|

| By Bob Czeschin |

Gold’s ascent is accelerating.

After clearing $3,000 in March 2025, it hit $4,000 earlier this month. That’s only about seven months (roughly 200 days) later.

Previous $1,000 leaps took far longer:

- $1,000 to $2,000 — 4,400 days

- $2,000 to $3,000 — 1,700 days

To some observers, this set up can look suspiciously like a bubble.

But it’s not.

To me, gold’s recent behavior likely heralds the approach of something even more disruptive.

A fateful tipping point …

Beyond which loss of faith in the world’s fiat-money financial system devolves into a self-reinforcing, unstoppable spiral.

As gold acts as an indicator for its digital counterpart — leading Bitcoin (BTC, “A-”) by about six months — crypto investors can gain an edge by watching the yellow metal.

Buying Hasn’t Dried Up Yet

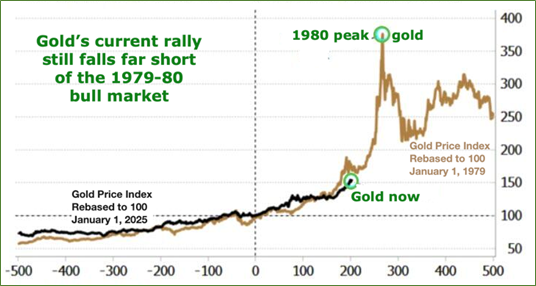

As impressive as gold’s bull run presently is, it’s still positively tame compared to the late 1970s …

When gold shot 4x in a little over a year.

In extreme rallies like this, I get why people shout, “bubble!”

But my skepticism kicks in when real demand drives prices up. So, while gold has more than doubled since 2024, I still see more ahead.

Because its biggest buyers don’t seem anywhere near ready to cut back or step away. And a bull run doesn’t end until that demand dries up.

So, how high can gold go on this run?

Before we can answer that, first we need to know who the buyers are, and what they’re doing.

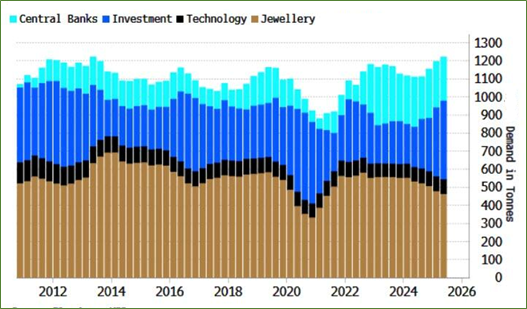

Demand for gold falls into four primary classifications:

- Technology,

- Jewelry,

- Investment,

- Central Banks.

As you can see (below), demand from all except jewelry has been going up in recent years.

Technology: This is the smallest demand category, and usually the least price sensitive. Instead, demand tends to be more influenced by fluctuations in industrial production and economic growth.

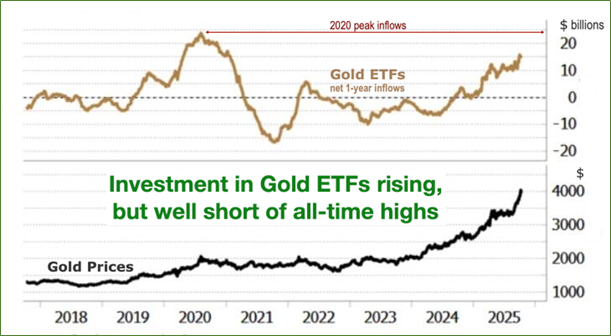

Investment: Exchange-traded funds (ETFs) are one of the largest vehicles for gold investment.

However, ETF investors really only stepped up their buying a couple months ago.

And as you can see, there’s still plenty of headroom before growing money inflows hit uncharted territory.

