Newly Enabled Google Ads Reveal Bitcoin Bullishness

|

| By Marija Matic |

If you’ve been out of the loop, the past two weeks may have been tough to traverse.

That’s because, as my colleague Juan Villaverde pointed out on Friday, much of the reaction to the broad pullback has been panic.

I and others on our team have shared our stance that this is a normal market correction with plenty to be bullish about. But we understand that it’s not so easy to fight market-fueled fear.

And Bitcoin’s (BTC, “A-”) climb back above $40,000 on Friday also didn’t do much to abate it. That’s because, for the past three days, BTC indicators have been signaling a neutral stance. As such, we’ve been in suspense about whether this momentum can be sustained … or if it’s a bull trap, tricking investors before falling to lower lows.

Fortunately, we didn’t have to wait too long for confirmation:

As you can see above, Bitcoin — positioned just below the $42,500 resistance level — initiated a breakout today.

The positive momentum du jour is linked to the launch of spot BTC ETF ads on Google.

This is the benefit of TradFi giants having skin in the crypto game.

Beginning today, advertisers targeting U.S. investors with "Cryptocurrency Coin Trust" products and services can leverage Google advertising. Provided they are certified and follow specific requirements given by Google.

At first, there was uncertainty regarding what “Cryptocurrency Coin Trusts” meant. Google clarified the definition, explaining it includes “financial products that allow investors to trade shares in trusts holding large pools of digital currency.”

That sounds like Bitcoin ETFs to me. But my understanding was only speculation, and I had reason to be skeptical. After all, Google already has a loaded history with Bitcoin.

Back in 2018, the search engine banned crypto ads. And it only opened ads for wallets and exchanges — though not specific cryptos — back in 2021. Even then, wallets and exchanges had to meet strict conditions to advertise.

Google then took another small step forward in 2023, when it officially enabled ads for blockchain-based games involving NFTs. Though it drew and continues to hold the line at ads for gambling-based games.

So, enabling ads for Bitcoin ETFs is a big leap for the TradFi giant.

Luckily, we once again didn’t have to wait long for verification. Over the course of the day, news started trickling then flooding the community about BlackRock (BLK) and VanEck now advertising Spot Bitcoin ETFs on Google.

Considering that spot BTC ETFs involve real BTC for settlements, this is bullish. Particularly if the marketing efforts are robust and ETF funds start pouring serious money into advertising Bitcoin.

Liquidity and Bitcoin Cycles Match

But I don’t want to chalk up Bitcoin’s daily bullishness to just an external development.

Because there’s more contributing to its momentum, as you can see from the Financial Times chart below. It shows global liquidity cycles and has captured the crypto community’s attention today:

Why? Because this global liquidity cycle aligns remarkably closely to Bitcoin's four-year cycles.

The ones we’ve been telling you about with growing frequency. And if global liquidity is on the rise at the same time we’re hitting a crypto bull market?

Well, that’s a recipe for a powerful upward force on crypto prices.

And sure enough, current global liquidity conditions appear to be improving, with signs of relaxation evident in international funding markets.

As numerous central banks — particularly the U.S. Federal Reserve and People’s Bank of China — contemplate more extensive policy easing, Crossborder Capital anticipates a $5 trillion liquidity injection from them in 2024.

But that’s not all. Founder and managing director of Crossborder Capital Michael Howell says that he foresees the latest liquidity upswing to peak no earlier than late 2025.

He underscores the inevitability of deploying existing funds, asserting, "All the money that is anywhere must be deployed somewhere," a sentiment I wholeheartedly endorse.

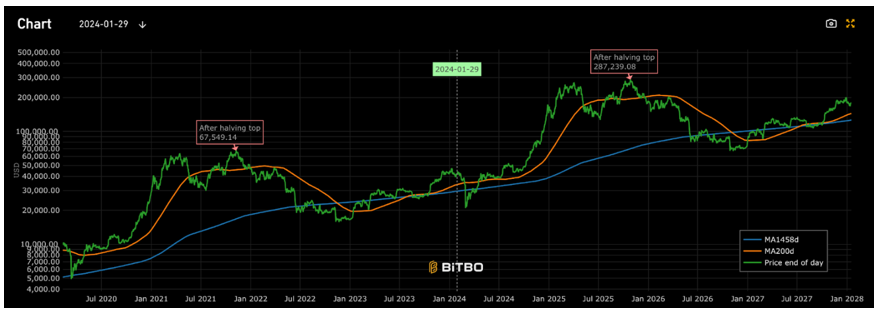

The expected peak of global liquidity aligns perfectly with the expected BTC cycle top in October 2025, as can be seen from the Bitcoin cycle chart below:

Of course, this does not guarantee that both will peak in October 2025. It is important to clarify this is a projection created using data-based estimations.

This chart is purely hypothetical. It illustrates what can be expected if today's price change mirrors the pattern observed in the previous cycle and projecting a full cycle ahead.

But don’t dismiss it. While we can’t know for sure how accurate it will be, we do know that the data used to generate this estimate is solid. Bitcoin's cycles and their historical accuracy in relation to the halvings is compelling and challenging to refute.

Our team knows this firsthand. Juan Villaverde used these cycles as the backbone of his Crypto Timing Model, a key tool we use in several of our newsletters to determine when to trade and when to hold tight.

With TradFi institutions now stepping into the crypto market, I’ll be keeping a close eye on the intersection of global liquidity trends with BTC cycles. I anticipate the growing liquidity will undeniably exert a positive influence on Bitcoin and, by extension, the broad market.

Notable News, Notes and Xeets

- Bruised by the stock market, Chinese investors rush into banned Bitcoin. China’s global ranking in terms of peer-to-peer trade volume jumped to the 13th place in 2023, from 144th in 2022.

- A spot Ethereum (ETH, “B+”) ETF approval is ‘unlikely until late 2025 or early 2026,’ says TD Cowen bank as there is no upside for SEC Chair Gary Gensler to approve a spot ETH ETF before the U.S. elections.

- Decentralized exchange OKX is adding support for newer token standards such as inscriptions on Dogecoin (DOGE, “C+”) called Dogecoin Ordinals, aka Doginals, in a “first-to-market” move.

What’s Next

The volatility on the upside is almost a given this week, due to the newly enabled Google ads for crypto-related funds. Especially if we see a change in flows to ETF funds as a direct result of ads.

It’s also helpful that outflows in digital assets — dominated by Grayscale’s Bitcoin Trust (GBTC) conversion to a spot bitcoin ETF — have subsided in recent days.

Notably, GBTC's outflows stand in stark contrast to the influx of $1.8 billion into the nine newly introduced spot Bitcoin ETFs last week.

The upcoming Fed decision regarding rates could also help out Bitcoin's next larger move. Should interest rates remain unchanged — an outcome with a 96.9% probability — Bitcoin may sustain trading above the resistance level, affirming a bullish reversal.

Keep checking in with us here at Weiss Crypto Daily for those updates as they happen.

Best,

Marija Matić