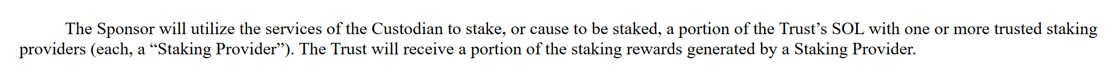

|

| By Marija Matic |

The next generation of crypto ETFs doesn’t just want to hold crypto.

They want to earn from it.

And, in a quiet regulatory U-turn, the SEC has begun to work directly with ETF issuers to make that a reality.

How?

By allowing the inclusion of staking in spot crypto ETFs.

That’s the process that powers proof-of-stake blockchains like Solana and Ethereum.

Validators provide their liquidity to the blockchain to help secure it. In return, they receive a percentage of the network’s fees.

Just over a year ago, the agency rejected Ethereum (ETH, “B+”) ETF filings that mentioned staking.

But in May 2025, with the regulatory body under new management, the SEC issued fresh guidance.

And now, at least seven major firms submitted revised Solana (SOL, “B”) ETF filings.

This group includes Fidelity, Franklin Templeton, VanEck, Bitwise, Galaxy, 21Shares and others. Each one promises to stake SOL tokens inside the ETF structure and distribute rewards to investors.

This would be a first in U.S. markets.

Fidelity’s filing offers one of the clearest signals. The word “staking” appears 148 times in its prospectus — a deliberate emphasis to confirm this isn’t a side feature.

The message from issuers is clear: They’re not just building a way for institutions to track crypto prices anymore.

They are paving the way for TradFi firms to participate in the crypto economy.

From Digital Gold to Digital Dividends

Traditional crypto ETFs, like the spot Bitcoin and Ethereum products approved last year, are historic.

But they’re also static.

They offer exposure, not income.

Staking-enabled ETFs are different. They represent a move from holding tokens to putting them to work.

In short, they capture the same on-chain rewards that crypto-native investors have long enjoyed.

Think of it as the dividend era of crypto ETFs. You’re not just owning the asset. You’re earning from it.

For institutions, this changes everything.

They’ve long been interested in staking, but operational and custodial challenges kept them sidelined. Now, they would be able to access this opportunity through traditional brokerage channels — no wallets, no validators, no complexity.

Just yield.

Why the SEC’s Shift Is a Big Deal

With the potential to earn “digital dividends” from ETFs, it’s no wonder issuers rushed to add staking to their filings.

What is surprising, however, is that the SEC is proactively working with issuers to make it work.

The agency has asked for revised language around in-kind redemptions and staking mechanics.

That’s a clear signal: The SEC is not just evaluating; it’s planning.

This kind of technical collaboration with issuers is rare. And it suggests that staking may not just be permitted … but could become standard in future crypto ETF structures.

Analysts say a decision could come within weeks. While some believe we could see an approved Solana ETF by late July, others believe the real action will start in Q4.

ETF Season: The Timeline to Watch

Whether we get an “ETF summer” filled with early approvals or an “ETF autumn” driven by SEC deadlines, one thing is clear …

The next few months could reshape how institutions access crypto.

Below are the final decision deadlines. That means we can get approvals sooner. But these are the last dates the SEC can approve, deny or delay its judgement for an ETF proposal.

October is the main event, with five major networks facing final calls:

- Solana, which has 90% approval odds according to Bloomberg,

- Litecoin (LTC, “C+”), which also boasts a 90% chance of approval,

- XRP (XRP, “B-”), which already has two futures ETFs and has approval odds of 85%,

- Dogecoin (DOGE, “C+”), has 80% odds, and

- Cardano (ADA, “B+”), with 75% odds.

November brings decisions on more niche, enterprise or infrastructure-focused networks, such as Polkadot (DOT, “C”) and Hedera (HBAR, “B”).

Then, December wraps up with projects that have strong developer momentum and growing retail traction like Avalanche (AVAX, “B”) and Sui (SUI, “B”).

If Solana staking ETFs are approved in July or August, we’ll be looking at a full-blown ETF summer. And the price momentum that generates will likely carry over into the fall.

But even if those early approvals don’t come through, autumn is locked in as the SEC’s final window for this wave of filings.

And with it could come a completely new category of institutional crypto exposure.

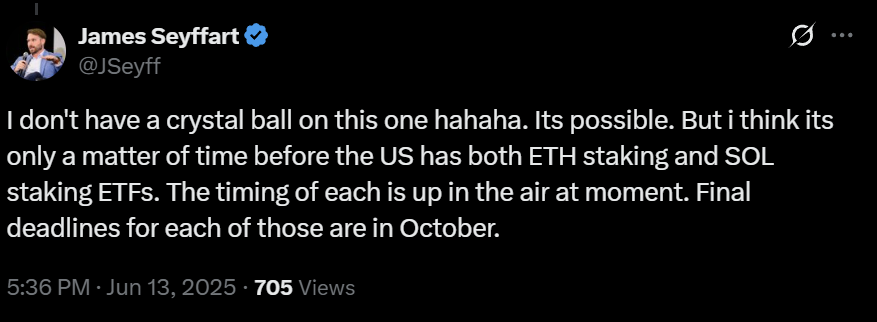

As Bloomberg analyst James Seyffart summed up:

The Bigger Picture: Crypto ETFs Are Growing Up

If staking-enabled ETFs are approved, both Solana and Ethereum are likely to be in the first wave.

While it's unclear which will get the green light first — as both face SEC decision deadlines in October— the broader direction is unmistakable …

Regulated, yield-generating crypto funds are coming.

For the first time, institutional investors could gain yield-generating exposure to proof-of-stake assets through a fully regulated ETF.

That aligns incentives.

It validates staking as a core function, not a crypto curiosity. And it finally gives TradFi players access to what DeFi users have known for years: In crypto, you can earn while you hold.

Final Thoughts

Crypto’s next big institutional unlock isn’t a new chain or a killer app.

It’s yield — delivered through ETFs that may finally behave like the blockchains they hold.

Price exposure brought institutions in.

But staking rewards may be what keeps them here.

That’s why this summer, my eyes will be on the SEC.

Best,

Marija Matić