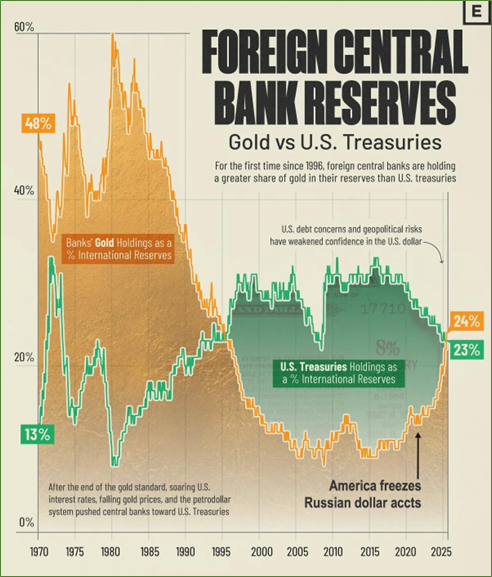

Central banks: Global central banks hold three primary reserve assets:

- ~47% in U.S. dollars and Treasurys

- ~20% in gold

- ~16% in euros

However, central banks — primarily in developing countries — have been on a gold buying binge for some time.

For example, China’s large dollar holdings made it vulnerable to fallout from the 2008 global financial crisis. So, the People’s Bank of China (PBOC) has been stockpiling gold and dumping dollars ever since.

Precise information on China’s current gold hoard is a state secret. But the PBOC’s dollar and Treasury holdings are not. They’re down a hefty 41% since 2015.

The Central Bank of Russia (CBR) shrewdly began swapping dollars for gold after Moscow’s annexation of Crimea in 2014 — when prices were still modest. This stockpile proved invaluable after Washington froze Russia’s dollar accounts to punish President Putin for invading Ukraine.

And that inspired other central banks to quietly begin diversifying away from dollars and buying gold.

As a result, gold now accounts for a larger fraction of central bank holdings than U.S. Treasurys … for the first time since 1996!

One more thing: Unlike private investors, central banks don’t spend their own money buying gold. Which means they don’t care what it costs.

Don’t know about you. But I find it hard to imagine a bunch of buyers more bullish for gold … than big-foot central bank bureaucrats spending other people’s money!

Especially considering the …

Financial Event Horizon Still Ahead

With global debt above $330 trillion and rising, more investors than ever see that the world fiat-currency financial system … is on life support.

The only way global central banks can escape the crushing weight of endlessly compounding interest is with relentless, accelerating money creation — sufficient to inflate away debt that cannot be repaid.

Which means wholesale destruction of paper currencies.

An event horizon is the outer edge of a black hole. That’s where the pull of gravity is so immense, nothing — not even light — can break free.

Anything that touches it gets sucked in and crushed. No appeals, no second chances, no escape.

So many investors today sense the nearness of a financial event horizon that social media has given it a name.

It’s called “the debasement trade.”

And far from winding down, today’s debasement traders are only just winding up.

Not since the 1970s have investors been so keen to buy appreciating gold with depreciating dollars. Before the roof caves in!

Which means gold prices are nowhere near topping out.

Investment Implications

Capital inflows to Gold ETFs are still far from all-time highs and therefore have ample room to grow.

Private investors motivated by the debasement trade are only just getting started.

And nothing on the horizon even suggests central banks are anyway near done dumping U.S. Treasurys for gold.

On top of that, Goldman Sachs estimates that merely another 1% of privately held Treasurys shifting to bullion … could send gold rocketing to $5,000.

So, if you don’t already have gold in your personal portfolio, stock up now. A good place to start: iShares Gold Trust (IAU) exchange-traded fund.

Or, if you want to keep your gold exposure on the blockchain, you may consider PAX Gold (PAXG) — a tokenized asset that tracks the price of gold.

Of course, since Bitcoin follows gold’s lead, this suggests more ahead for the OG crypto. Which makes current prices — about 9% off its all-time high — a good entry opportunity.

Finally, you may want to check out the All-In Retirement Income Challenge.

For the first time, Weiss’ top experts have come together to reveal a unique way to invest in gold …

And potentially generate big cash payments from it. Even though most gold investments don’t produce any income at all.

So yes, gold prices are already near all-time highs. But this big bull move is only just getting started.

Now is the time to nail down your gold strategy.

Best,

Bob Czeschin