Prediction Markets Say THIS Is When the U.S. Gov’t Shutdown Will End

|

| By Marija Matic |

The U.S. government has been shut down for 41 long days.

However, we’re seeing signs that the political gridlock — which has frozen agencies, stalled funding and kept risk sentiment on edge since Oct. 1 — could soon end.

For proof, just look toward the crypto markets.

They are already starting to signal that …

A Shutdown Deal Could Come Soon

Last night, headlines hit the tape that the U.S. Senate had reached a bipartisan deal to reopen the government.

The agreement seeks to fund key departments — Agriculture, Veterans Affairs, the FDA, military construction and Congressional operations — through Jan. 30.

It would also bring furloughed workers back with full pay.

A potential reopening after the longest shutdown on record — one that eclipsed the 34-day record in 2018–’19 — would mark an important turning point.

Right now, the funding deal still sits in the Senate.

From there, it would go to the House of Representatives and, ultimately, the president to approve.

Not only Are Traders Betting on This to Happen …They’re Predicting WHEN!

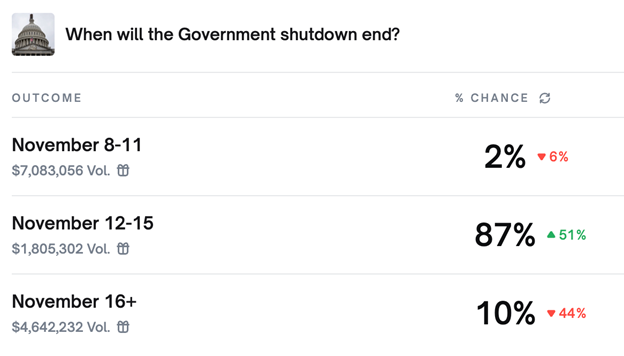

Prediction markets on Polymarket now give an 87% probability that the shutdown ends between Nov. 12 and Nov. 15.

That’s just three to five days away, if so!

Related story: The Deal Heard Around Wall Street (and Vegas)

The relief is palpable in the crypto markets.

Crypto Traders Unclench Their Jaws

Crypto finally caught a breather this weekend as Bitcoin closed Sunday at $104,700,

That’s comfortably above key support levels. And it suggests buyers tiptoed back in, after days of paralysis.

Momentum carried throughout today as a potential Senate deal stayed in the headlines.

The broad crypto market followed suit. Gains across major tokens marked a tentative return of confidence.

It's not euphoria — more like a market slowly unclenching its jaw.

It was also more than just the majors that benefited.

Institutional Projects Take the Spotlight

Risk appetite spilled into select altcoins.

Leading the charge among was World Liberty Financial (WLFI), which was up some 25%.

WLFI is the Trump family’s DeFi project. It marks a different kind of institutional arrival. Not the suits-and-ties kind, but the political establishment staking its claim in crypto.

Even his memecoin Official Trump (TRUMP) ran up some 17%. This suggests the market sees value in political alignment.

But the broader institutional undercurrent runs deeper.

Weiss “B” (“Buy”) rated names like Ripple (XRP), Hedera (HBAR) and Stellar (XLM) — the corporate-friendly blockchains — all outperformed today.

While Bitcoin maximalists debate decentralization purity, these networks are quietly positioning for the next wave. That is:

- Central bank pilots,

- Tokenized deposits, and

- The unglamorous but lucrative world of regulatory-compliant settlement rails.

These ledgers are optimized for know-your-customer (KYC), anti-money laundering (AML) and regulatory integration, rather than pure decentralization.

That philosophy resonates as institutions prepare for a more regulated era of digital assets.

Are We About to Witness a TradFi Season in Crypto?

The narrative writes itself …

If banks, governments and corporations are going to drive the next phase of crypto growth …

These are the chains built to capture it.

With political projects leading and compliance chains following, the market might think that, yes, a TradFi season is in the cards for crypto.

Midcap Movers: Starknet & Beyond

Among the crypto midcaps, Starknet (STRK) stole the show.

Its surge of 22% tells a bigger story.

As Bitcoin's Layer-2 ecosystem finally awakens from its slumber, STRK is positioning itself as the thinking trader's bet on BTCFi.

BTCFi is that nebulous but increasingly real vision of DeFi built on Bitcoin's security.

Capital continues flowing into Bitcoin-based DeFi.

Starknet wants to be the infrastructure they use.

Elsewhere, Pirate Chain (ARRR) surged 25%.

It’s riding extended enthusiasm for privacy assets. That’s because, in a world of Central Bank Digital Currencies and surveillance, some traders are hedging for a different future.

The week also saw the Canton Network (CC) blockchain launch big. It hit a roughly $5 billion market cap before its post-launch correction.

Canton's model of selective disclosure — where financial participants share only what regulation requires — targets the regulated finance niche.

Yet another sign that "boring" compliance tech might be crypto's next frontier.

Liquidity & Macro Context

Beyond the headlines, the eventual end of the U.S. government’s shutdown's has genuine macro implications.

The shutdown disrupted billions in federal discretionary spending for 40+ days — functioning like a mini quantitative tightening that nobody ordered.

When that spending resumes, it's effectively a liquidity injection back into the economy.

Crypto markets have historically shown a strong correlation with dollar liquidity. So, this shift could support crypto prices.

Some early signs already point to easing.

According to The Economic Times, the Federal Reserve quietly injected $125 billion into U.S. banks in just five days, likely to stabilize short-term funding conditions.

Still, traders remain cautious.

Liquidity returning to markets can boost risk appetite.

But this may also complicate the inflation outlook — something the Fed will weigh carefully as December’s policy meeting approaches.

What Comes Next

If the shutdown resolution proceeds as expected, several catalysts will re-enter focus.

- The SEC will resume its review of pending crypto ETF filings, including Solana and XRP, after weeks of delay.

- Meanwhile, Solana-linked ETFs already saw $118 million in inflows last week — an early sign of institutional positioning ahead of possible approvals.

Former President Trump’s proposed $2,000 “tariff dividend” — if it moves forward — would inject new liquidity into households, though its political feasibility remains uncertain.

Historically, direct payments have tended to spill over into speculative assets, crypto included.

And with GDP growth softening through the shutdown period, some investors see higher odds of a rate cut in December.

The risk there is that the Fed may hold back if financial conditions loosen too quickly.

Bottom Line

Crypto's rebound feels less like conviction and more like muscle memory.

In other words, markets are reflexively bidding on any hint of normalcy after 40+ days of paralysis.

But this isn't 2019's relief rally redux.

With inflation still sticky, the Fed divided on December's move, and institutional crypto (WLFI, XRP, HBAR, STRK) suddenly outperforming Bitcoin, we're watching a different movie.

The TradFi projects are positioning for something — regulatory clarity, ETF approvals or simply the next phase where banks and governments finally show up to the party.

That's the narrative gaining steam.

The question isn't whether liquidity returns, but whether it arrives before patience runs out.

December's Fed meeting could validate the rally or expose it as premature.

For now, the shutdown appears to be ending …

Liquidity is returning, and …

The market is doing what markets do.

That is, pricing in tomorrow's opportunities while keeping one eye on today's risks.

Best,

Marija Matić