.

Eventually, accumulated interest becomes the bulk of what you owe. At that point, the debt becomes unmanageable …

And bankruptcy is inevitable.

That’s where most Western governments stand today.

The U.S. fits this example perfectly.

With GDP (annual “income”) of roughly $30 trillion and public debt nearing $40 trillion, America is long past the point of no return.

By any honest definition, it is effectively bankrupt.

And it’s not even the worst offender. Japan’s public debt-to-GDP ratio is an astonishing 200%.

You may have noticed Japan in the headlines recently thanks to the weakening yen against the U.S. dollar.

The reason why stems from the key difference between our simple credit card analogy from earlier … and heavily indebted governments.

Governments print their own money. So, they don’t default like ordinary folks. Instead, they print more money …

Which debases the currency …

Which in turn triggers inflation …

And ultimately results in a perpetual bull market across asset classes — stocks and crypto included.

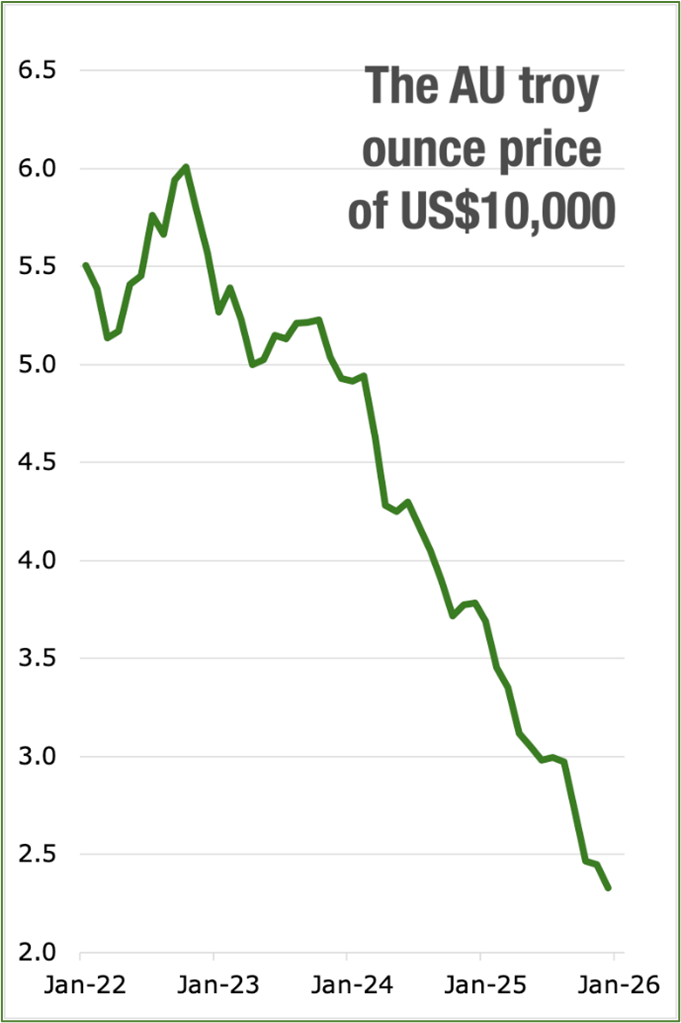

The reason the yen is collapsing against the dollar is the same reason the dollar is collapsing against gold. You know, that “bull market” chart of gold you see in financial press every time gold makes a new all-time high?

What it really shows is the U.S. dollar falling like a rock against gold (AU).

Public debt-to-GDP levels in the U.S., EU, UK and Japan are now so extreme that these countries no longer truly have central banks.

What they have instead is a money-printer-in-chief.

In the U.S., that role is currently filled by Federal Reserve Chair Jerome Powell.

The problem? He doesn’t like it.

Powell wants to be a central banker. He wants to set interest rates based on the Fed’s dual mandate: maximum employment and price stability.

But the U.S. government is spending far too much on interest. And year after year, politicians want to spend more, not less.

They have no appetite for fiscal restraint — and every incentive to borrow cheaply.

Our current Fed chair simply finds himself standing in the way of the inevitable.

That’s why the government moved this week to openly pressure the Federal Reserve. Such a spectacle may look awkward. And it certainly raised eyebrows. But the underlying dynamic is not unique to America.

What happened this week is pivotal. It marks the moment the U.S. — and much of the Western world — effectively abandoned independent monetary policy.

That’s not just Washington spending far beyond its means. It’s a signal — neon bright — that the dollar itself is subject to political control. A tool to be wielded by whoever occupies the Oval Office.

In short, it’s a clear public message to the world: The dollar is no longer the “safe haven” we’ve all pretended it is.

It’s happening everywhere. It’s just that other governments are somewhat more subtle about it than the Trump administration.

But one way or another, you are going to see heads of central banks replaced with compliant figures. Those who are willing to do whatever is necessary to keep the governments that sponsor them afloat.

That means a lot of money printing is coming. And quickly.

This is the real reason gold, stocks and crypto are all going up at the same time.

We’ve entered the era of fiscal dominance. Where the only variable that matters is how much governments want to spend.

And central banks? They exist solely to fund it.

Some now argue that this means the crypto four-year cycle is “dead.” I wouldn’t go that far.

But I do agree that this cycle will be different.

This year, 2026, was supposed to usher in a crypto winter. Instead, we’ve just heard the Fed announce a return to money printing — roughly $40 billion permonth.

Not enormous. But make no mistake, it’s the thin end of the wedge.

And now, it seems the Trump administration will install a compliant figure at the helm of the Federal Reserve. Someone willing to print whatever is required.

(And no, this isn’t a partisan issue. The same dynamic would unfold under a Democratic administration.)

With the money printer warming up once again, how severe will crypto winter really be in 2026?

Probably not very.

Liquidity is already rising this year, and crypto hasn’t truly responded … yet.

But it won’t be long before the “up only” memes return.

When will that be?

No one can say with 100% certainty. But my Crypto Timing Model anticipates a significant low soon.

To see the latest from my model and what crypto I’ll be targeting for my long-term portfolio, click here.

Best,

Juan Villaverde